Mastering Your Funds: A Complete Information to Making a Pattern Chart of Accounts in Excel

Associated Articles: Mastering Your Funds: A Complete Information to Making a Pattern Chart of Accounts in Excel

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Mastering Your Funds: A Complete Information to Making a Pattern Chart of Accounts in Excel. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Mastering Your Funds: A Complete Information to Making a Pattern Chart of Accounts in Excel

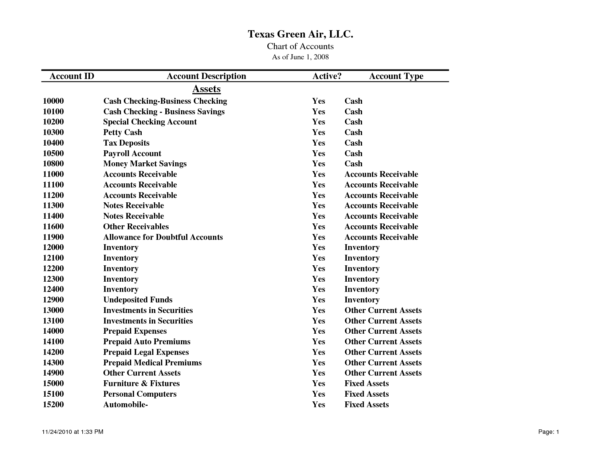

A chart of accounts (COA) is the spine of any sound monetary system, whether or not for a small enterprise, a non-profit, or a big company. It is a structured checklist of all of the accounts utilized by a corporation to report its monetary transactions. A well-designed COA facilitates correct monetary reporting, simplifies bookkeeping, and supplies useful insights into the monetary well being of your enterprise. Whereas accounting software program gives built-in COA performance, understanding the rules behind creating one and leveraging the facility of Excel could be extremely helpful, notably for these beginning out or searching for larger management over their monetary information. This text supplies a complete information to making a pattern chart of accounts in Excel, exploring its construction, functionalities, and greatest practices.

Understanding the Construction of a Chart of Accounts

A COA usually follows a hierarchical construction, categorized by account sort. The commonest construction makes use of a numbering system to categorise accounts into main classes and sub-categories, permitting for detailed monitoring of monetary exercise. The particular numbering system and classes will range relying on the character and complexity of what you are promoting, however a standard method makes use of a five-digit or extra system, providing flexibility for growth.

Key Account Classes:

-

Belongings: These signify what what you are promoting owns. Examples embrace:

- Present Belongings: Money, Accounts Receivable (cash owed to you), Stock, Pay as you go Bills.

- Non-Present Belongings: Property, Plant, and Tools (PP&E), Lengthy-term Investments.

-

Liabilities: These signify what what you are promoting owes to others. Examples embrace:

- Present Liabilities: Accounts Payable (cash you owe), Brief-term Loans, Salaries Payable.

- Non-Present Liabilities: Lengthy-term Loans, Mortgages.

-

Fairness: This represents the proprietor’s stake within the enterprise. For sole proprietorships and partnerships, that is typically merely the proprietor’s capital. For companies, this consists of retained earnings and contributed capital.

-

Income: This represents earnings generated from the enterprise’s core operations. Examples embrace:

- Gross sales Income

- Service Income

- Curiosity Income

-

Bills: These signify the prices incurred in operating the enterprise. Examples embrace:

- Value of Items Bought (COGS): Direct prices related to producing items.

- Working Bills: Hire, Utilities, Salaries, Advertising and marketing, and so forth.

- Curiosity Expense

- Taxes

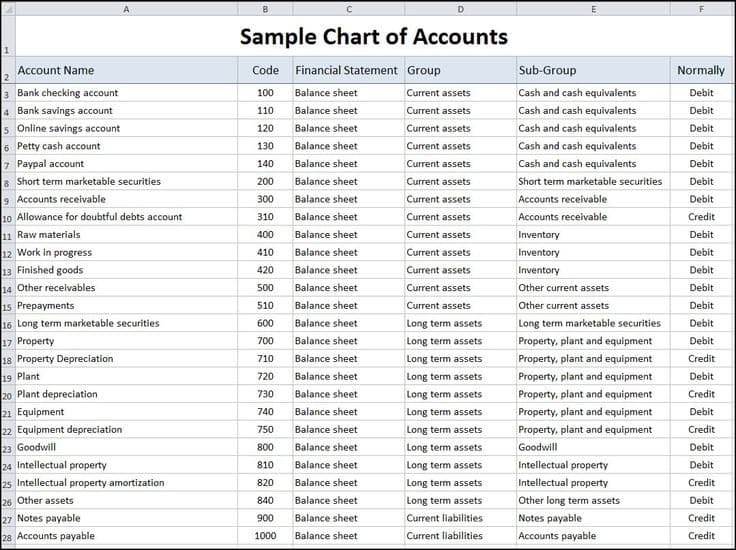

Making a Pattern Chart of Accounts in Excel:

Let’s create a pattern chart of accounts in Excel for a small retail enterprise referred to as "Instance Retail Store." We’ll use a five-digit numbering system for simplicity and readability.

Step 1: Organising the Excel Worksheet:

Create a brand new Excel worksheet and label the columns as follows:

- Account Quantity: This column will comprise the distinctive five-digit code for every account.

- Account Title: This column will comprise the descriptive identify of every account.

- Account Kind: This column will specify the kind of account (Asset, Legal responsibility, Fairness, Income, Expense).

- Sub-Class (Elective): This column permits for additional categorization inside every account sort (e.g., Present Asset, Non-Present Asset).

Step 2: Populating the Chart of Accounts:

Now, let’s populate the chart of accounts with pattern information for "Instance Retail Store":

| Account Quantity | Account Title | Account Kind | Sub-Class |

|---|---|---|---|

| 11000 | Money | Asset | Present Asset |

| 12000 | Accounts Receivable | Asset | Present Asset |

| 13000 | Stock | Asset | Present Asset |

| 14000 | Pay as you go Hire | Asset | Present Asset |

| 15000 | Tools | Asset | Non-Present Asset |

| 21000 | Accounts Payable | Legal responsibility | Present Legal responsibility |

| 22000 | Brief-Time period Mortgage | Legal responsibility | Present Legal responsibility |

| 31000 | Proprietor’s Fairness | Fairness | |

| 41000 | Gross sales Income | Income | |

| 51000 | Value of Items Bought | Expense | |

| 52000 | Hire Expense | Expense | Working Expense |

| 53000 | Salaries Expense | Expense | Working Expense |

| 54000 | Utilities Expense | Expense | Working Expense |

| 55000 | Advertising and marketing Expense | Expense | Working Expense |

| 56000 | Insurance coverage Expense | Expense | Working Expense |

| 57000 | Depreciation Expense | Expense | Working Expense |

Step 3: Increasing the Chart of Accounts:

It is a fundamental instance. As what you are promoting grows, you may have to increase your COA to accommodate extra detailed accounts. As an illustration, you may break down "Stock" into particular product classes, or "Working Bills" into extra granular sub-accounts. The five-digit numbering system permits for this growth (e.g., 13100 for "Stock – Clothes," 13200 for "Stock – Equipment").

Step 4: Using Excel’s Options:

Excel gives a number of options to boost your COA:

- Knowledge Validation: Use information validation to limit entries within the "Account Kind" column to solely legitimate choices (Asset, Legal responsibility, Fairness, Income, Expense).

- Formulation: Use formulation to calculate totals for every account sort or sub-category.

- Filtering and Sorting: Simply filter and type your COA by account sort, quantity, or identify.

- Pivot Tables: Create pivot tables to summarize and analyze your monetary information based mostly on totally different dimensions.

- Conditional Formatting: Spotlight accounts based mostly on particular standards, similar to unfavorable balances or accounts exceeding a sure threshold.

Greatest Practices for Making a Chart of Accounts:

- Consistency: Preserve consistency in your account naming and numbering conventions.

- Readability: Use clear and concise account names which might be simply understood.

- Relevance: Embody solely accounts related to what you are promoting operations.

- Future-Proofing: Design your COA to accommodate future progress and growth.

- Common Evaluation: Periodically evaluate and replace your COA to make sure it stays correct and related.

Integrating the Chart of Accounts with Your Bookkeeping System:

As soon as you have created your COA in Excel, you need to use it as a reference when recording transactions in your accounting software program and even instantly in Excel. You possibly can hyperlink your transactions to the particular account numbers in your COA, enabling automated reporting and evaluation. This integration streamlines your bookkeeping course of and minimizes the danger of errors.

Conclusion:

Making a well-structured chart of accounts is an important step in managing your funds successfully. Whereas accounting software program supplies complete COA performance, understanding the underlying rules and leveraging the facility of Excel permits for larger management, customization, and a deeper understanding of your monetary information. By following the steps and greatest practices outlined on this article, you possibly can create a strong and adaptable chart of accounts that may function a cornerstone of your monetary administration technique for years to return. Keep in mind to adapt this pattern COA to the particular wants of what you are promoting, making certain accuracy and readability in your monetary record-keeping. Common evaluate and updates will assure its continued relevance and usefulness in your monetary journey.

Closure

Thus, we hope this text has offered useful insights into Mastering Your Funds: A Complete Information to Making a Pattern Chart of Accounts in Excel. We admire your consideration to our article. See you in our subsequent article!