Mastering Zerodha ChartIQ: A Deep Dive into Chart Views and Technical Evaluation

Associated Articles: Mastering Zerodha ChartIQ: A Deep Dive into Chart Views and Technical Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering Zerodha ChartIQ: A Deep Dive into Chart Views and Technical Evaluation. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Mastering Zerodha ChartIQ: A Deep Dive into Chart Views and Technical Evaluation

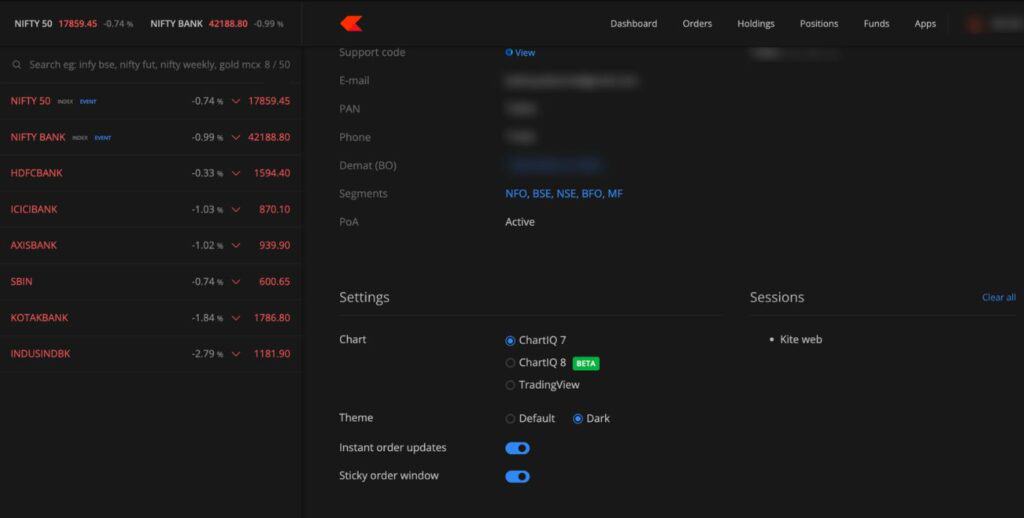

Zerodha, India’s main low cost brokerage, supplies its customers with a robust charting device powered by ChartIQ. This platform affords a complete suite of options designed to boost technical evaluation and buying and selling decision-making. Understanding its nuances is essential for any critical dealer utilizing Zerodha Kite. This text delves into the varied chart views, customization choices, and functionalities obtainable throughout the Zerodha ChartIQ interface, empowering you to harness its full potential.

Understanding the Fundamentals: Chart Sorts and Timeframes

The muse of any technical evaluation lies within the selection of chart sort and timeframe. Zerodha ChartIQ affords quite a lot of chart sorts, every revealing totally different points of worth motion:

-

Candlestick Charts: The preferred selection, candlestick charts signify worth actions over a particular interval, exhibiting the open, excessive, low, and shut (OHLC) costs. The physique of the candle signifies the vary between the open and shut, whereas the wicks (shadows) signify the excessive and low costs. Bullish candles (inexperienced or white) point out a better shut than open, whereas bearish candles (pink or black) present a decrease shut than open.

-

Line Charts: These charts merely join the closing costs of every interval with a line, offering a simplified view of worth traits. They’re helpful for figuring out long-term traits however lack the detailed info offered by candlestick charts.

-

Bar Charts: Just like candlestick charts, bar charts show the OHLC knowledge. Nonetheless, as a substitute of a candle physique, they use a vertical bar, making them barely much less visually intuitive than candlesticks.

-

Heikin Ashi Charts: These charts easy out worth fluctuations, making traits simpler to establish. They’re notably helpful for decreasing the noise in risky markets. Nonetheless, they’ll lag behind precise worth actions.

Choosing the proper timeframe is equally vital. Zerodha permits you to view charts from intraday (1 minute, 5 minutes, quarter-hour, half-hour, 1 hour, and many others.) to long-term (day by day, weekly, month-to-month, yearly). The timeframe choice will depend on your buying and selling type and the time horizon of your evaluation. Scalpers would possibly use 1-minute or 5-minute charts, whereas swing merchants would possibly choose day by day or weekly charts.

Navigating the Zerodha ChartIQ Interface: A Detailed Walkthrough

The Zerodha ChartIQ interface is intuitive but full of options. Let’s discover its key elements:

-

Chart Space: That is the central a part of the interface, displaying the chosen chart sort and timeframe. That is the place the value motion unfolds visually.

-

Toolbar: Positioned on the high, the toolbar supplies fast entry to important features like chart sort choice, timeframe modifications, drawing instruments, indicators, and saving chart layouts.

-

Drawing Instruments: Zerodha affords a complete set of drawing instruments, together with pattern strains, Fibonacci retracements, help and resistance strains, channels, rectangles, and extra. These instruments assist establish patterns and potential worth targets.

-

Indicators: An enormous library of technical indicators is offered, categorized for straightforward entry. These indicators present quantitative insights into worth traits, momentum, quantity, and volatility. Widespread indicators embody Shifting Averages (MA), Relative Energy Index (RSI), MACD, Bollinger Bands, and Stochastic Oscillator. Customers can add a number of indicators concurrently to realize a holistic perspective.

-

Research Panel: This panel permits customers to handle and customise the utilized indicators, adjusting their parameters and settings to optimize their relevance to the precise asset and timeframe.

-

Properties Panel: This panel supplies detailed details about the chosen drawing device or indicator, permitting for exact changes and modifications.

-

Zoom and Pan: Straightforward zoom and pan functionalities enable customers to concentrate on particular worth ranges or time durations, facilitating detailed evaluation.

-

Chart Settings: This part permits for complete chart customization, together with colour schemes, type preferences, and knowledge show choices.

Superior Options and Customization

Past the essential functionalities, Zerodha ChartIQ affords a number of superior options:

-

A number of Chart Layouts: Customers can create a number of chart layouts, every displaying totally different belongings, timeframes, or indicators. This enables for simultaneous evaluation of a number of devices and techniques.

-

Saved Chart Layouts: Customized chart layouts might be saved and recalled later, streamlining the analytical course of.

-

Alert System: Customers can set worth alerts primarily based on numerous standards, notifying them of potential buying and selling alternatives or danger occasions.

-

Backtesting (restricted): Whereas not a full-fledged backtesting platform, the flexibility to simply change timeframes and study historic worth knowledge supplies a rudimentary type of backtesting for technique validation.

-

Integration with Kite: Seamless integration with the Kite buying and selling platform permits customers to straight place trades primarily based on their chart evaluation, minimizing latency and enhancing buying and selling effectivity.

Methods and Purposes

Zerodha’s ChartIQ platform empowers merchants to make use of a variety of buying and selling methods:

-

Pattern Following: Determine main traits utilizing transferring averages, pattern strains, and different indicators to capitalize on sustained worth actions.

-

Imply Reversion: Make the most of indicators like RSI and Bollinger Bands to establish overbought and oversold circumstances, anticipating worth reversals.

-

Breakout Buying and selling: Determine potential breakouts from established help and resistance ranges, utilizing chart patterns and quantity evaluation to substantiate entries.

-

Swing Buying and selling: Determine swing highs and lows utilizing candlestick patterns and indicators, holding positions for a number of days or even weeks.

-

Scalping: Make the most of very short-term charts and indicators to capitalize on small worth fluctuations inside minutes.

Mastering the Artwork of Chart Evaluation with Zerodha ChartIQ

Efficient utilization of Zerodha ChartIQ requires observe and expertise. Start by experimenting with totally different chart sorts, timeframes, and indicators to know their strengths and limitations. Give attention to creating a constant buying and selling plan primarily based in your chosen technique and danger tolerance. Backtesting, or a minimum of thorough historic evaluation, is essential to refine your method and establish potential weaknesses. Do not forget that technical evaluation is only one piece of the puzzle; basic evaluation and danger administration are equally vital for profitable buying and selling.

Lastly, steady studying is vital. Keep up to date on market traits, refine your technical evaluation abilities, and adapt your methods as wanted. The ability of Zerodha ChartIQ lies in its skill to empower knowledgeable decision-making, however in the end, profitable buying and selling requires self-discipline, endurance, and a well-defined buying and selling plan. By mastering the instruments and methods obtainable inside this platform, merchants can considerably improve their analytical capabilities and doubtlessly enhance their buying and selling outcomes.

Closure

Thus, we hope this text has offered worthwhile insights into Mastering Zerodha ChartIQ: A Deep Dive into Chart Views and Technical Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!