The Bearish Chart Patterns Cheat Sheet: Deciphering Market Weak spot

Associated Articles: The Bearish Chart Patterns Cheat Sheet: Deciphering Market Weak spot

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to The Bearish Chart Patterns Cheat Sheet: Deciphering Market Weak spot. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

The Bearish Chart Patterns Cheat Sheet: Deciphering Market Weak spot

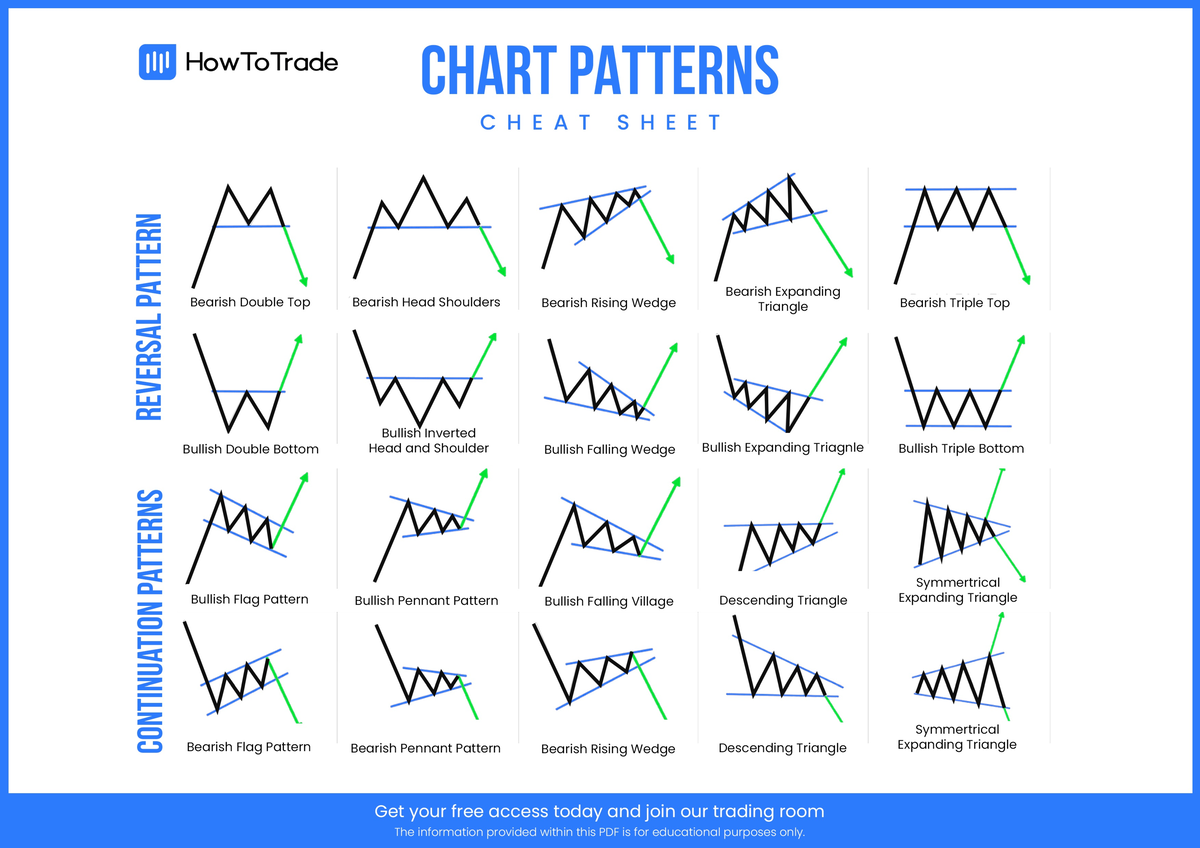

The inventory market is a dynamic beast, always fluctuating between durations of bullish optimism and bearish pessimism. Whereas predicting the longer term with absolute certainty is unimaginable, understanding and recognizing bearish chart patterns can considerably improve your buying and selling technique and aid you mitigate potential losses. This complete cheat sheet explores among the commonest and dependable bearish patterns, offering you with the information to navigate the market’s downward developments successfully.

Bearish chart patterns are visible representations of worth motion that recommend a possible decline within the worth of an asset. These patterns are shaped by the interaction of provide and demand, with sellers dominating the market and pushing costs decrease. Figuring out these patterns requires cautious remark of worth actions, quantity, and candlestick formations. Whereas no sample ensures a worth drop, their constant look can present worthwhile insights and enhance the chance of a bearish end result.

This cheat sheet is categorized for simpler understanding and contains detailed descriptions, visible representations (although textual, think about the charts alongside), and sensible buying and selling implications.

I. Reversal Patterns: These patterns sign a possible change within the prevailing pattern from bullish to bearish.

A. Head and Shoulders (H&S):

- Description: This basic sample resembles a human head and shoulders. It consists of three peaks, with the center peak (the "head") being the very best, flanked by two decrease peaks ("shoulders"). A neckline, a trendline connecting the lows between the peaks, is essential for affirmation.

- Formation: A left shoulder varieties, adopted by a rally to the next excessive (the top), then a drop again beneath the earlier excessive, forming the best shoulder. A subsequent break beneath the neckline confirms the sample.

- Goal Worth: The goal worth is usually calculated by measuring the gap between the top and the neckline and projecting that distance down from the neckline break.

- Quantity: Quantity must be rising in the course of the formation of the top and reducing in the course of the formation of the shoulders, confirming weakening shopping for strain.

- Instance: Think about a inventory worth rising to $50 (left shoulder), then surging to $60 (head), earlier than falling again to $55 (proper shoulder). A break beneath the neckline (to illustrate $45) confirms the sample, suggesting a possible drop to $40 ($45 – $5).

B. Inverse Head and Shoulders:

- Description: The mirror picture of the Head and Shoulders sample, this can be a bullish sample. Nevertheless, understanding it’s essential to distinguish it from a bearish continuation sample, which might be mistaken for an inverse head and shoulders. Be conscious of context.

- Formation: Three troughs, with the center trough being the bottom, type the "inverse head and shoulders." A neckline connects the highs between the troughs. A break above the neckline confirms the sample.

- Goal Worth: The goal worth is calculated by measuring the gap between the top (lowest trough) and the neckline and projecting that distance upwards from the neckline break.

C. Double High:

- Description: This sample exhibits two consecutive peaks at roughly the identical worth degree, adopted by a decline.

- Formation: The value rises to a peak, retraces barely, then rises once more to roughly the identical peak degree, earlier than breaking beneath the help degree created by the trough between the 2 peaks.

- Goal Worth: The goal worth is calculated by measuring the gap between the excessive of the double prime and the low level between the 2 peaks and projecting that distance downward from the neckline (help degree).

- Quantity: Excessive quantity on the peaks and decrease quantity on the retracement reinforces the sample.

D. Triple High:

- Description: Just like a double prime, however with three peaks at roughly the identical worth degree. This sample suggests stronger resistance.

- Formation: Three peaks are shaped, with the worth retracing barely between every peak earlier than failing to interrupt by the resistance degree. A break beneath the help degree confirms the sample.

- Goal Worth: The goal is calculated equally to the double prime, utilizing the gap between the excessive of the triple prime and the low level between the peaks.

E. Broadening High:

- Description: This sample shows progressively decrease lows and better highs, making a widening triangle form that ultimately reverses.

- Formation: Successive peaks create greater highs, whereas the troughs type decrease lows, widening the sample. A break beneath the decrease trendline confirms the sample.

- Goal Worth: Measuring the width of the sample at its widest level and projecting that distance downward from the breakout level is a standard methodology.

II. Continuation Patterns: These patterns recommend a short lived pause within the current bearish pattern earlier than the decline resumes.

A. Falling Wedge:

- Description: A wedge sample the place each the higher and decrease trendlines slope downwards, converging in the direction of the longer term.

- Formation: Costs make decrease highs and decrease lows, however the price of decline slows. A breakout beneath the decrease trendline confirms the continuation of the bearish pattern.

- Goal Worth: Measure the widest a part of the wedge and mission that distance downwards from the breakout level.

B. Descending Triangle:

- Description: This sample shows a horizontal resistance line and a downward sloping help line, making a triangle form.

- Formation: The value makes decrease lows, however fails to interrupt above the horizontal resistance. A break beneath the help line confirms the bearish continuation.

- Goal Worth: The goal is normally the gap from the resistance line to the bottom low of the triangle, projected downwards from the breakout.

III. Different Bearish Indicators:

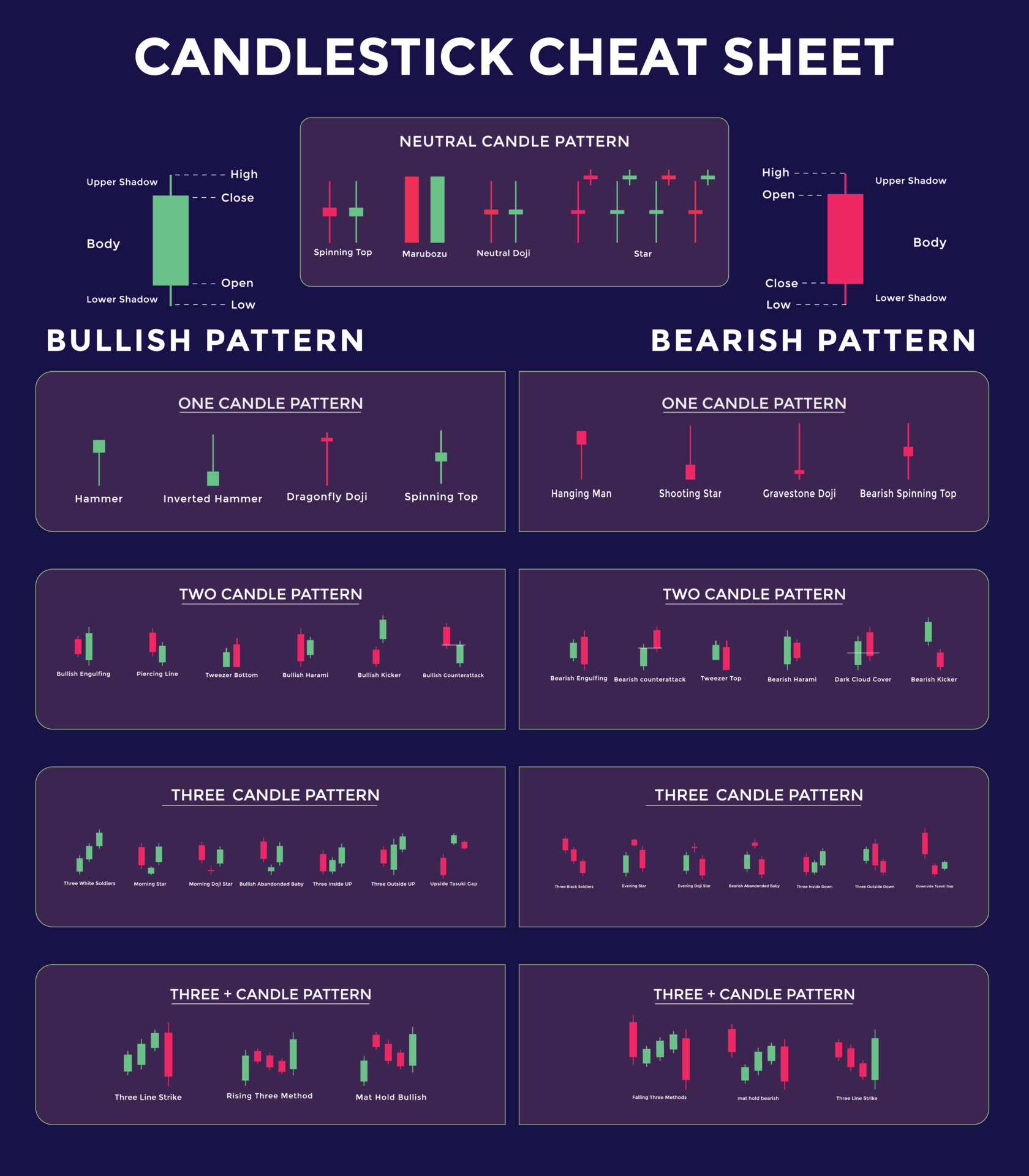

- Darkish Cloud Cowl: A bearish candlestick sample the place a big bullish candle is adopted by a bearish candle that opens above the earlier candle’s shut however closes beneath its midpoint.

- Night Star: A 3-candlestick sample exhibiting a bullish candle adopted by a doji or small physique candle, after which a bearish candle that closes considerably decrease than the primary candle’s open.

- Bearish Engulfing Sample: A two-candlestick sample the place a small bearish candle is adopted by a big bearish candle that utterly engulfs the earlier candle’s physique.

- Bearish Harami: A two-candlestick sample the place a big bearish candle is adopted by a small bullish candle that’s utterly contained throughout the physique of the earlier candle.

IV. Necessary Issues:

- Quantity: At all times analyze quantity alongside worth motion. Growing quantity throughout a bearish breakout confirms the power of the transfer.

- Affirmation: Depend on a number of indicators for affirmation. Do not solely depend on one sample. Corroborate with different technical indicators like shifting averages, RSI, MACD, and many others.

- Context: Think about the broader market context. A bearish sample would possibly fail if the general market is strongly bullish.

- Threat Administration: At all times use stop-loss orders to restrict potential losses. By no means threat greater than you possibly can afford to lose.

- Follow: Mastering chart sample recognition takes time and observe. Begin by analyzing historic charts and steadily construct your abilities.

Conclusion:

This cheat sheet supplies a foundational understanding of frequent bearish chart patterns. Keep in mind, these patterns are instruments to assist your evaluation, not ensures of future worth actions. Profitable buying and selling includes a mix of technical evaluation, elementary evaluation, threat administration, and self-discipline. Repeatedly studying, practising, and adapting your technique is essential to navigating the ever-changing world of economic markets. At all times conduct thorough analysis and take into account looking for recommendation from a professional monetary advisor earlier than making any funding choices. The data offered right here is for instructional functions solely and shouldn’t be construed as monetary recommendation.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has offered worthwhile insights into The Bearish Chart Patterns Cheat Sheet: Deciphering Market Weak spot. We thanks for taking the time to learn this text. See you in our subsequent article!