The Chart of Accounts: A Complete Information to Monetary Group

Associated Articles: The Chart of Accounts: A Complete Information to Monetary Group

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to The Chart of Accounts: A Complete Information to Monetary Group. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts: A Complete Information to Monetary Group

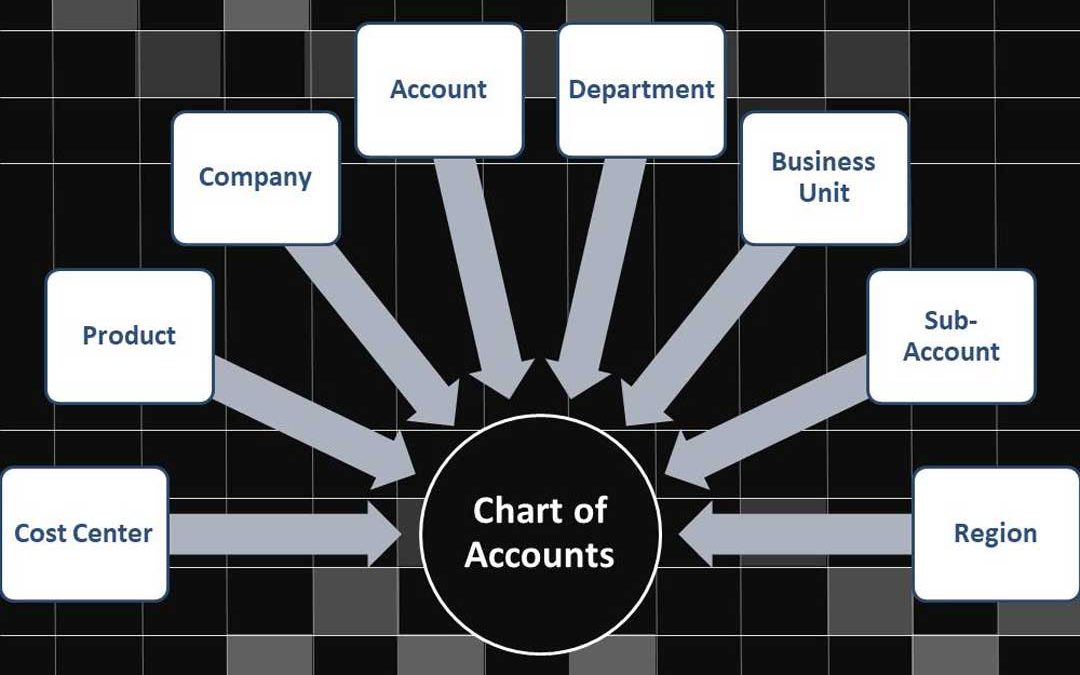

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured listing of all of the accounts used to file monetary transactions, offering an in depth categorization of belongings, liabilities, fairness, revenues, and bills. A well-designed COA ensures correct monetary reporting, simplifies the accounting course of, and facilitates knowledgeable decision-making. This text will delve into the intricacies of the chart of accounts, exploring its construction, elements, and the vital concerns for its design and implementation.

Understanding the Construction of a Chart of Accounts

The COA follows a hierarchical construction, sometimes utilizing a numerical or alphanumeric coding system. This technique permits environment friendly group and retrieval of account data. The most typical method is a multi-digit system the place every digit or group of digits represents a particular class or sub-category. For instance:

- 1000-1999: Belongings

- 2000-2999: Liabilities

- 3000-3999: Fairness

- 4000-4999: Revenues

- 5000-5999: Bills

Inside every main class, additional sub-categories are created to offer granular element. As an example, inside the "Belongings" class (1000-1999), you might need:

- 1100-1199: Present Belongings (Money, Accounts Receivable, Stock)

- 1200-1299: Non-Present Belongings (Property, Plant, and Gear, Intangible Belongings)

This hierarchical construction permits for detailed monitoring of economic data and facilitates the era of assorted monetary studies. The precise coding system and stage of element will range relying on the scale and complexity of the group. Bigger organizations usually make the most of extra advanced COA buildings with quite a few sub-accounts to seize particular data related to their operations.

Key Elements of a Chart of Accounts

A complete chart of accounts sometimes contains accounts categorized underneath the next main headings:

1. Belongings: These symbolize what the corporate owns. They’re categorized into:

-

Present Belongings: Belongings anticipated to be transformed into money or used inside one yr. Examples embody:

- Money: Cash readily available and in financial institution accounts.

- Accounts Receivable: Cash owed to the corporate by clients.

- Stock: Items held on the market.

- Pay as you go Bills: Bills paid upfront (e.g., insurance coverage).

-

Non-Present Belongings: Belongings anticipated for use for a couple of yr. Examples embody:

- Property, Plant, and Gear (PP&E): Land, buildings, equipment, and gear.

- Intangible Belongings: Non-physical belongings resembling patents, copyrights, and logos.

- Lengthy-Time period Investments: Investments in different corporations held for longer than one yr.

2. Liabilities: These symbolize what the corporate owes to others. They’re categorized into:

-

Present Liabilities: Obligations due inside one yr. Examples embody:

- Accounts Payable: Cash owed to suppliers.

- Salaries Payable: Wages owed to workers.

- Quick-Time period Loans: Loans due inside one yr.

-

Non-Present Liabilities: Obligations due in a couple of yr. Examples embody:

- Lengthy-Time period Loans: Loans due in a couple of yr.

- Bonds Payable: Cash borrowed by means of the issuance of bonds.

3. Fairness: This represents the homeowners’ stake within the firm. For sole proprietorships and partnerships, that is usually the proprietor’s capital account. For firms, this contains:

- Widespread Inventory: Represents the possession shares issued to shareholders.

- Retained Earnings: Amassed income that haven’t been distributed as dividends.

4. Revenues: These symbolize the inflows of assets from the corporate’s working actions. Examples embody:

- Gross sales Income: Income from the sale of products or providers.

- Service Income: Income from offering providers.

- Curiosity Income: Income earned from interest-bearing accounts.

5. Bills: These symbolize the outflows of assets incurred in producing revenues. Examples embody:

- Price of Items Bought (COGS): Direct prices related to producing items bought.

- Salaries Expense: Wages paid to workers.

- Lease Expense: Lease funds for workplace house.

- Utilities Expense: Funds for electrical energy, water, and gasoline.

- Advertising Expense: Prices related to advertising and marketing and promoting.

- Depreciation Expense: Allocation of the price of belongings over their helpful life.

Issues for Designing a Chart of Accounts

Designing an efficient chart of accounts requires cautious planning and consideration of a number of components:

- Business-Particular Necessities: Sure industries have particular accounting necessities that have to be mirrored within the COA.

- Firm Measurement and Complexity: Bigger, extra advanced organizations require extra detailed COA buildings than smaller ones.

- Future Development: The COA needs to be designed to accommodate future development and growth.

- Reporting Necessities: The COA ought to facilitate the era of required monetary studies.

- Consistency and Standardization: Sustaining consistency in account naming and coding is essential for correct reporting.

- Common Overview and Updates: The COA needs to be reviewed and up to date periodically to make sure its accuracy and relevance.

Software program and Automation

Trendy accounting software program packages sometimes embody built-in chart of accounts performance. These programs automate many facets of account administration, together with account creation, modification, and reporting. In addition they usually present pre-defined COA templates that may be personalized to fulfill particular organizational wants. This automation considerably reduces the guide effort concerned in sustaining the COA and minimizes the chance of errors.

Conclusion

The chart of accounts is a basic factor of any group’s monetary administration system. A well-designed and maintained COA ensures correct monetary reporting, facilitates environment friendly accounting processes, and supplies precious insights for decision-making. By fastidiously contemplating the components outlined on this article, organizations can create a COA that meets their particular wants and helps their long-term monetary success. Common evaluate and updates are essential to make sure the COA stays related and correct, reflecting the evolving wants of the enterprise. The funding in a strong and well-structured chart of accounts is a vital step in the direction of reaching sound monetary administration and knowledgeable strategic planning.

![Ecommerce Accounting & Bookkeeping Guide To Best Practices [2024]](https://www.ecommerceceo.com/wp-content/uploads/2020/12/image-1024x598.png)

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered precious insights into The Chart of Accounts: A Complete Information to Monetary Group. We hope you discover this text informative and useful. See you in our subsequent article!