Mastering the Candlestick Chart: A Dealer’s Complete Information

Associated Articles: Mastering the Candlestick Chart: A Dealer’s Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Mastering the Candlestick Chart: A Dealer’s Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering the Candlestick Chart: A Dealer’s Complete Information

Candlestick charts, removed from being mere ornamental parts, are highly effective instruments for technical analysts. Their potential to visually characterize worth motion over a selected interval, revealing essential details about market sentiment and momentum, makes them indispensable for merchants throughout numerous asset courses – from shares and foreign exchange to cryptocurrencies and futures. This text gives a complete information to understanding and using candlestick charts successfully in your buying and selling technique.

Understanding the Anatomy of a Candlestick:

Every candlestick represents the worth motion of an asset throughout a selected time interval (e.g., 1 minute, 5 minutes, 1 hour, 1 day). It consists of a number of key elements:

-

Physique (Actual Physique): The oblong portion of the candlestick represents the distinction between the opening and shutting costs. A "bullish" (or inexperienced/white) candlestick signifies the closing worth was increased than the opening worth, signifying shopping for stress. A "bearish" (or crimson/black) candlestick exhibits the closing worth was decrease than the opening worth, indicating promoting stress. The size of the physique displays the magnitude of the worth change.

-

Wicks (Shadows or Tails): The skinny strains extending above and beneath the physique are the wicks. The higher wick represents the best worth reached through the interval, whereas the decrease wick exhibits the bottom worth. Lengthy wicks recommend important worth rejection at these ranges, indicating potential resistance (higher wick) or assist (decrease wick).

Deciphering Candlestick Patterns:

The true energy of candlestick charts lies in figuring out and deciphering recurring patterns. These patterns, fashioned by the mix of particular person candlesticks, provide worthwhile insights into potential worth actions. Listed below are a number of the commonest and vital candlestick patterns:

1. Single Candlestick Patterns:

-

Doji: A Doji candlestick has nearly the identical opening and shutting worth, leading to a small or non-existent physique. It alerts indecision or a possible reversal out there development. Several types of Dojis (e.g., long-legged Doji, dragonfly Doji, headstone Doji) provide nuanced interpretations.

-

Hammer: A bullish reversal sample characterised by a small physique on the prime of the candlestick and a protracted decrease wick, suggesting patrons stepped in to forestall additional worth decline. The lengthy decrease wick signifies robust assist.

-

Hanging Man: A bearish reversal sample, much like a hammer however inverted. It seems on the prime of an uptrend and signifies potential promoting stress.

-

Taking pictures Star: A bearish reversal sample with a small physique on the backside and a protracted higher wick. It suggests robust resistance and potential worth reversal.

-

Inverted Hammer: A bullish reversal sample with a small physique on the backside and a protracted higher wick. It is the alternative of a capturing star.

2. Two-Candlestick Patterns:

-

Engulfing Sample: A two-candlestick sample the place the second candlestick utterly engulfs the physique of the primary. A bullish engulfing sample (crimson adopted by a bigger inexperienced) suggests a possible bullish reversal, whereas a bearish engulfing sample (inexperienced adopted by a bigger crimson) signifies a possible bearish reversal.

-

Piercing Sample: A bullish reversal sample the place a crimson candlestick is adopted by a inexperienced candlestick that closes at the very least midway up the crimson candlestick’s physique.

-

Darkish Cloud Cowl: A bearish reversal sample the place a inexperienced candlestick is adopted by a crimson candlestick that opens above the inexperienced candlestick’s shut and closes beneath its midpoint.

3. Three-Candlestick Patterns:

-

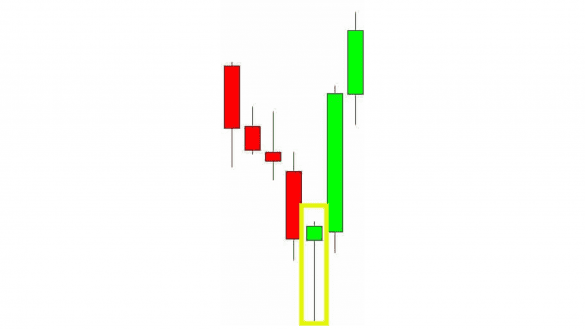

Morning Star: A bullish reversal sample consisting of a bearish candlestick adopted by a small physique (Doji or small vary candlestick) after which a powerful bullish candlestick.

-

Night Star: A bearish reversal sample, the alternative of a Morning Star. It consists of a bullish candlestick adopted by a small physique (Doji or small vary candlestick) after which a powerful bearish candlestick.

4. Different Essential Patterns:

-

Three White Troopers: A powerful bullish sign consisting of three consecutive bullish candlesticks with progressively increased closes.

-

Three Black Crows: A powerful bearish sign, the alternative of Three White Troopers.

-

Harami: A two-candlestick sample the place the second candlestick’s physique is totally contained throughout the first candlestick’s physique. It alerts indecision and potential reversal.

Utilizing Candlestick Patterns Successfully:

Whereas candlestick patterns present worthwhile insights, it is essential to make use of them strategically:

-

Affirmation is Key: Relying solely on candlestick patterns is dangerous. Verify potential reversals or traits with different technical indicators (e.g., transferring averages, RSI, MACD) and elementary evaluation.

-

Context Issues: The importance of a candlestick sample relies upon closely on the broader market context. A sample which may sign a powerful reversal in a trending market could be insignificant in a sideways market.

-

Timeframe Evaluation: Analyze candlestick patterns throughout a number of timeframes. A sample that appears important on a 5-minute chart could be much less related on a day by day chart.

-

Threat Administration: At all times use applicable danger administration strategies, resembling stop-loss orders, to guard your capital.

-

Apply and Endurance: Mastering candlestick chart evaluation requires observe and endurance. Begin by analyzing historic charts and progressively incorporate your learnings into your buying and selling technique.

Combining Candlestick Charts with Different Technical Indicators:

Candlestick charts are simplest when used at the side of different technical indicators. Combining them can present a extra holistic view of the market and improve the accuracy of buying and selling choices. For instance:

-

Transferring Averages: Combining candlestick patterns with transferring averages (e.g., 20-day, 50-day, 200-day) may also help determine potential assist and resistance ranges and ensure development route.

-

Relative Power Index (RSI): The RSI may also help determine overbought and oversold circumstances, confirming potential reversal alerts from candlestick patterns.

-

Transferring Common Convergence Divergence (MACD): The MACD may also help determine momentum modifications and potential development reversals, offering additional affirmation for candlestick patterns.

-

Quantity: Analyzing buying and selling quantity alongside candlestick patterns can present extra insights into the energy of worth actions. Excessive quantity confirms the importance of a sample, whereas low quantity would possibly recommend a weak sign.

Conclusion:

Candlestick charts are a strong software for technical evaluation, providing worthwhile insights into market sentiment and potential worth actions. By understanding the anatomy of candlesticks, recognizing widespread patterns, and mixing them with different technical indicators, merchants can considerably enhance their buying and selling choices and improve their probabilities of success. Nevertheless, keep in mind that no buying and selling technique is foolproof. Constant studying, disciplined danger administration, and steady adaptation are essential for long-term success within the markets. At all times observe on a demo account earlier than utilizing actual capital. The knowledge supplied on this article is for instructional functions solely and shouldn’t be thought-about monetary recommendation.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering the Candlestick Chart: A Dealer’s Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!