Mastering Xero’s Chart of Accounts: A Complete Information to Chart of Accounts Codes

Associated Articles: Mastering Xero’s Chart of Accounts: A Complete Information to Chart of Accounts Codes

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering Xero’s Chart of Accounts: A Complete Information to Chart of Accounts Codes. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Mastering Xero’s Chart of Accounts: A Complete Information to Chart of Accounts Codes

Xero’s chart of accounts is the spine of your monetary record-keeping. It is a meticulously organized listing of all your online business’s accounts, every recognized by a novel code. These codes usually are not simply arbitrary numbers; they’re the important thing to environment friendly monetary reporting, correct bookkeeping, and streamlined accounting processes. Understanding and successfully using Xero’s chart of accounts codes is essential for any enterprise proprietor or accountant utilizing the platform. This complete information delves into the intricacies of Xero’s chart of accounts codes, exploring their construction, performance, and finest practices for implementation and administration.

Understanding the Construction of Xero Chart of Accounts Codes

Xero affords flexibility in the way you construction your chart of accounts codes. Whereas there isn’t any single mandated format, a well-structured system is important for readability and scalability. The most typical method makes use of a hierarchical system, usually using numbers and/or letters to categorize accounts. This enables for detailed breakdowns of your monetary knowledge. For instance, a code like "1000-1010-1010-1" may characterize:

- 1000: Property (essential class)

- 1010: Present Property (subcategory)

- 1010: Money (sub-subcategory)

- 1: Particular money account (e.g., working account)

This hierarchical construction permits for straightforward filtering and reporting. You may generate reviews exhibiting all accounts beneath "1000" (Property), or drill right down to see solely the stability of "1010-1010-1" (the precise working account).

Selecting a Chart of Accounts Construction: Greatest Practices

The construction you select relies on your online business’s complexity and reporting wants. Contemplate these elements:

- Trade Requirements: Some industries have established charting conventions. Adhering to those can simplify comparisons and exterior audits.

- Enterprise Measurement: A small enterprise may require an easier construction, whereas a bigger enterprise wants a extra detailed one.

- Reporting Necessities: Contemplate the sorts of reviews you’ll want to generate. Your chart of accounts ought to facilitate the creation of those reviews effectively.

- Future Scalability: Design your construction to accommodate future progress and modifications in your online business operations. Go away room for growth inside your coding system.

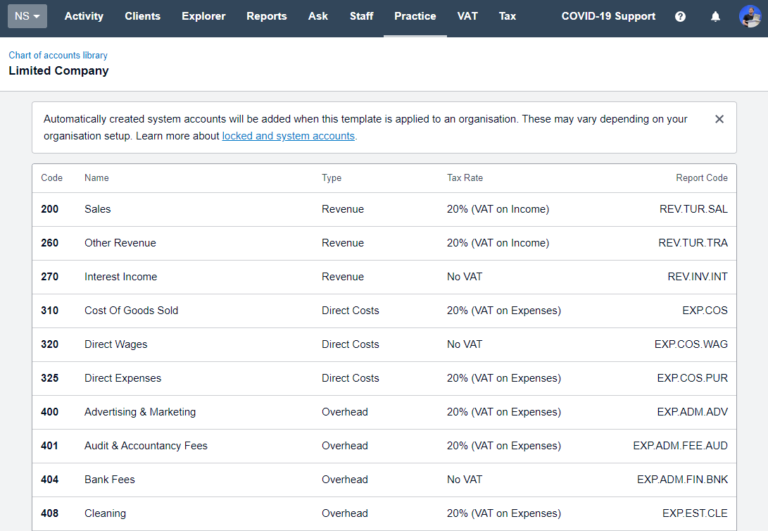

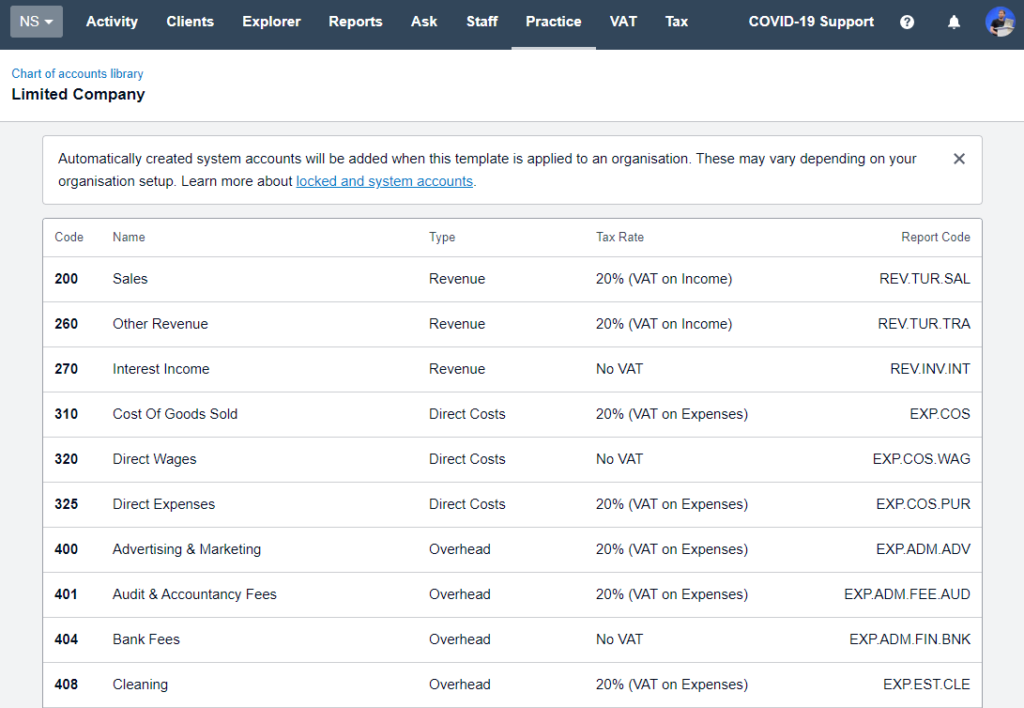

Frequent Account Sorts and their Typical Codes

Xero’s chart of accounts sometimes consists of accounts from these main classes:

-

Property: Assets owned by the enterprise. Frequent examples embody:

- Present Property (1000-1xxx): Money, accounts receivable, stock.

- Non-Present Property (1000-2xxx): Property, plant, and gear (PP&E), intangible property.

-

Liabilities: Obligations owed by the enterprise. Frequent examples embody:

- Present Liabilities (2000-1xxx): Accounts payable, short-term loans.

- Non-Present Liabilities (2000-2xxx): Lengthy-term loans, mortgages.

-

Fairness: The proprietor’s funding within the enterprise. This consists of:

- Capital Accounts (3000): Proprietor’s contributions, retained earnings.

-

Income: Earnings generated from enterprise operations. Examples embody:

- Gross sales Income (4000): Gross sales of products or providers.

- Different Income (4000-1xxx): Curiosity revenue, rental revenue.

-

Bills: Prices incurred in working the enterprise. Examples embody:

- Value of Items Bought (5000): Direct prices related to producing items.

- Working Bills (5000-1xxx): Hire, salaries, utilities.

- Administrative Bills (5000-2xxx): Workplace provides, insurance coverage.

Utilizing a Constant Coding System

Consistency is paramount. As soon as you’ve got established your chart of accounts construction, persist with it. Inconsistent coding results in errors and makes reporting extremely troublesome. Contemplate the following pointers:

- Detailed Documentation: Preserve a complete doc outlining your chart of accounts construction, together with the which means of every code.

- Coaching: Guarantee all employees concerned in bookkeeping perceive the chart of accounts and its coding system.

- Common Opinions: Periodically evaluation your chart of accounts to make sure it stays related and environment friendly. Regulate it as your online business grows and modifications.

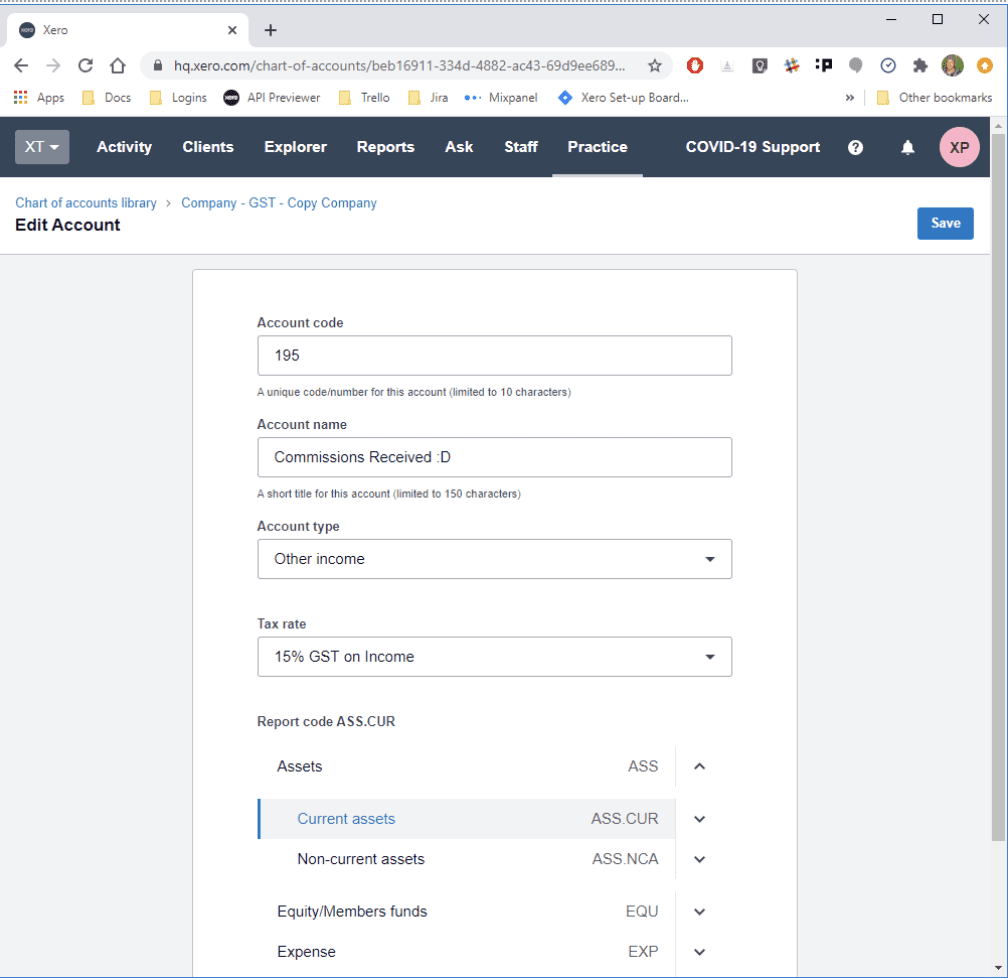

Implementing Your Chart of Accounts in Xero

Xero gives instruments to simply arrange and handle your chart of accounts. You may:

- Import a Chart of Accounts: Should you’re migrating from one other accounting system, you may have the ability to import your present chart.

- Manually Create Accounts: Xero lets you manually create accounts and assign codes.

- Use Xero’s Default Chart: Xero gives a default chart of accounts you could modify to fit your wants. This can be a good start line for brand new companies.

Superior Chart of Accounts Methods

For bigger companies or these with particular reporting necessities, extra superior methods could be employed:

- Phase Reporting: Utilizing codes to trace efficiency throughout completely different segments of your online business (e.g., product traces, geographical areas).

- Customized Fields: Including customized fields to accounts permits for monitoring further knowledge past the fundamental monetary info.

- Account Reconciliation: Common reconciliation of accounts is important to make sure accuracy and determine discrepancies.

Troubleshooting Frequent Chart of Accounts Points

- Inconsistent Coding: This results in inaccurate reviews and difficulties in monetary evaluation. Evaluation your coding system and guarantee consistency.

- Lacking Accounts: Guarantee you might have accounts for all points of your online business. Lacking accounts can result in incomplete monetary statements.

- Duplicate Accounts: Having duplicate accounts could cause confusion and errors. Commonly evaluation your chart to determine and proper duplicates.

Conclusion:

A well-designed and meticulously managed chart of accounts is key to efficient monetary administration in Xero. By understanding the construction, implementing finest practices, and constantly making use of your coding system, you may unlock the facility of your monetary knowledge. This enables for knowledgeable decision-making, correct reporting, and a streamlined accounting course of, in the end contributing to the success and progress of your online business. Bear in mind, investing time in designing and sustaining a strong chart of accounts is an funding within the long-term well being and prosperity of your online business. Common evaluation and adaptation are key to making sure its continued effectiveness as your online business evolves.

Closure

Thus, we hope this text has offered invaluable insights into Mastering Xero’s Chart of Accounts: A Complete Information to Chart of Accounts Codes. We admire your consideration to our article. See you in our subsequent article!