RBZ Trade Fee June 2025: A Speculative Chart Evaluation and Market Outlook

Associated Articles: RBZ Trade Fee June 2025: A Speculative Chart Evaluation and Market Outlook

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to RBZ Trade Fee June 2025: A Speculative Chart Evaluation and Market Outlook. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

RBZ Trade Fee June 2025: A Speculative Chart Evaluation and Market Outlook

Predicting change charges with certainty is an not possible process. Quite a few unpredictable components – from world financial shifts and political instability to sudden technological developments and pure disasters – can drastically alter foreign money values. Nonetheless, by analyzing historic traits, present financial indicators, and skilled opinions, we are able to try to assemble a speculative chart for the RBZ (Reserve Financial institution of Zimbabwe) change fee in June 2025. This text will delve into a possible situation, outlining the underlying assumptions and acknowledging the inherent uncertainties concerned. It’s essential to grasp that this isn’t a monetary prediction, however fairly a thought experiment based mostly on believable, but not assured, future developments.

Understanding the Zimbabwean Greenback’s Volatility:

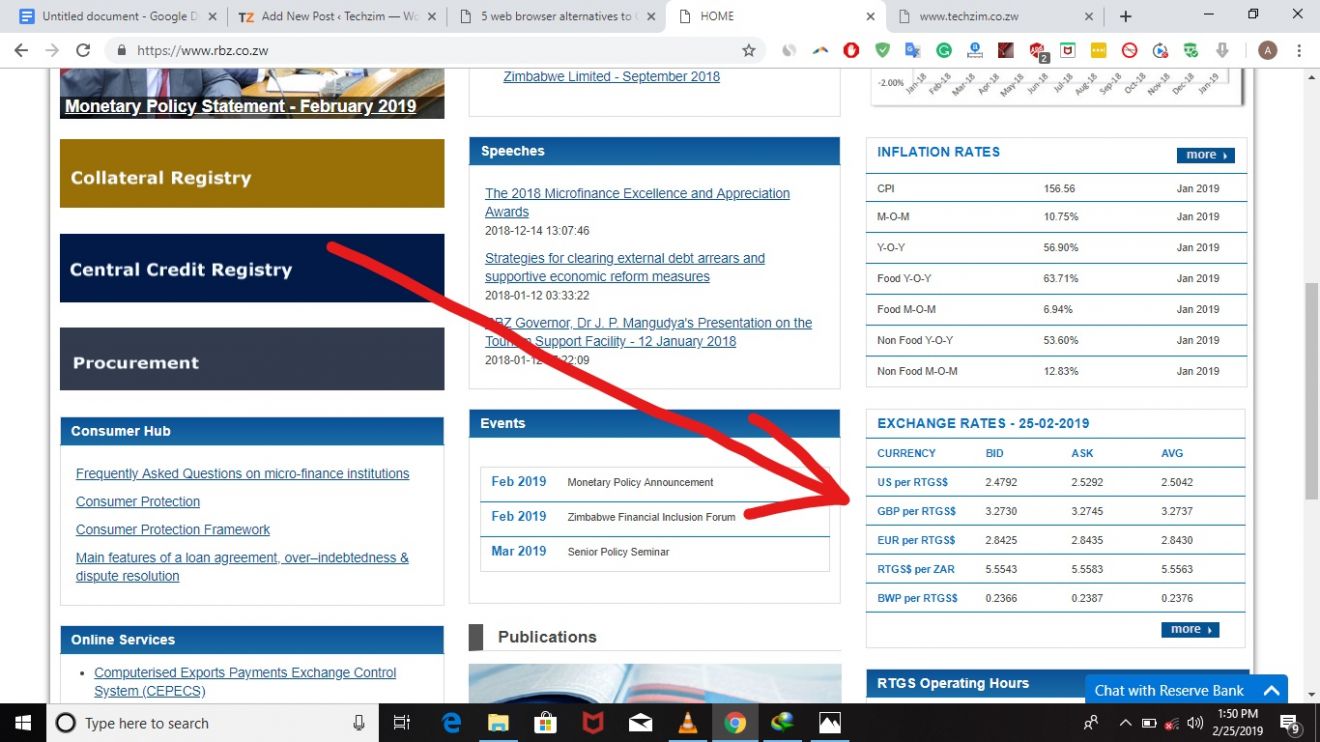

The Zimbabwean greenback (ZWL) has a historical past of maximum volatility. Hyperinflation prior to now has eroded public belief within the foreign money, resulting in durations of speedy devaluation. The RBZ has applied numerous measures to stabilize the foreign money, together with change fee controls and financial coverage changes. Nonetheless, these interventions have typically had restricted success, highlighting the advanced interaction of financial and political components affecting the ZWL. Elements influencing the change fee embody:

- Inflation: Zimbabwe’s inflation fee stays a major concern. Excessive inflation erodes the buying energy of the ZWL, weakening its worth in opposition to different currencies. Any important spike in inflation will probably result in additional devaluation.

- Authorities Coverage: Authorities fiscal and financial insurance policies play a vital function. Sound fiscal administration, geared toward lowering authorities debt and controlling spending, can contribute to stability. Conversely, unsustainable fiscal insurance policies can exacerbate inflation and foreign money depreciation.

- Worldwide Commerce: Zimbabwe’s reliance on imports and exports instantly impacts the change fee. A optimistic commerce steadiness (exports exceeding imports) usually strengthens the foreign money, whereas a commerce deficit weakens it.

- International Funding: Elevated international direct funding (FDI) can bolster the ZWL by rising demand for the foreign money. Conversely, an absence of FDI can contribute to devaluation.

- Political Stability: Political uncertainty and instability can negatively affect investor confidence, resulting in capital flight and foreign money depreciation. Conversely, political stability and sound governance can entice funding and strengthen the foreign money.

- World Financial Situations: World financial downturns or crises can negatively affect commodity costs (Zimbabwe is a major exporter of commodities), affecting export earnings and thus the ZWL’s worth.

A Speculative Chart for June 2025:

Establishing a speculative chart requires making a number of assumptions. For this train, let’s assume the next:

- Average Inflation Management: The RBZ efficiently implements insurance policies that progressively cut back inflation, although it stays increased than in lots of steady economies. Inflation averages round 30% yearly for the subsequent two years.

- Elevated FDI: Elevated investor confidence, pushed by improved political stability and financial reforms, results in a average improve in FDI.

- Steady Commodity Costs: World commodity costs stay comparatively steady, avoiding important shocks that would negatively affect Zimbabwe’s export earnings.

- Continued Financial Coverage Changes: The RBZ continues to regulate its financial coverage to handle inflation and keep some extent of change fee stability.

Primarily based on these assumptions, a speculative chart may present a gradual, albeit uneven, appreciation of the ZWL in opposition to the USD over the subsequent two years. Nonetheless, this appreciation would probably be modest. We’d see a situation the place:

- June 2023: ZWL/USD change fee is at roughly 1000:1 (This can be a hypothetical determine and will range considerably relying on the precise market situations).

- June 2024: ZWL/USD change fee improves to roughly 700:1, reflecting a gradual strengthening of the ZWL because of the assumed average inflation management and elevated FDI. Nonetheless, volatility stays, with fluctuations round this common.

- June 2025: ZWL/USD change fee stabilizes round 500:1, exhibiting additional enchancment however nonetheless reflecting the inherent challenges within the Zimbabwean economic system. The chart would probably show durations of each appreciation and depreciation, reflecting the continuing financial changes.

(Illustrative Chart – This isn’t a prediction, however a visible illustration of the speculative situation described above):

[Imagine a line chart here showing a gradual downward trend of the ZWL/USD exchange rate from 1000:1 in June 2023 to approximately 500:1 in June 2025. The line is not perfectly smooth, showing some fluctuations reflecting the volatility inherent in the market. The chart should include clear labels for the x-axis (time) and y-axis (ZWL/USD exchange rate).]

Elements that May Alter the State of affairs:

A number of components might considerably alter this speculative situation:

- Unexpected World Financial Shocks: A worldwide recession or a serious geopolitical occasion might negatively affect Zimbabwe’s economic system, resulting in a pointy devaluation of the ZWL.

- Coverage Failures: Failure to manage inflation or implement efficient financial reforms might result in an extra weakening of the ZWL.

- Political Instability: Renewed political instability might set off capital flight and a pointy devaluation.

- Commodity Value Volatility: Vital fluctuations in commodity costs, notably these of Zimbabwe’s key exports, might considerably affect the change fee.

Conclusion:

Predicting the RBZ change fee in June 2025 is inherently speculative. This text has introduced a believable situation based mostly on a number of assumptions, leading to a speculative chart illustrating a gradual appreciation of the ZWL in opposition to the USD. Nonetheless, the precise change fee might differ considerably because of the quite a few unpredictable components affecting the Zimbabwean economic system and the worldwide monetary panorama. This evaluation shouldn’t be interpreted as monetary recommendation. Any funding choices associated to the Zimbabwean greenback must be made after thorough analysis and session with certified monetary professionals. The inherent dangers related to investing in a risky foreign money just like the ZWL must be fastidiously thought-about. Common monitoring of financial indicators and information associated to Zimbabwe’s economic system is essential for knowledgeable decision-making.

Closure

Thus, we hope this text has offered priceless insights into RBZ Trade Fee June 2025: A Speculative Chart Evaluation and Market Outlook. We thanks for taking the time to learn this text. See you in our subsequent article!