Mastering Swing Buying and selling: Unveiling the Finest Chart Patterns for Constant Good points

Associated Articles: Mastering Swing Buying and selling: Unveiling the Finest Chart Patterns for Constant Good points

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Mastering Swing Buying and selling: Unveiling the Finest Chart Patterns for Constant Good points. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering Swing Buying and selling: Unveiling the Finest Chart Patterns for Constant Good points

Swing buying and selling, a technique targeted on capitalizing on short-to-medium-term worth swings, calls for a eager eye for chart patterns. These patterns, fashioned by worth motion and quantity, provide priceless insights into potential future worth actions, permitting merchants to establish profitable entry and exit factors. Whereas no sample ensures success, understanding and accurately decoding these formations considerably improves the chances of worthwhile swing trades. This text delves into a number of the greatest chart patterns for swing buying and selling, exploring their traits, identification methods, and danger administration concerns.

I. Understanding the Basis: Worth Motion and Quantity

Earlier than diving into particular patterns, it is essential to know the basic constructing blocks: worth motion and quantity. Worth motion refers back to the motion of the asset’s worth over time, reflecting the interaction of provide and demand. Quantity, the variety of shares or contracts traded, confirms the energy and validity of worth actions. Excessive quantity throughout a worth breakout suggests sturdy conviction, whereas low quantity might point out a weak transfer susceptible to reversal.

II. Prime Chart Patterns for Swing Buying and selling:

A number of chart patterns constantly show priceless for swing merchants. We are going to discover a number of the most dependable:

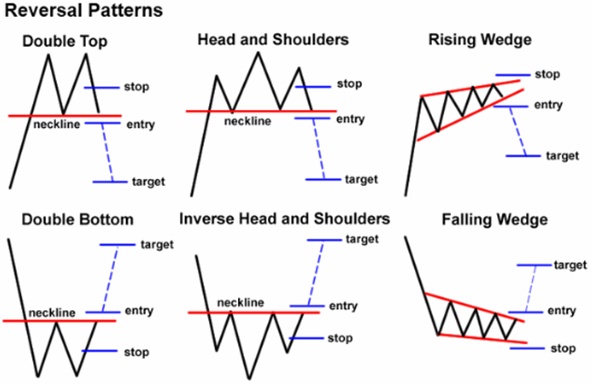

A. Head and Shoulders (H&S):

This traditional reversal sample signifies a possible shift from an uptrend to a downtrend (Head and Shoulders Prime) or vice-versa (Head and Shoulders Backside). It consists of three distinct peaks or troughs:

- Left Shoulder: The preliminary peak or trough, representing a interval of worth consolidation.

- Head: The next peak (Prime) or decrease trough (Backside) than the shoulders, indicating a surge in momentum.

- Proper Shoulder: A peak or trough related in top to the left shoulder, signaling weakening momentum.

- Neckline: A trendline connecting the lows of the left and proper shoulders (Prime) or the highs (Backside).

Buying and selling Technique: A bearish H&S (Prime) alerts a possible promote alternative as soon as the value breaks beneath the neckline, with affirmation offered by elevated quantity. A bullish H&S (Backside) suggests a purchase sign when the value breaks above the neckline, once more supported by greater quantity. Cease-loss orders needs to be positioned beneath the neckline (Prime) or above (Backside).

B. Double Tops and Double Bottoms:

These patterns are easier than H&S, that includes two distinct peaks (Double Prime) or troughs (Double Backside) of roughly equal top. They point out a possible reversal of the present development.

Buying and selling Technique: A Double Prime alerts a possible promote alternative when the value breaks beneath the neckline (the low level between the 2 peaks). A Double Backside suggests a purchase alternative when the value breaks above the neckline (the excessive level between the 2 troughs). Quantity affirmation is essential for validating the breakout.

C. Triple Tops and Triple Bottoms:

Much like Double Tops/Bottoms, however with three peaks or troughs. The energy of the reversal is often amplified by the elevated variety of affirmation factors.

Buying and selling Technique: The buying and selling technique mirrors that of Double Tops/Bottoms, with the added affirmation offered by the third peak or trough. The break beneath/above the neckline, accompanied by elevated quantity, supplies a robust sign.

D. Triangles:

Triangles are continuation patterns, suggesting a pause within the current development earlier than a resumption. A number of sorts exist:

- Symmetrical Triangle: The value oscillates inside converging trendlines, with no clear indication of the route of the breakout.

- Ascending Triangle: The value makes greater highs and equal lows, suggesting a bullish continuation.

- Descending Triangle: The value makes decrease lows and equal highs, suggesting a bearish continuation.

Buying and selling Technique: The breakout from a triangle is the important thing buying and selling sign. A breakout above the higher trendline in an ascending triangle or a symmetrical triangle confirms a bullish continuation. A break beneath the decrease trendline in a descending triangle or a symmetrical triangle alerts a bearish continuation. Quantity affirmation is crucial to validate the breakout.

E. Flags and Pennants:

These are continuation patterns characterised by a quick interval of consolidation inside a clearly outlined development.

- Flags: Rectangular or barely sloping consolidations.

- Pennants: Triangle-shaped consolidations.

Buying and selling Technique: The breakout from the flag or pennant confirms the continuation of the prevailing development. A breakout above the higher trendline (flag or pennant) signifies a bullish continuation, whereas a break beneath the decrease trendline alerts a bearish continuation. Quantity ought to improve throughout the breakout.

F. Cup and Deal with:

This bullish continuation sample resembles a cup with a deal with. The "cup" is a rounded backside, indicating a interval of worth accumulation. The "deal with" is a brief, downward consolidation.

Buying and selling Technique: The breakout above the deal with’s resistance degree alerts a possible purchase alternative. Elevated quantity throughout the breakout confirms the bullish sign.

G. Rectangles:

Rectangles are horizontal consolidation patterns, characterised by parallel horizontal help and resistance strains.

Buying and selling Technique: Breakouts above the resistance line are bullish alerts, whereas breakouts beneath the help line are bearish alerts. Quantity affirmation is essential for validating the breakout.

III. Threat Administration in Swing Buying and selling Chart Patterns:

Profitable swing buying and selling depends closely on efficient danger administration. Listed here are essential concerns:

- Cease-Loss Orders: All the time place stop-loss orders to restrict potential losses. For a lot of patterns, putting the stop-loss slightly below the neckline (for bearish patterns) or above (for bullish patterns) is a standard observe.

- Place Sizing: By no means danger greater than a small share of your buying and selling capital on a single commerce. This protects your account from vital drawdowns.

- Commerce Choice: Not all patterns shall be profitable. Deal with high-probability setups with clear entry and exit factors, and keep away from overtrading.

- Affirmation: Search for affirmation from different technical indicators or elementary evaluation to extend confidence in your trades.

- Persistence: Anticipate the sample to totally type and for a transparent breakout earlier than coming into a commerce. Keep away from leaping the gun.

IV. Conclusion:

Mastering swing buying and selling entails understanding and using numerous chart patterns successfully. Whereas these patterns present priceless insights, they shouldn’t be seen as foolproof predictors. Combining chart sample evaluation with different technical indicators, elementary evaluation, and sound danger administration methods considerably will increase the chance of success in swing buying and selling. Constant studying, observe, and self-discipline are important for attaining long-term profitability on this dynamic market atmosphere. Keep in mind to all the time backtest your methods and adapt your strategy primarily based on market situations and your private danger tolerance. By no means make investments greater than you’re keen to lose.

Closure

Thus, we hope this text has offered priceless insights into Mastering Swing Buying and selling: Unveiling the Finest Chart Patterns for Constant Good points. We hope you discover this text informative and helpful. See you in our subsequent article!