Mastering Commerce View Charts: A Deep Dive into Technical Evaluation and Charting

Associated Articles: Mastering Commerce View Charts: A Deep Dive into Technical Evaluation and Charting

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Mastering Commerce View Charts: A Deep Dive into Technical Evaluation and Charting. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Mastering Commerce View Charts: A Deep Dive into Technical Evaluation and Charting

Commerce View, a well-liked charting platform built-in inside TradingView, has change into a cornerstone for merchants throughout numerous asset lessons. Its complete suite of instruments, customizable interfaces, and huge neighborhood options make it a strong useful resource for each inexperienced persons and seasoned professionals. This text gives a complete overview of Commerce View charts, exploring their options, functionalities, and the way they are often leveraged for efficient technical evaluation.

Understanding the Commerce View Chart Interface:

At its core, the Commerce View chart gives a visible illustration of value actions over time. The default view sometimes shows a candlestick chart, although different chart varieties like line, bar, and Heikin-Ashi are available. The chart itself is extremely customizable, permitting merchants to regulate:

-

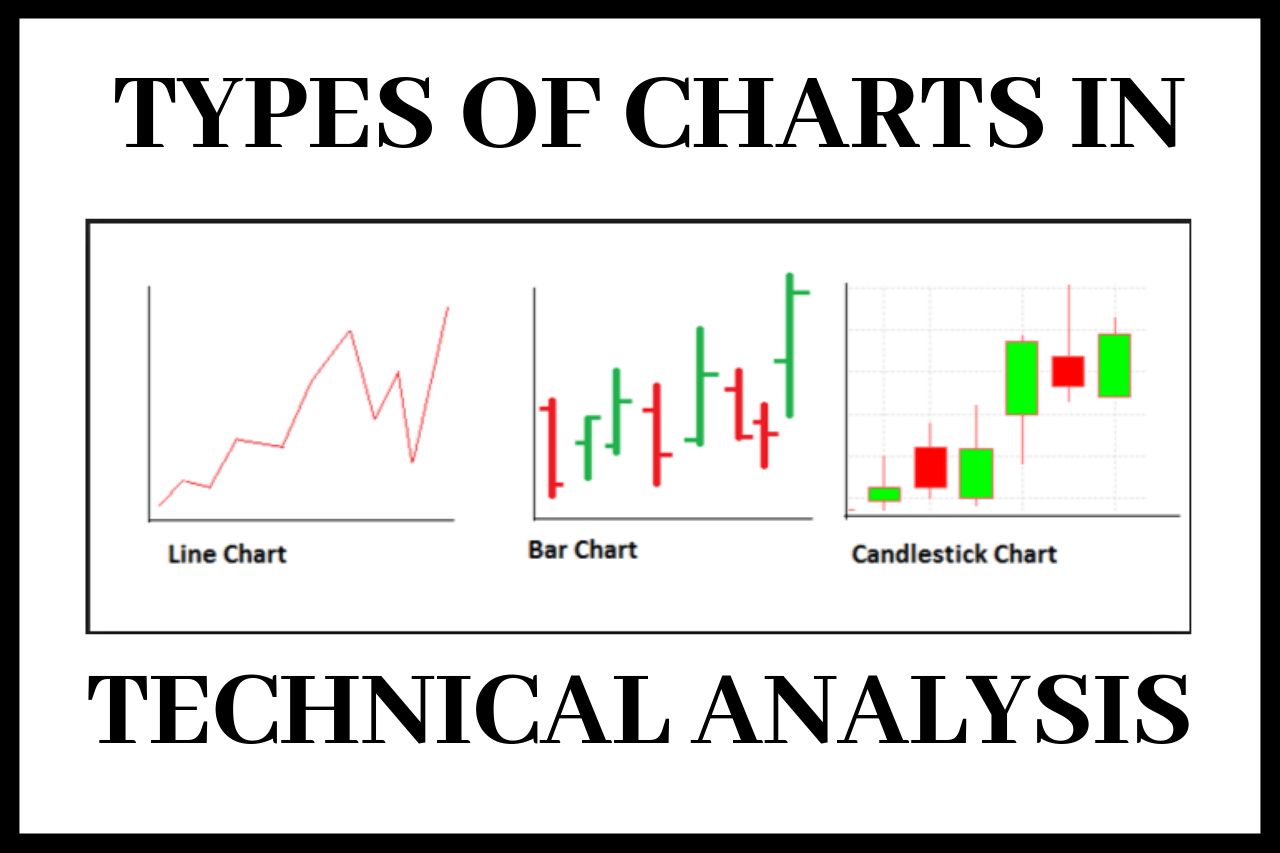

Chart Sort: Selecting the suitable chart sort is essential. Candlestick charts spotlight value open, excessive, low, and shut values, making them superb for figuring out value patterns. Line charts simplify value motion, whereas bar charts provide an identical illustration to candlestick charts however with an easier visible. Heikin-Ashi charts clean out value fluctuations, making development identification simpler.

-

Timeframe: Commerce View provides a variety of timeframes, from intraday intervals (1 minute, 5 minutes, quarter-hour, and so on.) to day by day, weekly, and month-to-month charts. The chosen timeframe considerably impacts the evaluation, with shorter timeframes revealing short-term value fluctuations and longer timeframes illustrating broader developments.

-

Indicators: An enormous library of technical indicators is built-in instantly into Commerce View. These indicators present quantitative insights into value motion, momentum, quantity, and volatility. Well-liked indicators embody:

- Shifting Averages (MA): Calculate the common value over a selected interval, smoothing out value noise and figuring out developments. Frequent varieties embody Easy Shifting Common (SMA), Exponential Shifting Common (EMA), and Weighted Shifting Common (WMA).

- Relative Power Index (RSI): Measures the magnitude of latest value modifications to guage overbought and oversold circumstances.

- Shifting Common Convergence Divergence (MACD): Identifies modifications in momentum by evaluating two transferring averages.

- Bollinger Bands: Plot normal deviations round a transferring common, highlighting value volatility and potential reversal factors.

- Quantity Indicators: Analyze buying and selling quantity to verify value actions and determine potential breakouts. Examples embody On-Steadiness Quantity (OBV) and Chaikin Cash Move (CMF).

-

Drawing Instruments: Commerce View gives a complete set of drawing instruments, enabling customers to visually determine patterns, assist and resistance ranges, trendlines, and Fibonacci retracements. These instruments facilitate sample recognition and assist formulate buying and selling methods.

-

Research: Past pre-built indicators, Commerce View permits customers so as to add customized research, both by creating their very own or importing them from the huge community-contributed library. This flexibility caters to superior customers with particular analytical wants.

Leveraging Commerce View for Technical Evaluation:

Commerce View’s charting capabilities are instrumental in numerous technical evaluation approaches:

-

Pattern Following: Figuring out prevailing developments is a elementary side of technical evaluation. Commerce View facilitates this by way of transferring averages, trendlines, and different indicators that spotlight directional value actions. Merchants can make the most of these instruments to determine long-term developments and capitalize on sustained value appreciation or depreciation.

-

Help and Resistance Ranges: These ranges symbolize value zones the place shopping for or promoting stress is predicted to be significantly sturdy. Commerce View’s drawing instruments enable merchants to determine these ranges visually, doubtlessly offering entry and exit factors for trades. Breakouts above resistance or beneath assist can sign important value actions.

-

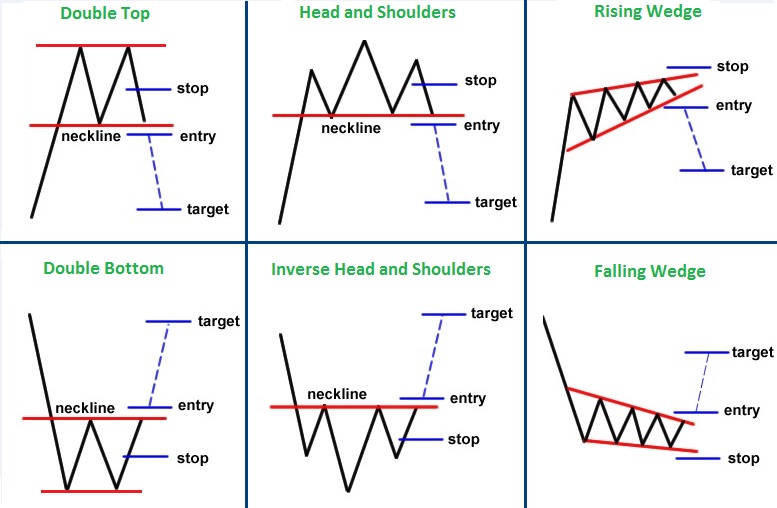

Sample Recognition: Chart patterns, corresponding to head and shoulders, double tops/bottoms, flags, and pennants, can present useful insights into potential value reversals or continuations. Commerce View’s drawing instruments and customizable chart varieties facilitate the identification and interpretation of those patterns.

-

Candlestick Evaluation: Understanding candlestick patterns is essential for decoding short-term value actions. Commerce View’s candlestick charts enable merchants to investigate particular person candlesticks and their combos to determine potential reversal alerts or affirmation of present developments. Hammer, hanging man, engulfing patterns, and doji are some examples of candlestick patterns that may be readily analyzed.

-

Quantity Evaluation: Buying and selling quantity gives essential context for value actions. Excessive quantity confirms value strikes, whereas low quantity suggests weak momentum. Commerce View integrates quantity indicators and permits for direct visible evaluation of quantity bars alongside value motion, enabling merchants to verify developments and determine potential divergences.

Past the Charts: Group and Social Options:

Commerce View’s energy extends past its charting capabilities. Its built-in social options present a useful studying and collaborative atmosphere:

-

Thought Sharing: Merchants can share their chart setups, analyses, and buying and selling concepts with the broader neighborhood, fostering collaboration and studying.

-

Script Growth: Skilled customers can develop and share customized indicators and scripts, extending the performance of the platform. This community-driven improvement considerably enhances the platform’s analytical capabilities.

-

Actual-time Market Sentiment: Observing different merchants’ analyses and concepts can present useful insights into prevailing market sentiment. This will help merchants gauge the general market outlook and potential dangers.

Limitations and Issues:

Whereas Commerce View is a strong instrument, it is important to acknowledge its limitations:

-

Over-reliance on Indicators: No single indicator or chart sample ensures worthwhile trades. Over-reliance on technical evaluation can result in flawed choices. Basic evaluation and danger administration ought to all the time be thought of.

-

Information Lag: Actual-time knowledge is essential, however minor delays can happen. This ought to be thought of when making high-frequency trades.

-

Subjectivity: Decoding charts and indicators includes a level of subjectivity. Totally different merchants might draw completely different conclusions from the identical knowledge.

Conclusion:

Commerce View’s complete charting instruments, customizable interface, and vibrant neighborhood make it a strong platform for technical evaluation. By mastering its options and mixing technical evaluation with sound danger administration and elementary evaluation, merchants can considerably improve their buying and selling methods and decision-making processes. Nonetheless, it is essential to keep in mind that no instrument ensures success, and steady studying and adaptation are important for long-term success within the dynamic world of buying and selling. Using Commerce View successfully requires follow, endurance, and a deep understanding of each technical and elementary evaluation ideas. By combining the platform’s highly effective instruments with a disciplined method, merchants can unlock a wealth of insights and enhance their general buying and selling efficiency.

Closure

Thus, we hope this text has supplied useful insights into Mastering Commerce View Charts: A Deep Dive into Technical Evaluation and Charting. We thanks for taking the time to learn this text. See you in our subsequent article!