The Candlestick Chart Sample Cheat Sheet: Mastering the Language of Value Motion

Associated Articles: The Candlestick Chart Sample Cheat Sheet: Mastering the Language of Value Motion

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to The Candlestick Chart Sample Cheat Sheet: Mastering the Language of Value Motion. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

The Candlestick Chart Sample Cheat Sheet: Mastering the Language of Value Motion

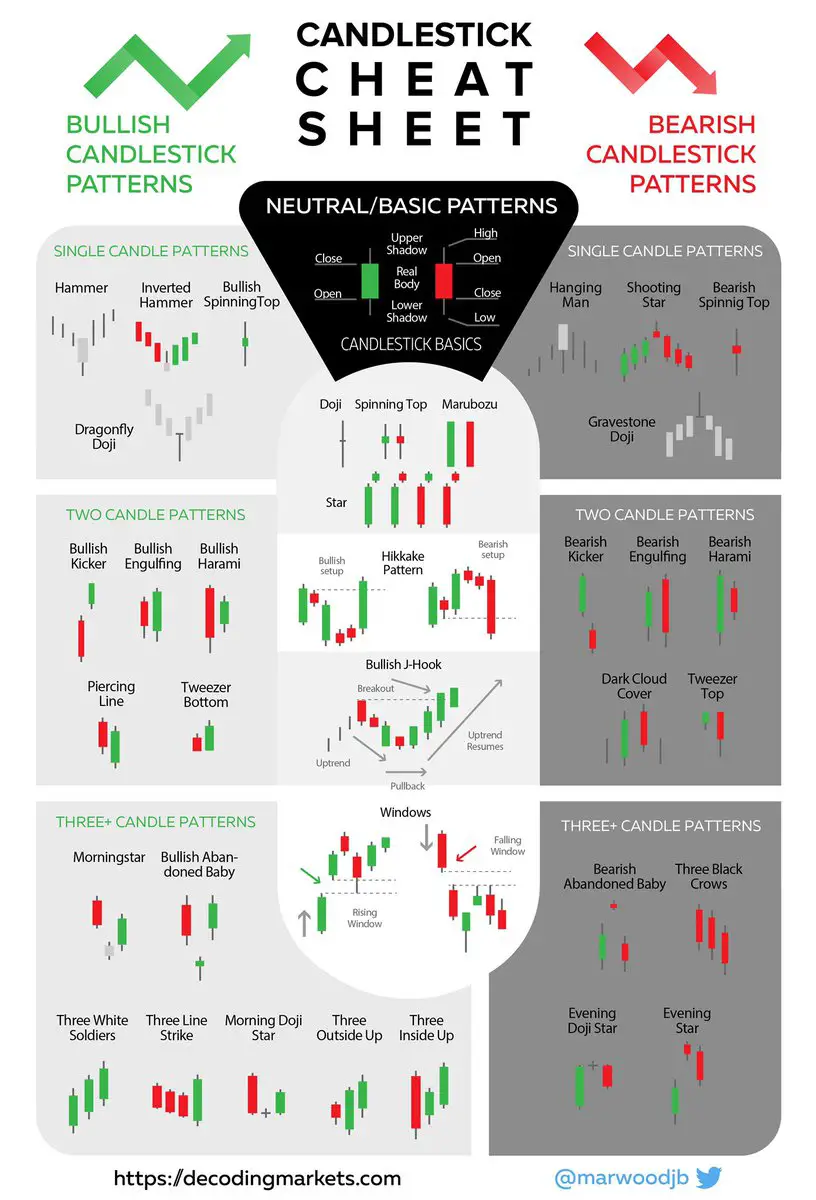

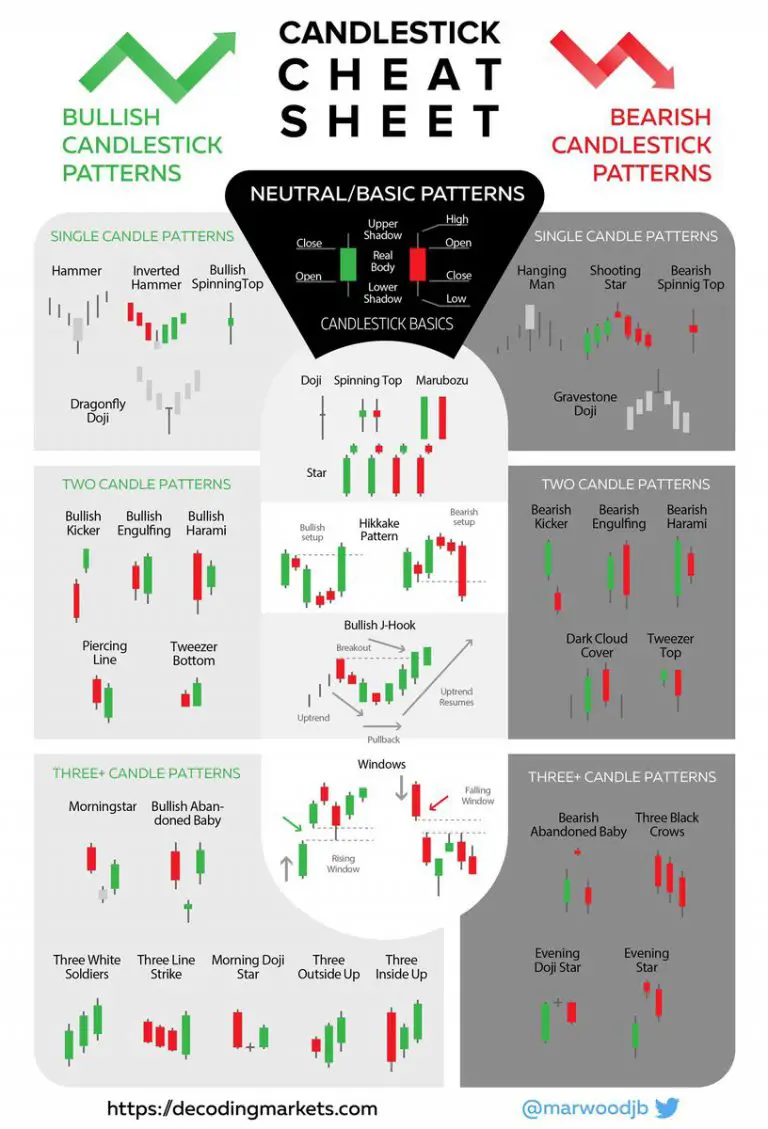

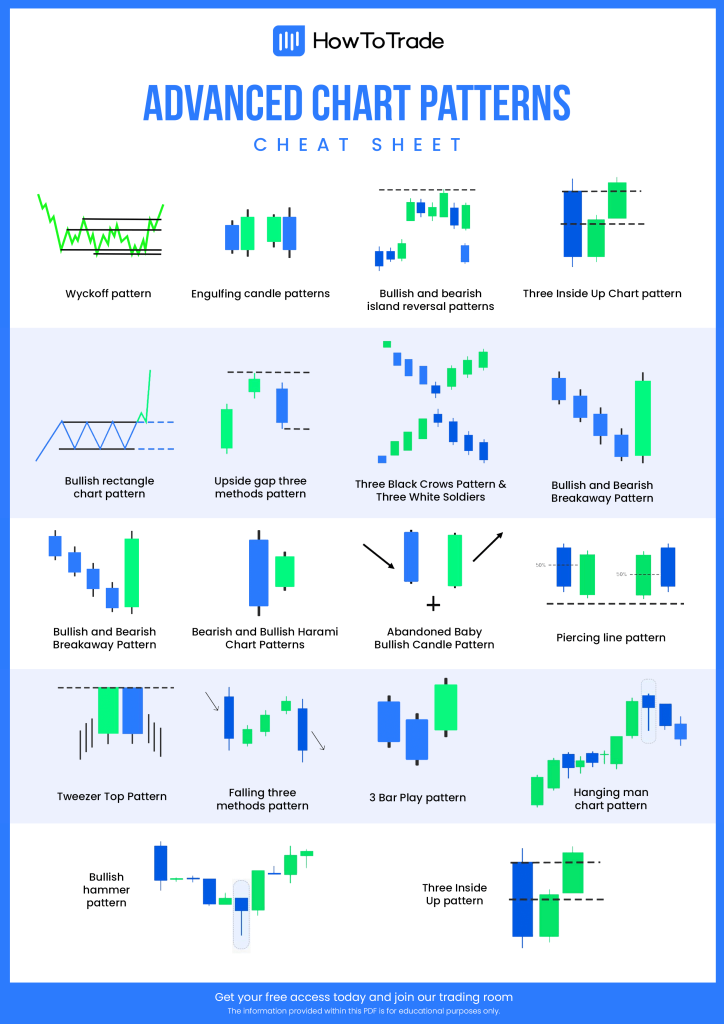

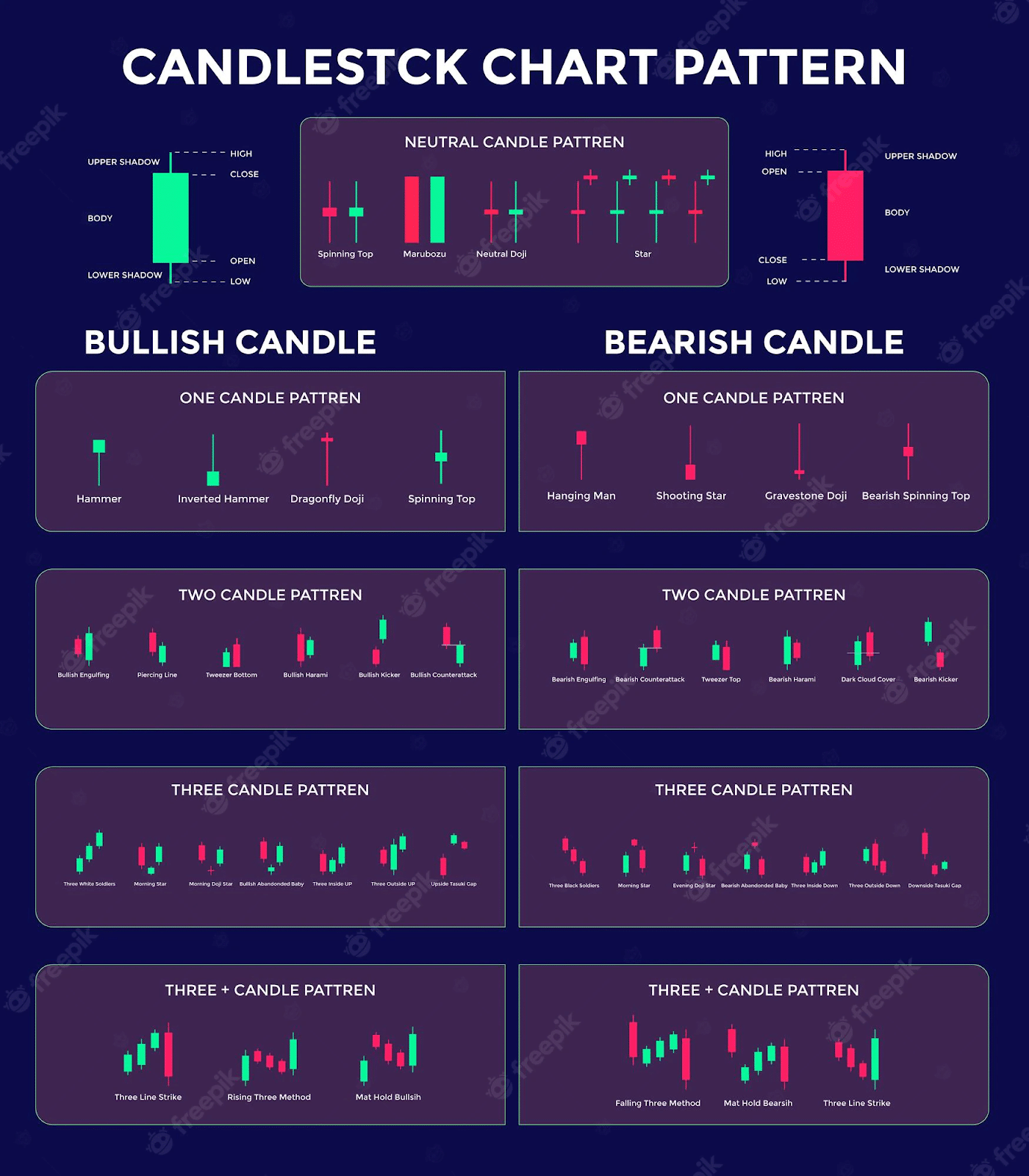

Candlestick charts, with their visually intuitive illustration of value actions, have turn out to be a cornerstone of technical evaluation. In contrast to bar charts, which merely present the excessive, low, open, and shut costs, candlestick charts use distinct shapes to convey details about the market’s sentiment and potential future value motion. Mastering candlestick patterns can considerably improve your buying and selling technique, offering helpful insights into market momentum and potential reversals. This complete information serves as a candlestick chart sample cheat sheet, detailing among the commonest and dependable patterns, full with explanations, illustrations, and buying and selling implications.

Understanding the Fundamentals: Deciphering the Candlestick

Earlier than diving into particular patterns, let’s refresh our understanding of the candlestick’s elements:

- Actual Physique: The oblong portion of the candlestick represents the distinction between the open and shutting costs. A strong (crammed) physique signifies a closing value increased than the opening value (bullish), whereas a hole (unfilled) physique signifies a closing value decrease than the opening value (bearish).

- Wicks (Shadows): The skinny traces extending above and under the true physique characterize the excessive and low costs of the interval. Lengthy wicks recommend robust value rejection at these ranges.

Single Candlestick Patterns:

These patterns, shaped by a single candlestick, present fast insights into instant market sentiment.

-

Doji: A doji is characterised by a candlestick with virtually equal opening and shutting costs, leading to a really small or non-existent actual physique. It signifies indecision available in the market, typically previous a major value transfer. Several types of dojis (long-legged, dragonfly, headstone) provide refined variations of their implications. A doji typically suggests a possible reversal, however affirmation is essential.

-

Hammer: A bullish reversal sample, a hammer has a small actual physique on the prime of the candlestick and a protracted decrease wick, indicating robust shopping for strain overcoming promoting strain. The lengthy decrease wick suggests consumers stepped in to stop additional declines. Affirmation is required by means of subsequent bullish candles.

-

Hanging Man: The bearish counterpart of the hammer, a dangling man encompasses a small actual physique on the prime of the candlestick and a protracted decrease wick. It alerts potential bearish reversal, suggesting sellers overwhelmed consumers regardless of an preliminary bullish opening. Affirmation from subsequent bearish candles is important.

-

Capturing Star: A bearish reversal sample characterised by a protracted higher wick, a small actual physique close to the underside of the candlestick, and a brief decrease wick. It signifies robust promoting strain overcoming shopping for strain, indicating a possible reversal from an uptrend. Affirmation is essential.

-

Inverted Hammer: A bullish reversal sample with a small actual physique on the backside of the candlestick and a protracted higher wick. It suggests consumers stepped in to stop additional declines, probably signaling a reversal from a downtrend. Affirmation is important.

Two-Candlestick Patterns:

These patterns mix the data from two consecutive candlesticks to supply a extra sturdy sign.

-

Engulfing Sample (Bullish & Bearish): A two-candlestick sample the place the second candlestick utterly engulfs the true physique of the primary. A bullish engulfing sample happens when a big bullish candle follows a bearish candle, suggesting a possible bullish reversal. A bearish engulfing sample is the alternative, with a big bearish candle following a bullish candle, indicating a possible bearish reversal.

-

Piercing Sample: A bullish reversal sample the place a bearish candle is adopted by a bullish candle that opens decrease than the day prior to this’s shut however closes greater than midway up the earlier candle’s actual physique. It signifies a possible backside is forming.

-

Darkish Cloud Cowl: A bearish reversal sample the place a bullish candle is adopted by a bearish candle that opens increased than the day prior to this’s shut however closes under the midpoint of the earlier candle’s actual physique. It suggests a possible prime is forming.

Three-Candlestick Patterns:

These patterns present much more context and affirmation, growing their reliability.

-

Morning Star: A bullish reversal sample consisting of three candlesticks: a bearish candle, a small physique candle (doji or small actual physique), and a bullish candle that gaps up from the day prior to this’s shut. It suggests a possible backside is forming.

-

Night Star: The bearish counterpart of the morning star, it consists of a bullish candle, a small physique candle (doji or small actual physique), and a bearish candle that gaps down from the day prior to this’s shut. It alerts a possible prime is forming.

-

Three White Troopers: A bullish sample characterised by three consecutive bullish candles, every with a better shut than the earlier one. It signifies robust shopping for strain and growing bullish momentum.

-

Three Black Crows: The bearish counterpart of three white troopers, it consists of three consecutive bearish candles, every with a decrease shut than the earlier one. It suggests robust promoting strain and growing bearish momentum.

Different Vital Issues:

-

Affirmation: Whereas candlestick patterns present helpful insights, they shouldn’t be relied upon solely. Affirmation from different technical indicators (equivalent to transferring averages, RSI, MACD) or basic evaluation is essential earlier than making any buying and selling choices.

-

Quantity: The amount accompanying a candlestick sample can considerably improve its significance. Excessive quantity throughout a reversal sample confirms the power of the transfer, whereas low quantity suggests weak point and potential for a false sign.

-

Timeframe: Candlestick patterns might be recognized on numerous timeframes (e.g., 1-minute, 5-minute, every day, weekly). The timeframe chosen will affect the interpretation and significance of the sample. Patterns on increased timeframes usually carry extra weight.

-

Context: Think about the general market development. A bullish reversal sample in a robust downtrend is much less dependable than one in a sideways or barely bullish market.

-

Follow: Mastering candlestick patterns requires observe and expertise. Begin by analyzing historic charts and figuring out these patterns. Backtesting your buying and selling methods utilizing historic knowledge is important to evaluate their effectiveness.

Conclusion:

This candlestick chart sample cheat sheet gives a complete overview of among the commonest and dependable candlestick patterns. Keep in mind that candlestick patterns are only one piece of the puzzle in technical evaluation. Combining candlestick evaluation with different technical indicators and a strong threat administration plan is essential for profitable buying and selling. Constant studying, observe, and disciplined execution are important for mastering the artwork of candlestick chart evaluation and attaining constant profitability within the monetary markets. This information serves as a place to begin; additional analysis and steady studying are extremely inspired to refine your understanding and develop your buying and selling methods.

Closure

Thus, we hope this text has offered helpful insights into The Candlestick Chart Sample Cheat Sheet: Mastering the Language of Value Motion. We thanks for taking the time to learn this text. See you in our subsequent article!