gold vs usd chart reside

Associated Articles: gold vs usd chart reside

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to gold vs usd chart reside. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Gold vs. USD: A Reside Chart Deconstruction and Market Evaluation

The connection between gold (XAU) and the US greenback (USD) is a fancy and continuously evolving dance. A reside chart depicting their interplay offers an interesting window into international macroeconomic situations, investor sentiment, and geopolitical occasions. Understanding this dynamic is essential for traders navigating the turbulent waters of the dear metals and forex markets. This text will delve deep into deciphering a reside Gold vs. USD chart, exploring the components influencing their correlation, and providing insights into potential buying and selling methods.

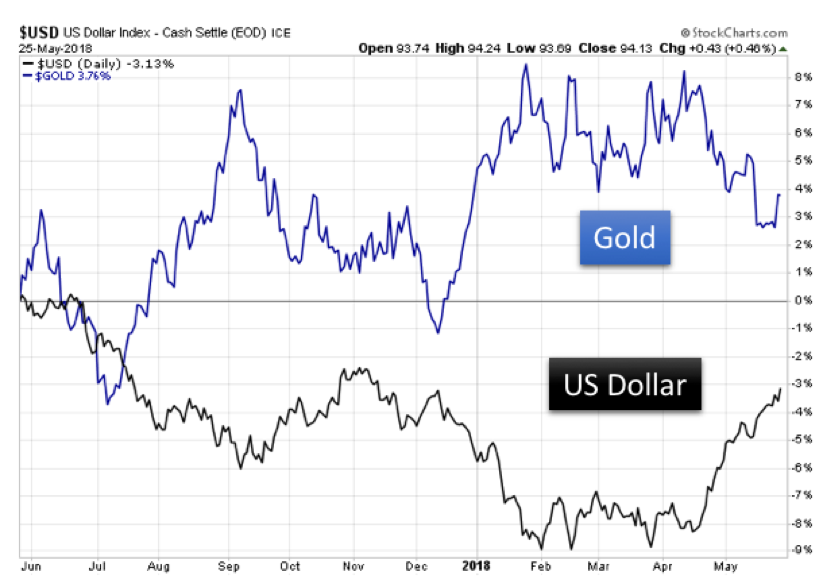

The Inverse Relationship: A Basic Precept

Probably the most elementary side of the Gold vs. USD chart is the widely inverse relationship between the 2. Which means that as the worth of the US greenback strengthens (USD appreciates), the worth of gold sometimes falls, and vice versa. This inverse correlation stems from a number of key components:

-

Secure-Haven Asset: Gold is usually thought of a safe-haven asset, a retailer of worth throughout occasions of financial uncertainty or geopolitical instability. When traders understand threat within the international economic system, they typically flock to gold as a hedge towards inflation and forex devaluation. A weakening US greenback, typically related to such uncertainty, will increase the demand for gold, pushing its worth larger.

-

Greenback as a Pricing Mechanism: Gold is primarily priced in US {dollars}. Due to this fact, a stronger greenback makes gold dearer for holders of different currencies, decreasing demand and consequently miserable its worth. Conversely, a weaker greenback makes gold extra inexpensive, stimulating demand and driving its worth upwards.

-

Inflationary Pressures: Inflation erodes the buying energy of fiat currencies just like the US greenback. Gold, being a tangible asset with restricted provide, is usually seen as a hedge towards inflation. When inflation rises, traders typically search refuge in gold, pushing its worth larger even when the greenback stays comparatively secure.

-

Curiosity Charges: Modifications in US rates of interest considerably affect the greenback’s worth and, consequently, gold’s worth. Increased rates of interest sometimes appeal to international funding into US dollar-denominated property, strengthening the greenback and placing downward strain on gold. Decrease rates of interest, alternatively, can weaken the greenback and increase gold’s enchantment.

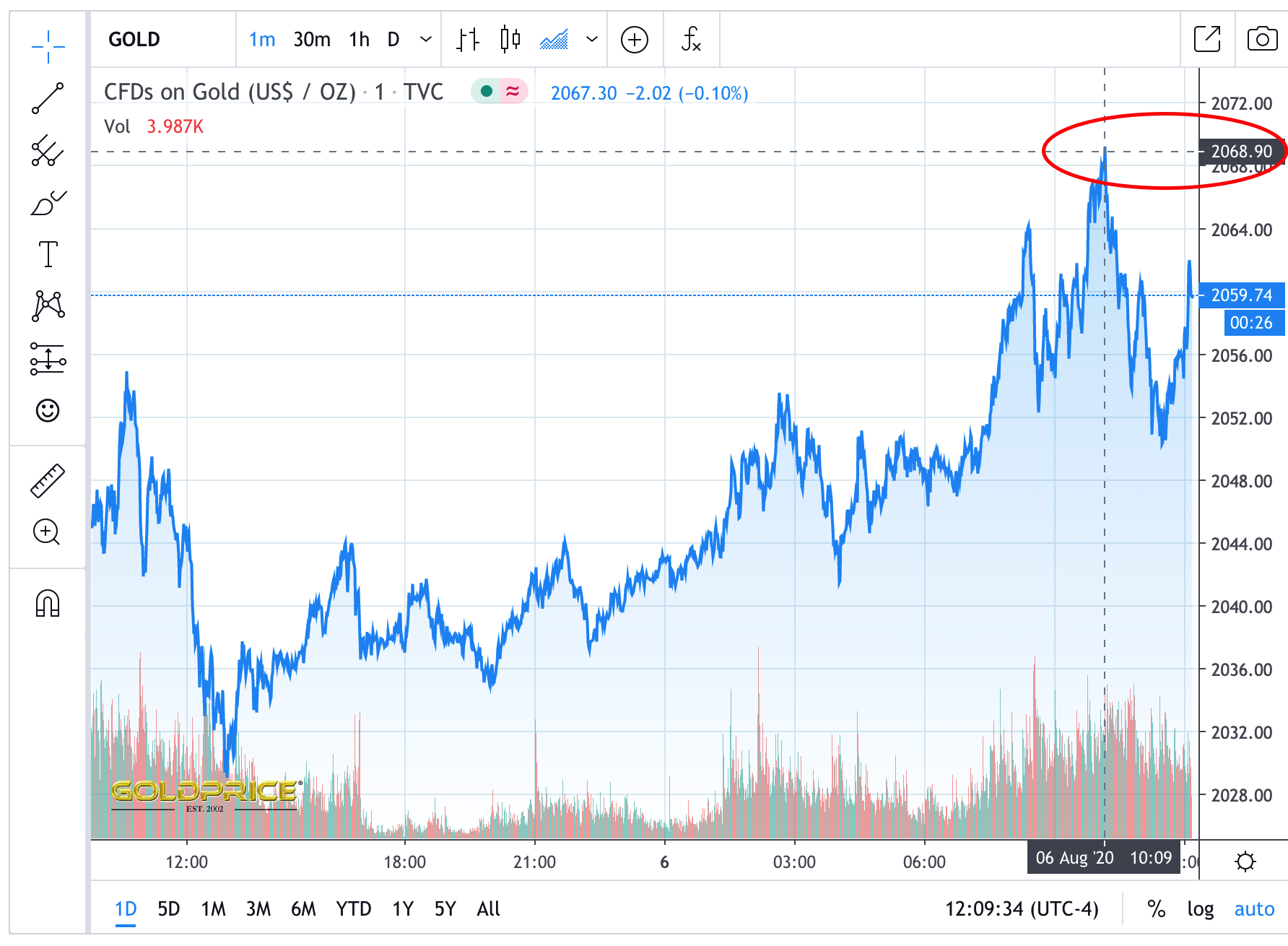

Decoding the Reside Chart: Key Indicators and Patterns

Analyzing a reside Gold vs. USD chart requires wanting past simply the uncooked worth actions. A number of key indicators and patterns can present worthwhile insights:

-

Help and Resistance Ranges: These are worth ranges the place the worth of gold has traditionally struggled to interrupt by. Help ranges signify areas the place shopping for strain is predicted to be robust, stopping additional worth declines. Resistance ranges signify areas the place promoting strain is predicted to be robust, stopping additional worth will increase. Breaks above resistance or under assist can sign important worth actions.

-

Transferring Averages: These are calculated averages of the worth over a selected interval (e.g., 50-day, 200-day transferring common). They clean out short-term worth fluctuations and can assist determine developments. Crossovers between totally different transferring averages can present purchase or promote alerts.

-

Relative Power Index (RSI): This momentum indicator measures the pace and alter of worth actions. RSI values above 70 sometimes counsel the market is overbought, whereas values under 30 counsel it’s oversold. These extremes can sign potential reversals.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies modifications within the power, route, momentum, and period of a development. Crossovers of the MACD traces can present purchase or promote alerts.

-

Chart Patterns: Recognizing chart patterns like head and shoulders, double tops/bottoms, triangles, and flags can present insights into potential future worth actions. These patterns are fashioned by worth motion and quantity, suggesting potential assist or resistance ranges.

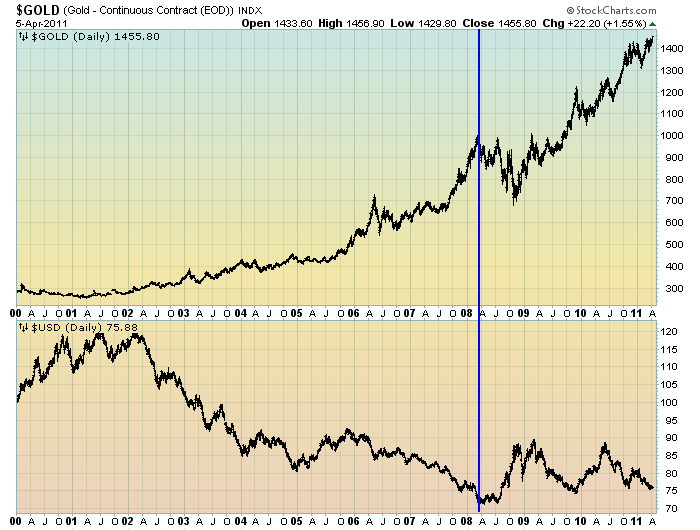

Geopolitical and Financial Components: Exterior Influences

The Gold vs. USD chart just isn’t solely pushed by technical indicators. Geopolitical occasions and macroeconomic components considerably affect the connection:

-

International Financial Uncertainty: Durations of worldwide financial uncertainty, corresponding to recessions, monetary crises, or geopolitical tensions, typically result in elevated demand for gold as a safe-haven asset, pushing its worth larger and weakening the greenback.

-

US Financial Coverage: The Federal Reserve’s financial coverage selections, together with rate of interest changes and quantitative easing (QE) packages, have a direct affect on the greenback’s worth and, consequently, gold’s worth.

-

Inflationary Expectations: Rising inflation erodes the buying energy of the greenback, making gold a extra enticing funding. Conversely, low inflation can cut back gold’s enchantment.

-

Provide and Demand Dynamics: Modifications in gold mining manufacturing, funding flows into gold ETFs (Alternate Traded Funds), and central financial institution gold purchases can all have an effect on the availability and demand dynamics of gold, influencing its worth.

-

US Debt Ranges: Excessive ranges of US nationwide debt can elevate issues in regards to the long-term stability of the greenback, doubtlessly growing demand for gold as a hedge.

Buying and selling Methods: Leveraging the Gold vs. USD Relationship

Buyers can make use of numerous buying and selling methods to capitalize on the connection between gold and the US greenback:

-

Lengthy Gold, Quick USD: This technique includes shopping for gold and concurrently promoting US {dollars}, cashing in on a weakening greenback and rising gold costs.

-

Quick Gold, Lengthy USD: This technique includes promoting gold and shopping for US {dollars}, cashing in on a strengthening greenback and falling gold costs.

-

Pairs Buying and selling: This technique includes figuring out and exploiting momentary deviations from the historic relationship between gold and the US greenback.

-

Choices Buying and selling: Choices contracts can be utilized to hedge towards worth fluctuations or speculate on future worth actions.

Disclaimer: It’s essential to do not forget that buying and selling in gold and currencies includes important threat. Earlier than partaking in any buying and selling actions, it’s important to conduct thorough analysis, perceive the related dangers, and doubtlessly search recommendation from a certified monetary advisor. Previous efficiency just isn’t indicative of future outcomes.

Conclusion:

The reside Gold vs. USD chart offers a dynamic and multifaceted view of the worldwide economic system. By understanding the elemental inverse relationship, deciphering technical indicators and chart patterns, and contemplating the affect of macroeconomic and geopolitical components, traders can acquire worthwhile insights into market developments and doubtlessly develop efficient buying and selling methods. Nonetheless, it’s essential to strategy this market with warning, acknowledging the inherent dangers and complexities concerned. Steady studying and adaptation are very important for fulfillment on this dynamic area. Staying knowledgeable about present occasions, financial indicators, and market sentiment is paramount to creating knowledgeable selections when navigating the interaction between gold and the US greenback.

Closure

Thus, we hope this text has offered worthwhile insights into gold vs usd chart reside. We recognize your consideration to our article. See you in our subsequent article!