Mastering the iChart Possibility Chart: A Complete Information

Associated Articles: Mastering the iChart Possibility Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Mastering the iChart Possibility Chart: A Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering the iChart Possibility Chart: A Complete Information

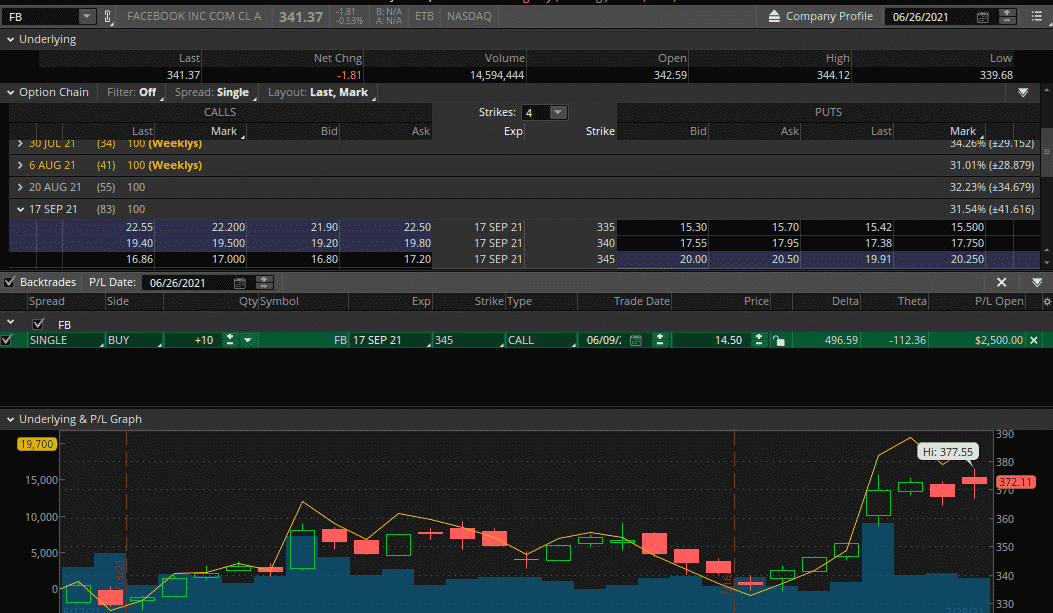

The iChart choice chart, a robust device inside numerous buying and selling platforms, gives a visible illustration of choice pricing and associated information. Understanding and successfully using this chart is essential for choices merchants of all ranges, from freshmen navigating the complexities of choices methods to seasoned professionals fine-tuning their buying and selling approaches. This text provides a complete exploration of the iChart choice chart, masking its key options, interpretation, and sensible purposes.

Understanding the Fundamentals: What’s an iChart Possibility Chart?

An iChart choice chart, in contrast to a normal candlestick or bar chart depicting the worth motion of the underlying asset, focuses particularly on choices contracts. It presents a visible show of choice costs (each calls and places) throughout numerous strike costs and expiration dates. This enables merchants to rapidly assess the market’s implied volatility, sentiment, and potential revenue/loss eventualities for various choice methods. The precise options and presentation can fluctuate barely relying on the buying and selling platform, however core parts stay constant.

Key Parts of an iChart Possibility Chart:

-

Underlying Asset Value: The present market worth of the underlying asset (inventory, index, and so forth.) is prominently displayed, serving as a vital reference level for deciphering choice costs.

-

Strike Costs: The horizontal axis sometimes represents the strike costs of the choices contracts. These are the costs at which the choice holder should purchase (name) or promote (put) the underlying asset.

-

Expiration Dates: A number of expiration dates are normally proven, permitting merchants to match choice costs throughout totally different time horizons. That is typically represented by separate charts or tabs throughout the iChart interface.

-

Possibility Costs (Bid/Ask): The vertical axis represents the choice costs, sometimes exhibiting each the bid (lowest worth a purchaser is prepared to pay) and the ask (highest worth a vendor is prepared to simply accept) for every contract. The distinction between the bid and ask is the unfold.

-

Possibility Greeks: Many iChart implementations incorporate key choice Greeks (Delta, Gamma, Theta, Vega, Rho) instantly onto the chart or readily accessible by linked information. These metrics present insights into the sensitivity of choice costs to adjustments within the underlying asset’s worth, time decay, implied volatility, and rates of interest.

-

Quantity and Open Curiosity: Information on buying and selling quantity and open curiosity for every choice contract may be overlaid or displayed alongside the worth information, providing worthwhile details about market exercise and potential liquidity.

-

Interactive Options: Fashionable iChart implementations are sometimes interactive, permitting merchants to:

- Zoom in/out: Alter the extent of element displayed on the chart.

- Pan: Transfer throughout the chart to look at totally different strike costs and expiration dates.

- Overlay indicators: Add technical indicators (e.g., transferring averages, Bollinger Bands) for additional evaluation.

- Draw instruments: Make the most of instruments like pattern strains and Fibonacci retracements to establish potential worth patterns.

- Customise show: Alter the displayed information (e.g., exhibiting solely calls or places, highlighting particular strike costs).

Deciphering the iChart Possibility Chart:

The power to successfully interpret an iChart choice chart is essential for profitable choices buying and selling. Listed here are some key points to think about:

-

Implied Volatility: The form and positioning of the choice worth curve (the visible illustration of choice costs throughout totally different strike costs) can present insights into implied volatility. A steeper curve typically suggests increased implied volatility, indicating higher market uncertainty.

-

Market Sentiment: The relative costs of calls and places can reveal market sentiment. Greater name costs in comparison with places might recommend bullish sentiment, whereas the other may point out bearish sentiment.

-

Possibility Technique Evaluation: The iChart permits merchants to visualise the potential revenue/loss profiles of various choice methods (e.g., straddles, strangles, spreads) throughout numerous underlying asset worth actions. That is typically carried out by overlaying a revenue/loss diagram onto the chart.

-

Figuring out Alternatives: By analyzing the interaction of worth, quantity, open curiosity, and choice Greeks, merchants can establish doubtlessly worthwhile buying and selling alternatives. For instance, a excessive open curiosity in a selected strike worth may point out a big degree of assist or resistance.

Sensible Purposes of the iChart Possibility Chart:

The iChart choice chart has quite a few sensible purposes in choices buying and selling:

-

Technique Choice: Visualizing potential revenue/loss profiles helps merchants select methods aligned with their threat tolerance and market outlook.

-

Threat Administration: Understanding the sensitivity of choice costs to varied market components (by the Greeks) permits for higher threat administration.

-

Order Placement: The chart facilitates exact order placement, enabling merchants to execute trades at desired costs and strike costs.

-

Monitoring Positions: Merchants can simply monitor the efficiency of their present choice positions by observing worth adjustments and the affect of market actions on their P/L.

-

Backtesting Methods: Whereas not a direct backtesting device, the iChart can be utilized at the side of historic information to investigate the efficiency of various methods beneath numerous market circumstances.

-

Figuring out Uncommon Exercise: Vital deviations from anticipated choice pricing patterns (e.g., unusually excessive quantity in a selected strike worth) can alert merchants to potential market-moving occasions or manipulative actions.

Superior Methods and Concerns:

-

Combining with different indicators: Integrating the iChart with different technical evaluation instruments can improve its effectiveness. For instance, combining it with quantity evaluation or transferring averages can present a extra holistic view of the market.

-

Understanding volatility skew and smile: The iChart can reveal the volatility skew and smile, which symbolize the connection between implied volatility and strike costs. Understanding these patterns can present insights into market sentiment and potential buying and selling alternatives.

-

Contemplating time decay (Theta): The iChart ought to be used at the side of an understanding of time decay. As expiration approaches, the worth of choices erodes, impacting the profitability of methods.

-

Platform-specific options: The particular options and functionalities of the iChart can fluctuate throughout totally different buying and selling platforms. It is essential to know the capabilities of your chosen platform.

Conclusion:

The iChart choice chart is an indispensable device for choices merchants. Its means to visually symbolize advanced choice pricing information, mixed with its interactive options, makes it a robust useful resource for technique growth, threat administration, and figuring out buying and selling alternatives. By mastering the interpretation and utility of the iChart, merchants can considerably improve their understanding of the choices market and enhance their buying and selling efficiency. Nevertheless, it is essential to keep in mind that the iChart is only one device amongst many, and profitable choices buying and selling requires a complete understanding of choices pricing, threat administration, and market dynamics. Steady studying and follow are important for successfully leveraging the ability of the iChart choice chart.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering the iChart Possibility Chart: A Complete Information. We respect your consideration to our article. See you in our subsequent article!