Mastering the MT4 Chart Scale: A Complete Information for Merchants

Associated Articles: Mastering the MT4 Chart Scale: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering the MT4 Chart Scale: A Complete Information for Merchants. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Mastering the MT4 Chart Scale: A Complete Information for Merchants

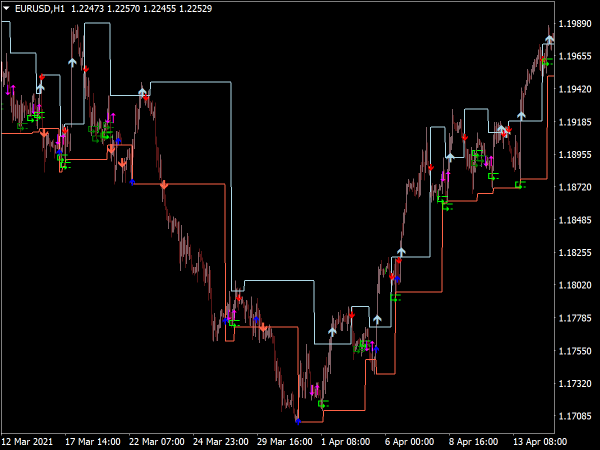

The MetaTrader 4 (MT4) platform affords a strong charting system, permitting merchants to visualise worth actions and analyze market tendencies. A vital factor of this technique is the chart scale, which dictates the granularity and visible illustration of worth knowledge. Understanding and successfully managing your MT4 chart scale is paramount for profitable buying and selling, impacting every little thing from figuring out patterns to executing trades. This text delves deep into the nuances of MT4 chart scales, exploring their functionalities, customization choices, and strategic implications to your buying and selling strategy.

Understanding the Fundamentals: Timeframes and Worth Scales

The MT4 chart scale is basically composed of two interconnected parts: the timeframe and the worth scale.

-

Timeframe: This determines the interval at which worth knowledge is displayed. Widespread timeframes embrace M1 (1-minute), M5 (5-minute), M15 (15-minute), H1 (1-hour), H4 (4-hour), D1 (day by day), W1 (weekly), and MN1 (month-to-month). Choosing the proper timeframe is essential. Shorter timeframes (e.g., M1, M5) reveal high-frequency worth fluctuations, excellent for scalping and intraday buying and selling, however will be noisy and susceptible to whipsaws. Longer timeframes (e.g., D1, W1) present a broader perspective, highlighting long-term tendencies and decreasing the impression of short-term volatility, higher fitted to swing and positional buying and selling.

-

Worth Scale: This represents the vertical axis of the chart, exhibiting the value vary of the asset. The value scale robotically adjusts based mostly on the timeframe and the value motion inside that timeframe. Nevertheless, you may have vital management over its customization, permitting you to zoom in or out, specializing in particular worth ranges or increasing the view to embody a bigger worth vary.

Customizing Your MT4 Chart Scale: A Detailed Exploration

MT4 gives a number of strategies for customizing your chart scale, granting you fine-grained management over your visible illustration of market knowledge.

-

Zooming: The only methodology is utilizing the mouse wheel to zoom in or out. Scrolling up zooms in, offering a extra detailed view of worth motion inside a shorter interval, whereas scrolling down zooms out, providing a broader, much less detailed perspective.

-

Drag and Drop: You possibly can manually modify the value scale by clicking and dragging the highest or backside of the chart’s vertical axis. This lets you give attention to particular worth ranges, highlighting help and resistance ranges, or increasing the view to incorporate broader market actions.

-

Chart Properties: Accessing the chart properties window (right-click on the chart and choose "Properties") gives much more granular management. Right here you’ll be able to:

- Change Timeframe: Simply swap between completely different timeframes, immediately altering the granularity of your chart.

- Alter Scale: Manually enter particular worth ranges for the vertical axis, making certain exact give attention to essential worth ranges.

- Customise Look: Modify numerous chart parts, reminiscent of colours, fonts, and grid traces, enhancing readability and visible readability.

- Choose Chart Sort: Select between completely different chart sorts (candlestick, bar, line) to finest fit your analytical wants.

-

Keyboard Shortcuts: MT4 affords keyboard shortcuts for fast changes. For instance, urgent "+" zooms in, whereas "-" zooms out. These shortcuts can considerably pace up your evaluation and scale back the time spent manually adjusting the chart.

Strategic Implications of Chart Scale Administration

The selection of timeframe and the administration of the value scale should not merely aesthetic choices; they’ve profound strategic implications to your buying and selling strategy.

-

Figuring out Patterns: Completely different timeframes reveal completely different patterns. A head and shoulders sample is likely to be clearly seen on a day by day chart however obscured by noise on a 1-minute chart. Equally, adjusting the value scale can spotlight particular worth ranges appearing as help or resistance, essential for figuring out potential entry and exit factors.

-

Threat Administration: The chart scale immediately influences your notion of threat. A zoomed-in chart may enlarge short-term volatility, resulting in impulsive trades and elevated threat. A zoomed-out chart, however, gives a extra balanced perspective, enabling higher threat administration by contemplating broader market context.

-

Buying and selling Technique Choice: Your alternative of timeframe and chart scale ought to align along with your buying and selling technique. Scalpers will depend on very quick timeframes and zoomed-in worth scales, whereas swing merchants will desire longer timeframes and a broader worth scale view.

-

Avoiding Over-Evaluation: A cluttered chart with an excessive amount of data can result in evaluation paralysis. By strategically managing your chart scale, you’ll be able to filter out pointless noise and give attention to probably the most related data, enhancing decision-making effectivity.

-

Backtesting and Optimization: Constant chart scale utilization throughout backtesting is essential for correct technique analysis. Inconsistent scaling can result in biased outcomes and inaccurate optimization of buying and selling parameters.

Superior Methods and Issues

-

A number of Timeframe Evaluation: Combining completely different timeframes concurrently is a strong analytical approach. Observing the identical asset on a number of timeframes (e.g., M5, H1, D1) permits for a holistic view, confirming tendencies and figuring out potential divergences.

-

Customized Indicators and Templates: MT4’s extensibility permits for the combination of customized indicators and chart templates. These can improve your chart scale administration by robotically adjusting the dimensions based mostly on particular indicators or pre-defined settings.

-

Alert Methods: Setting worth alerts based mostly on particular worth ranges inside your custom-made worth scale can present well timed notifications of potential buying and selling alternatives or threat administration triggers.

-

Display Decision and Chart Dimension: The dimensions and determination of your display screen immediately impression the effectiveness of your chart scale. A bigger display screen permits for a extra detailed view with out sacrificing readability, whereas a smaller display screen may require extra strategic scale administration to keep away from muddle.

Conclusion:

Mastering the MT4 chart scale is a elementary ability for any severe dealer. It isn’t nearly visible desire; it immediately impacts your skill to establish patterns, handle threat, and execute profitable trades. By understanding the completely different customization choices, strategic implications, and superior strategies, you’ll be able to leverage the ability of the MT4 charting system to considerably improve your buying and selling efficiency. Experiment with completely different timeframes and worth scales, discovering the optimum settings that align along with your buying and selling fashion and technique, and constantly apply these settings for correct evaluation and constant outcomes. Do not forget that constant observe and a deep understanding of market dynamics are essential for successfully using the MT4 chart scale to its full potential.

Closure

Thus, we hope this text has offered beneficial insights into Mastering the MT4 Chart Scale: A Complete Information for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!