Merging Chart of Accounts in QuickBooks On-line: A Complete Information

Associated Articles: Merging Chart of Accounts in QuickBooks On-line: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Merging Chart of Accounts in QuickBooks On-line: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Merging Chart of Accounts in QuickBooks On-line: A Complete Information

Merging chart of accounts in QuickBooks On-line (QBO) generally is a daunting job, particularly in the event you’re coping with a big and sophisticated account construction. Whether or not you are consolidating companies, cleansing up outdated accounts, or just streamlining your monetary reporting, a well-executed chart of accounts merge is essential for sustaining correct monetary data. This complete information will stroll you thru the method, highlighting finest practices and potential pitfalls to keep away from.

Understanding the Implications of Merging Chart of Accounts

Earlier than diving into the mechanics of merging, it is important to know the implications. Merging accounts irreversibly combines information from a number of accounts into one. This implies historic transaction information will likely be consolidated, making it unattainable to isolate the person contributions of the merged accounts after the method is full. Due to this fact, thorough planning and preparation are paramount.

Preparation is Key: A Step-by-Step Method

-

Backup Your Knowledge: That is essentially the most essential step. Earlier than making any modifications to your QBO information, create a full backup. This lets you revert to your earlier state if something goes unsuitable in the course of the merge. QBO affords the power to export your information, however think about using a third-party backup resolution for added safety.

-

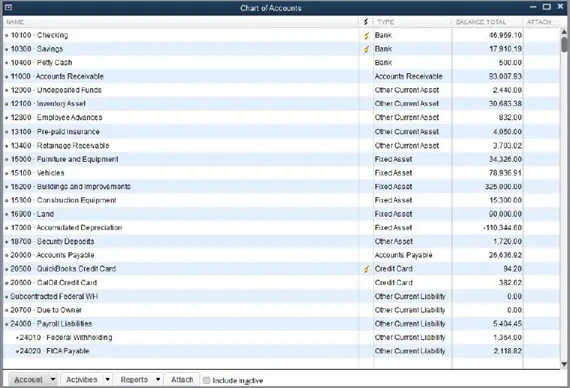

Analyze Your Chart of Accounts: Rigorously assessment your current chart of accounts. Determine accounts which can be redundant, out of date, or may be logically mixed. Create a spreadsheet to map out the proposed merges. This spreadsheet ought to clearly record:

- Supply Account(s): The account(s) you plan to merge. Embrace account names, numbers, and balances.

- Vacation spot Account: The account into which the supply accounts will likely be merged.

- Purpose for Merging: Briefly clarify the rationale behind every merge. This helps you justify the modifications and observe your progress.

- Potential Points: Anticipate any potential issues, resembling completely different account sorts (e.g., expense vs. asset) being merged.

-

Reconcile Your Accounts: Guarantee all of your accounts are reconciled earlier than you start the merge. This supplies a transparent and correct start line for the consolidation course of. Unreconciled accounts can result in inaccurate balances after the merge.

-

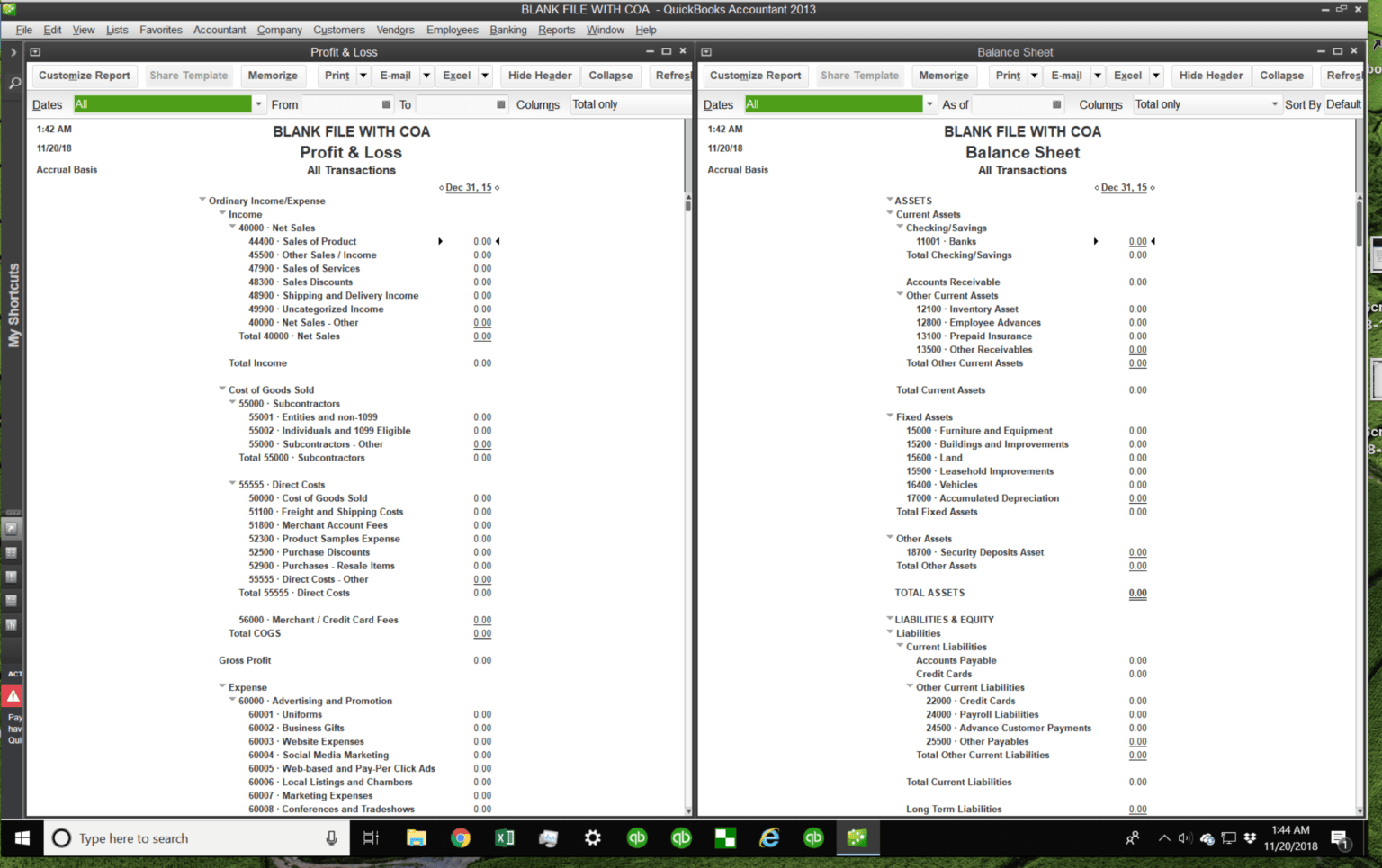

Think about the Affect on Reviews: Take into consideration how the merge will have an effect on your monetary studies. Will it affect the accuracy of your earnings assertion, steadiness sheet, or money movement assertion? If mandatory, modify your reporting classes to replicate the modifications.

-

Take a look at the Merge (Non-obligatory however Beneficial): If potential, create a take a look at firm in QBO and carry out the merge there. This lets you experiment with the method and determine any potential points earlier than impacting your reside information.

Strategies for Merging Chart of Accounts in QBO

QBO does not provide a direct "merge accounts" operate. The method entails transferring transactions after which deleting the supply accounts. There are two main approaches:

Technique 1: Utilizing Journal Entries

This technique is finest suited to smaller merges or when coping with accounts which have a comparatively small variety of transactions.

- Create Journal Entries: For every supply account, create a journal entry that debits the vacation spot account and credit the supply account. The quantity ought to match the steadiness of the supply account. Make sure the journal entry’s date displays the interval coated by the transactions.

- Evaluate and Approve: Rigorously assessment every journal entry earlier than approving it. Incorrect entries can considerably affect your monetary information.

- Delete Supply Accounts: As soon as the journal entries are posted, you possibly can safely delete the supply accounts. Nonetheless, guarantee no additional transactions are posted to those accounts earlier than deletion.

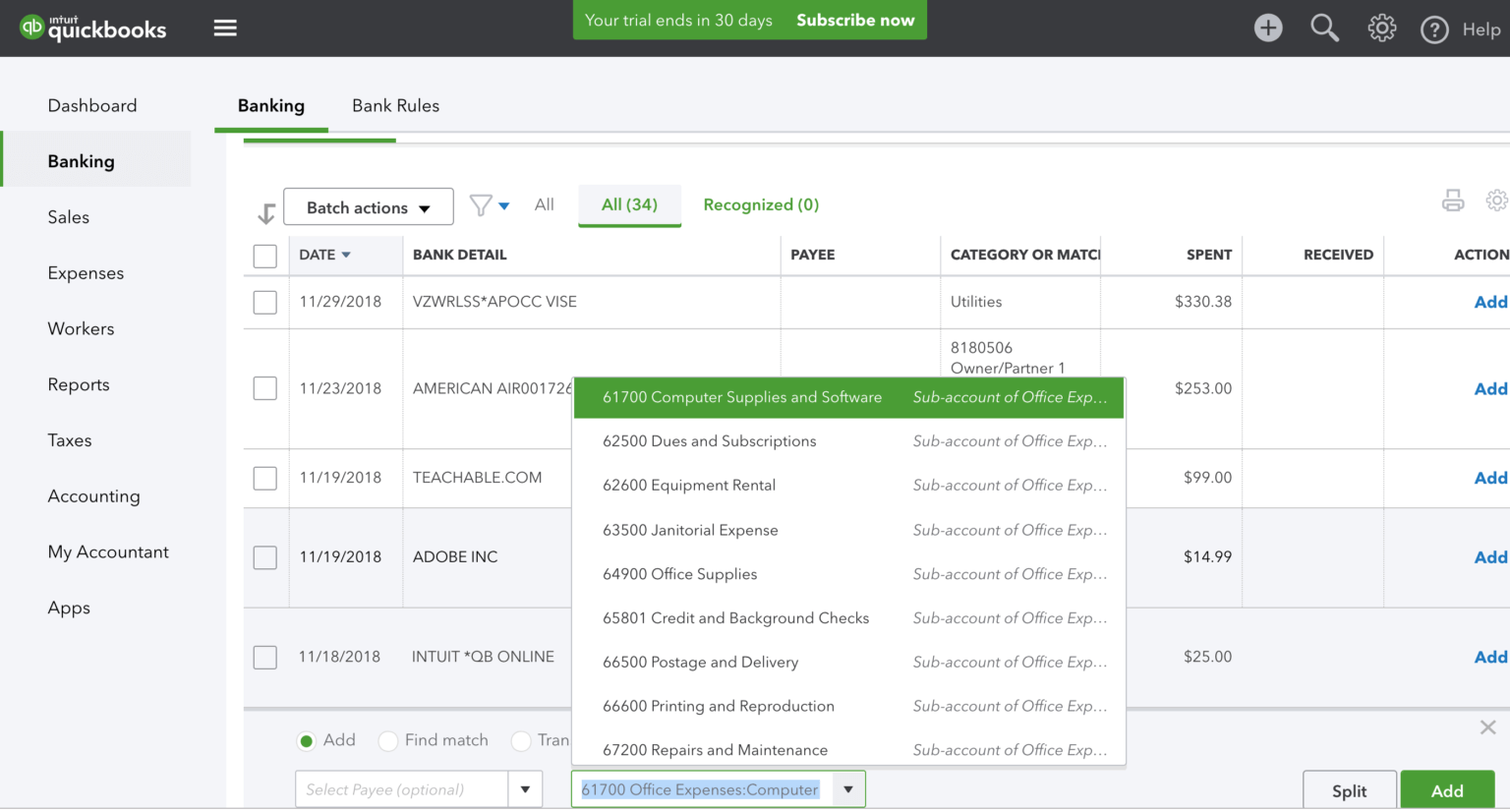

Technique 2: Utilizing the "Switch Transactions" Function (for bigger merges)

This technique is extra environment friendly for bigger merges or when coping with a major variety of transactions.

- Select the Vacation spot Account: Determine the vacation spot account the place you wish to consolidate the information.

- Choose Transactions: Use QBO’s search and filtering options to pick the transactions related to the supply accounts you wish to merge.

- Switch Transactions: QBO does not have a direct "switch" operate. As a substitute, you may must create a brand new transaction within the vacation spot account that mirrors the unique transaction. This normally entails making a guide journal entry or bill. This can be a tedious course of and vulnerable to errors if not performed rigorously.

- Confirm Accuracy: Double-check that every one transactions have been appropriately transferred. Reconcile the accounts to make sure the balances are correct.

- Delete Supply Accounts: As soon as the transactions are efficiently transferred, delete the supply accounts.

Vital Issues

- Account Sorts: Make sure you’re merging accounts of the identical sort. Merging an expense account with an asset account will result in inaccurate monetary reporting.

- Customized Fields: Customized fields related to the supply accounts will likely be misplaced in the course of the merge. Think about transferring related data manually earlier than merging.

- Transaction Historical past: Keep in mind that merging accounts combines transaction historical past. You’ll lose the power to isolate information from particular person supply accounts after the merge.

- Skilled Help: For advanced merges involving a lot of accounts and transactions, take into account looking for skilled help from a QuickBooks ProAdvisor. They can assist streamline the method and reduce the chance of errors.

Put up-Merge Verification and Cleanup

After finishing the merge, completely confirm the accuracy of your monetary information. Reconcile all accounts and run numerous studies to make sure the balances and figures are appropriate. Evaluate your monetary statements to determine any anomalies. If any discrepancies are discovered, promptly examine and proper them.

Stopping Future Merges:

Commonly reviewing and cleansing your chart of accounts can forestall the necessity for large-scale merges sooner or later. This consists of:

- Common Account Reconciliation: Common reconciliation identifies discrepancies and potential points early on.

- Periodic Chart of Accounts Evaluate: Schedule common evaluations to determine out of date or redundant accounts.

- Constant Chart of Accounts Construction: Set up a well-defined and constant chart of accounts construction to forestall future inconsistencies.

Merging chart of accounts in QBO is a fancy course of requiring meticulous planning and execution. By following these steps, paying shut consideration to element, and leveraging the suitable strategies, you possibly can efficiently merge your accounts whereas sustaining the integrity of your monetary data. Keep in mind, correct monetary information is essential for making knowledgeable enterprise selections, and a well-maintained chart of accounts is the muse of that accuracy. Do not hesitate to hunt skilled assist if wanted, particularly for advanced situations.

Closure

Thus, we hope this text has offered invaluable insights into Merging Chart of Accounts in QuickBooks On-line: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!