Mastering ATR Settings for 5-Minute Chart Buying and selling: A Complete Information

Associated Articles: Mastering ATR Settings for 5-Minute Chart Buying and selling: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Mastering ATR Settings for 5-Minute Chart Buying and selling: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Mastering ATR Settings for 5-Minute Chart Buying and selling: A Complete Information

The Common True Vary (ATR) indicator, developed by J. Welles Wilder Jr., is a strong software for measuring market volatility. Whereas it does not predict value course, its capacity to quantify volatility makes it invaluable for setting stop-losses, figuring out place sizing, and figuring out potential commerce entries and exits, particularly when coupled with different technical indicators. This text delves into optimizing ATR settings for 5-minute chart buying and selling, exploring varied methods and concerns.

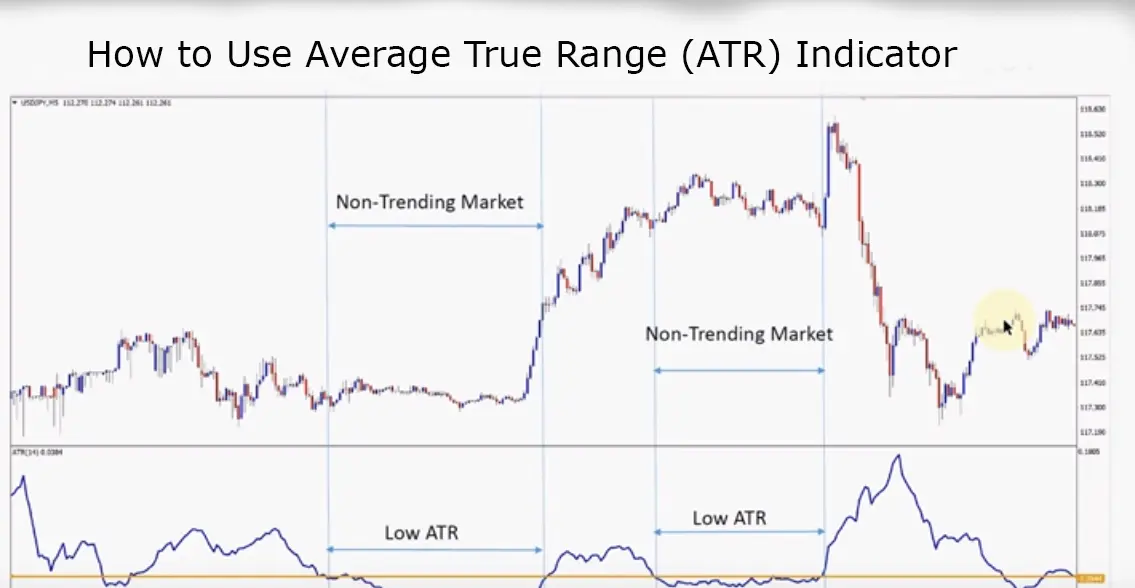

Understanding the ATR Indicator

The ATR calculates the common vary of value motion over a specified interval. This vary considers the True Vary (TR), which is the best of the next three values:

- Present Excessive minus Present Low: The true vary for a single interval.

- Absolute worth of Present Excessive minus Earlier Shut: Captures in a single day gaps.

- Absolute worth of Present Low minus Earlier Shut: Accounts for gaps on the open.

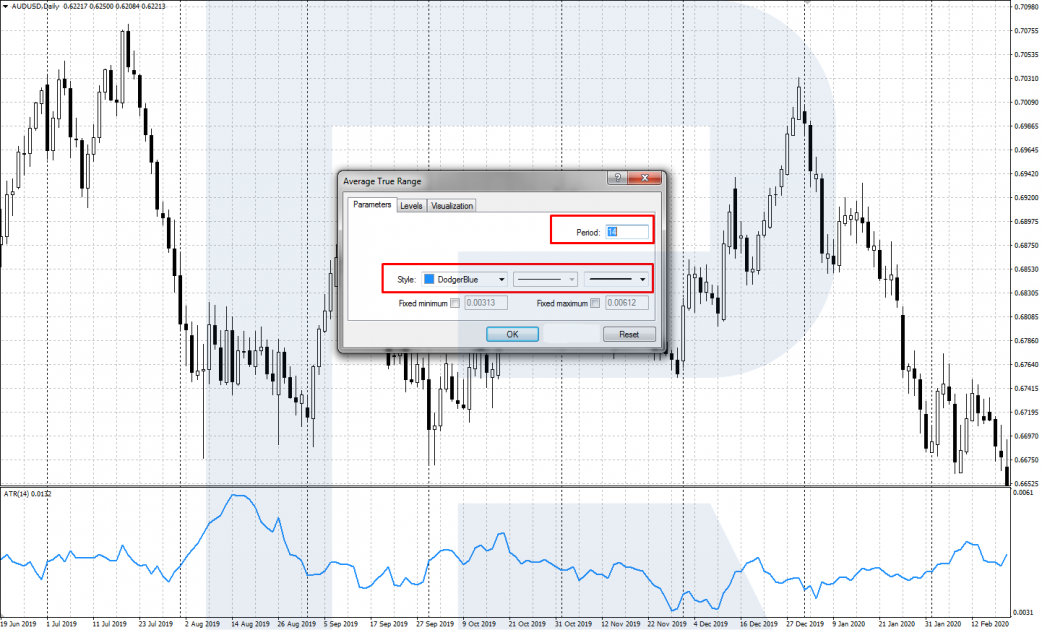

The ATR then smooths these true vary values utilizing a shifting common, sometimes an exponential shifting common (EMA), to offer a extra steady studying. The most typical interval used for the ATR is 14, however this may be adjusted primarily based on the timeframe and market situations. For five-minute charts, shorter or longer intervals could be extra applicable relying in your buying and selling model and the instrument being traded.

ATR Settings for 5-Minute Charts: A Balancing Act

The optimum ATR setting for a 5-minute chart shouldn’t be a one-size-fits-all resolution. It relies on a number of components:

- Market Volatility: Extremely unstable markets require wider stop-losses and doubtlessly bigger ATR multipliers for place sizing. Much less unstable markets permit for tighter stop-losses and smaller multipliers.

- Buying and selling Type: Scalpers would possibly choose shorter ATR intervals (e.g., 5-10), whereas swing merchants would possibly use longer intervals (e.g., 20-30).

- Instrument Traded: Extremely liquid devices like main forex pairs usually exhibit much less erratic value motion than much less liquid devices, permitting for tighter stop-losses.

- Threat Tolerance: Conservative merchants will choose wider stop-losses, whereas aggressive merchants would possibly settle for tighter stops.

Exploring Completely different ATR Interval Settings for 5-Minute Charts:

-

Quick-Time period ATR (5-10): These settings are extremely aware of short-term value fluctuations. They are perfect for scalpers and day merchants who deal with fast entries and exits. The stop-loss can be tighter, resulting in smaller potential losses but additionally doubtlessly lacking out on bigger value actions. The elevated frequency of stop-loss hits requires a strong threat administration technique.

-

Medium-Time period ATR (14-20): This vary presents a steadiness between responsiveness and stability. It captures the short-term volatility whereas smoothing out a number of the noise. It is appropriate for merchants who maintain positions for just a few hours to some days. The stop-loss is wider than with shorter intervals, permitting for extra value fluctuation earlier than the stop-loss is triggered.

-

Lengthy-Time period ATR (20-30+): These settings are much less delicate to short-term value swings and deal with longer-term volatility developments. That is higher suited to swing merchants who maintain positions for a number of days and even weeks. Cease-losses can be wider, doubtlessly resulting in bigger most losses, but additionally permitting for extra important value actions to develop earlier than the stop-loss is triggered.

Utilizing ATR for Cease-Loss Placement:

A typical technique is to set stop-losses primarily based on a a number of of the ATR. For instance, a 1.5x or 2x ATR stop-loss means your stop-loss is positioned 1.5 or 2 occasions the present ATR worth away out of your entry value. This dynamic stop-loss adjusts to altering market volatility, offering a extra strong threat administration strategy than mounted stop-losses. For five-minute charts, a 1x to 2x ATR stop-loss is commonly used, however this may be adjusted primarily based on the components talked about earlier.

ATR and Place Sizing:

The ATR can even information place sizing. By dividing your threat capital by the ATR-based stop-loss, you may decide the suitable place measurement to take care of a constant threat per commerce. This ensures that even with various volatility, your threat stays managed. That is notably essential for 5-minute charts, the place frequent trades can shortly amplify threat if not correctly managed.

Combining ATR with Different Indicators:

The ATR is simplest when used at the side of different technical indicators. Some frequent combos embrace:

- ATR and Transferring Averages: Utilizing shifting averages to establish developments and the ATR to handle threat. As an illustration, a dealer would possibly enter an extended place when the value crosses above a shifting common and place a stop-loss primarily based on the ATR.

- ATR and RSI (Relative Energy Index): Combining the ATR for threat administration with the RSI to establish overbought and oversold situations. This enables merchants to enter trades with an outlined threat profile in doubtlessly favorable market situations.

- ATR and MACD (Transferring Common Convergence Divergence): Utilizing the MACD to establish potential pattern adjustments and the ATR to set stop-losses and handle place measurement.

Backtesting and Optimization:

Earlier than implementing any ATR-based buying and selling technique on a dwell account, it is essential to backtest it totally. Backtesting means that you can consider the efficiency of your technique underneath varied market situations and refine your ATR settings for optimum outcomes. Completely different ATR intervals and multipliers ought to be examined to find out probably the most appropriate configuration to your particular buying and selling model and threat tolerance. Think about using historic knowledge spanning varied market regimes (bull, bear, sideways) to get a strong evaluation.

Essential Issues:

- False Breakouts: The ATR does not predict value course. A large ATR would possibly result in frequent stop-loss hits during times of false breakouts. Combining the ATR with different affirmation indicators might help mitigate this threat.

- Slippage and Commissions: Account for slippage and commissions when calculating your stop-loss and place measurement. These prices can erode earnings, particularly with frequent trades on a 5-minute chart.

- Market Context: All the time take into account the broader market context when deciphering the ATR. A sudden spike in volatility may not be sustainable, and relying solely on the ATR would possibly result in poor commerce selections.

Conclusion:

Mastering ATR settings for 5-minute chart buying and selling requires understanding the interaction between volatility, buying and selling model, and threat tolerance. Whereas there is not any magic quantity, experimenting with totally different ATR intervals and multipliers, coupled with thorough backtesting and the mixing of different technical indicators, can considerably improve your buying and selling efficiency and threat administration. Do not forget that constant threat administration and a well-defined buying and selling plan are paramount to success in any buying and selling endeavor, particularly when using short-term methods on the 5-minute chart. Steady studying and adaptation are key to navigating the dynamic world of economic markets.

Closure

Thus, we hope this text has offered worthwhile insights into Mastering ATR Settings for 5-Minute Chart Buying and selling: A Complete Information. We admire your consideration to our article. See you in our subsequent article!