Mastering TradingView Charts: A Complete Information

Associated Articles: Mastering TradingView Charts: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering TradingView Charts: A Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering TradingView Charts: A Complete Information

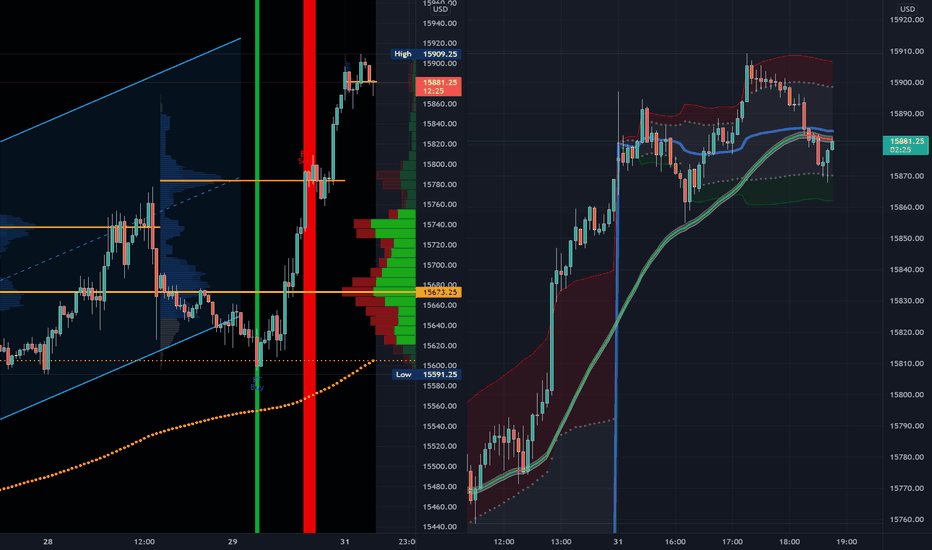

TradingView has turn out to be the de facto normal charting platform for merchants of all ranges. Its intuitive interface, highly effective instruments, and huge group assist make it a useful useful resource for analyzing markets and executing trades. Nevertheless, the platform’s versatility can even really feel overwhelming to newcomers. This complete information will stroll you thru the important facets of charting on TradingView, from primary navigation to superior strategies.

I. Getting Began: Navigation and Fundamental Chart Settings

Earlier than diving into superior evaluation, understanding the essential format is essential. Upon logging in, you may be offered with a chart displaying a default instrument (typically a serious index just like the S&P 500). The core elements embrace:

-

Chart Space: That is the central area displaying the value motion of your chosen asset. You’ll be able to zoom out and in utilizing the mouse wheel or the zoom controls. Dragging the chart means that you can pan throughout completely different time durations.

-

Toolbar: Positioned usually on the prime, the toolbar offers fast entry to generally used features: including indicators, drawing instruments, altering chart varieties, modifying timeframes, and accessing settings.

-

Indicator Panel: This panel, normally situated on the left, shows all the symptoms you’ve got added to your chart. You’ll be able to customise their settings, reorder them, and take away them from right here.

-

Settings Panel: Usually accessible by way of a gear icon, this panel means that you can alter numerous chart settings corresponding to model, colours, gridlines, and quantity show.

-

Timeframe Selector: This significant aspect helps you to change between completely different timeframes, from intraday (e.g., 1-minute, 5-minute, 1-hour) to day by day, weekly, and month-to-month charts. Choosing the proper timeframe is crucial in your evaluation and buying and selling technique.

Selecting your Chart Kind: TradingView presents a number of chart varieties, every providing a singular perspective on value motion:

-

Candlestick Chart: The preferred selection, displaying open, excessive, low, and shut costs for a particular interval. The colour of the candlestick signifies whether or not the value closed larger (usually inexperienced or bullish) or decrease (usually purple or bearish) than it opened.

-

Bar Chart: Much like candlestick charts, however easier, displaying solely the open, excessive, low, and shut costs as vertical bars.

-

Line Chart: Connects the closing costs of every interval with a line, emphasizing traits and smoothing out value fluctuations.

-

Heikin Ashi: A sort of candlestick chart that smooths out value motion, making traits simpler to establish. It is significantly helpful for figuring out potential pattern reversals.

-

Space Chart: Much like a line chart however fills the realm beneath the road, offering a visible illustration of value accumulation or distribution.

II. Mastering Indicators: Including and Customizing

TradingView presents an enormous library of technical indicators, categorized by their function (e.g., pattern indicators, oscillators, quantity indicators). So as to add an indicator:

- Click on the "Indicators" button within the toolbar.

- Seek for the specified indicator utilizing key phrases (e.g., "RSI," "MACD," "Bollinger Bands").

- Click on on the indicator so as to add it to your chart.

- Customise its settings (interval, size, and so on.) inside the indicator’s settings panel.

Understanding the strengths and weaknesses of various indicators is essential. Listed below are some standard examples:

-

Shifting Averages (MA): Clean out value fluctuations, highlighting traits. Widespread varieties embrace Easy Shifting Common (SMA), Exponential Shifting Common (EMA), and Weighted Shifting Common (WMA).

-

Relative Power Index (RSI): An oscillator that measures the magnitude of latest value adjustments to guage overbought or oversold situations.

-

Shifting Common Convergence Divergence (MACD): A trend-following momentum indicator that identifies potential adjustments in pattern path.

-

Bollinger Bands: Envelopes that show value volatility. Value actions exterior the bands typically sign potential breakouts or reversals.

-

Quantity Indicators: Measure buying and selling quantity, offering insights into the energy of value actions. Examples embrace On-Stability Quantity (OBV) and Chaikin Cash Move (CMF).

Bear in mind to experiment with completely different indicators and settings to seek out what works greatest in your buying and selling model and the precise market you are analyzing.

III. Using Drawing Instruments: Enhancing Your Evaluation

TradingView’s drawing instruments are indispensable for figuring out patterns, assist and resistance ranges, and potential commerce setups. Some frequent instruments embrace:

-

Development Strains: Join important value factors to establish traits and potential assist/resistance ranges.

-

Horizontal Strains: Mark particular value ranges, typically representing assist or resistance.

-

Fibonacci Retracements: Based mostly on the Fibonacci sequence, these instruments establish potential assist and resistance ranges inside a pattern.

-

Fibonacci Extensions: Much like retracements, however undertaking potential value targets past a pattern.

-

Assist/Resistance Strains: Mechanically establish potential assist and resistance ranges based mostly on value motion.

-

Rectangles, Channels, and different Geometric Shapes: Spotlight particular value patterns or ranges.

-

Annotations: Add textual content and different annotations to your chart for note-taking and evaluation.

Mastering these instruments requires observe and understanding of value motion. Experiment with completely different instruments and observe how they may also help you establish potential buying and selling alternatives.

IV. Superior Strategies and Options:

TradingView presents many superior options that may considerably improve your evaluation:

-

Pine Script: A proprietary scripting language that means that you can create your individual customized indicators and techniques. This can be a highly effective software for skilled customers who wish to tailor their evaluation to their particular wants.

-

Alerts: Arrange alerts based mostly on value motion, indicator alerts, or different situations. This lets you obtain notifications when potential buying and selling alternatives come up.

-

Backtesting: Check your buying and selling methods on historic information to guage their efficiency. This characteristic is essential for refining your methods and minimizing threat.

-

Technique Tester: A robust software for backtesting and optimizing buying and selling methods, incorporating numerous parameters and threat administration strategies.

-

Screeners: Use pre-built or customized screeners to rapidly establish property that meet particular standards, corresponding to these exhibiting specific technical patterns or elementary traits.

-

Neighborhood Options: Interact with the huge TradingView group, sharing concepts, studying from others, and accessing publicly shared indicators and techniques.

V. Conclusion: A Steady Studying Course of

Mastering TradingView charting is an ongoing course of. Begin with the fundamentals, step by step incorporating extra superior options and strategies as your understanding grows. Experiment with completely different chart varieties, indicators, and drawing instruments to seek out the mix that most closely fits your buying and selling model and the markets you are analyzing. Bear in mind to all the time observe threat administration and by no means rely solely on technical evaluation when making buying and selling choices. The platform’s huge sources, together with its in depth assist part and energetic group, present invaluable assist in your studying journey. By dedicating effort and time to mastering TradingView, you may considerably improve your skill to investigate markets and make knowledgeable buying and selling choices.

Closure

Thus, we hope this text has supplied precious insights into Mastering TradingView Charts: A Complete Information. We admire your consideration to our article. See you in our subsequent article!