The Chart of Accounts: A Basis for Monetary Readability and Management

Associated Articles: The Chart of Accounts: A Basis for Monetary Readability and Management

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to The Chart of Accounts: A Basis for Monetary Readability and Management. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

The Chart of Accounts: A Basis for Monetary Readability and Management

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

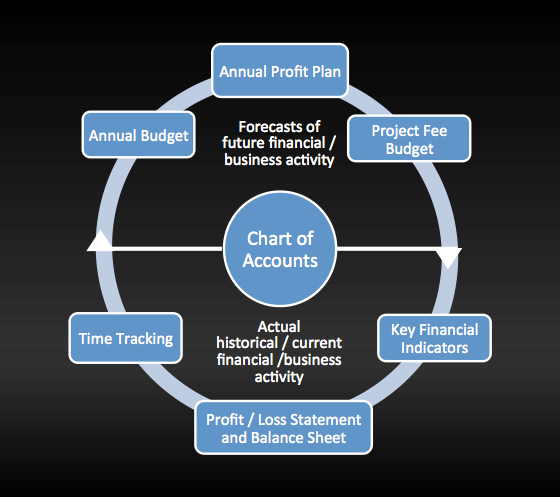

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured record of all of the accounts utilized by a enterprise to file its monetary transactions. Consider it as an in depth index, meticulously categorizing each single monetary exercise, from the smallest buy to the biggest funding. A well-designed and meticulously maintained COA is essential for correct monetary reporting, efficient budgeting, and knowledgeable decision-making. With out it, monetary chaos reigns.

This text will delve into the intricacies of the chart of accounts, exploring its function, construction, design concerns, upkeep, and its essential function in numerous features of monetary administration.

The Objective of a Chart of Accounts:

The first function of a COA is to arrange and categorize all monetary transactions. This group permits for:

-

Correct Monetary Reporting: The COA ensures that each one transactions are recorded within the appropriate accounts, resulting in correct monetary statements (revenue assertion, steadiness sheet, money movement assertion). This accuracy is crucial for complying with accounting requirements, tax rules, and offering dependable info to stakeholders.

-

Efficient Budgeting and Forecasting: By categorizing bills and revenues, the COA facilitates the creation of life like budgets and correct monetary forecasts. This permits companies to plan for future bills, allocate assets effectively, and observe efficiency towards targets.

-

Improved Monetary Management: An in depth COA permits for higher monitoring of monetary actions. Managers can simply observe bills, establish areas of inefficiency, and take corrective actions. This enhanced management reduces the danger of fraud and errors.

-

Streamlined Auditing: A well-structured COA simplifies the auditing course of. Auditors can rapidly find and confirm transactions, making certain the accuracy and reliability of monetary information.

-

Facilitating Choice-Making: The data organized inside the COA supplies the inspiration for knowledgeable enterprise choices. By analyzing monetary information categorized inside the accounts, administration can establish tendencies, assess profitability, and make strategic decisions.

Construction and Parts of a Chart of Accounts:

A COA sometimes follows a hierarchical construction, grouping accounts into broader classes. The particular construction varies relying on the scale and complexity of the enterprise, the trade, and the accounting requirements adopted. Nonetheless, frequent parts embody:

-

Property: These characterize what the enterprise owns, together with money, accounts receivable (cash owed to the enterprise), stock, property, plant, and gear (PP&E), and investments.

-

Liabilities: These characterize what the enterprise owes to others, together with accounts payable (cash owed to suppliers), loans payable, and accrued bills.

-

Fairness: This represents the homeowners’ stake within the enterprise, together with contributed capital and retained earnings (amassed income).

-

Revenues: These characterize the revenue generated from the enterprise’s operations, together with gross sales income, service income, and curiosity revenue.

-

Bills: These characterize the prices incurred in producing income, together with price of products offered (COGS), salaries, hire, utilities, and advertising bills.

Inside every of those predominant classes, additional sub-accounts are created to supply a extra granular degree of element. For instance, inside the "Bills" class, there is likely to be sub-accounts for "Salaries – Gross sales," "Salaries – Administration," "Lease – Workplace," and "Lease – Warehouse." This degree of element permits for extra exact monitoring and evaluation of monetary efficiency.

Designing an Efficient Chart of Accounts:

Designing a COA requires cautious planning and consideration. Key components embody:

-

Enterprise Dimension and Complexity: A small enterprise may require a less complicated COA with fewer accounts, whereas a big company will want a extra advanced construction with quite a few sub-accounts.

-

Trade Particular Necessities: Sure industries have particular accounting necessities that should be mirrored within the COA. For instance, a producing firm will want accounts for uncooked supplies, work-in-progress, and completed items.

-

Accounting Requirements: The COA should adjust to related accounting requirements, corresponding to Usually Accepted Accounting Rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS).

-

Future Progress and Scalability: The COA ought to be designed to accommodate future development and modifications within the enterprise. It ought to be versatile sufficient to deal with new merchandise, providers, or departments with out requiring an entire overhaul.

-

Consistency and Uniformity: All transactions should be recorded persistently utilizing the identical account codes to keep up accuracy and facilitate monetary reporting.

-

Account Numbering System: A well-defined numbering system is crucial for organizing and monitoring accounts. A typical method is to make use of a hierarchical system, with every digit representing a selected class or sub-category.

Sustaining the Chart of Accounts:

A COA isn’t a static doc. It requires common evaluate and updates to replicate modifications within the enterprise. This consists of:

-

Including New Accounts: Because the enterprise grows and expands, new accounts might should be added to accommodate new merchandise, providers, or departments.

-

Deleting Out of date Accounts: Accounts which might be now not related ought to be eliminated to streamline the COA and enhance effectivity.

-

Modifying Current Accounts: Adjustments in enterprise operations or accounting requirements might require modifications to present accounts.

-

Common Audits: Periodic evaluations of the COA guarantee its accuracy, completeness, and compliance with accounting requirements.

The Chart of Accounts and Totally different Accounting Techniques:

The COA is built-in with accounting software program. Accounting software program makes use of the COA to routinely categorize transactions, generate monetary reviews, and supply worthwhile insights into the monetary well being of the enterprise. Totally different accounting methods might have barely other ways of implementing and managing the COA, however the underlying rules stay the identical.

Conclusion:

The chart of accounts is a elementary device for monetary administration. It supplies the construction and group crucial for correct monetary reporting, efficient budgeting, and knowledgeable decision-making. A well-designed and meticulously maintained COA is crucial for the success of any enterprise, regardless of its measurement or complexity. By understanding its function, construction, and upkeep necessities, companies can leverage the COA to achieve worthwhile insights into their monetary efficiency and make strategic choices that drive development and profitability. Neglecting the COA, nonetheless, can result in inaccurate monetary info, poor decision-making, and finally, monetary instability. Due to this fact, a sturdy and thoroughly deliberate chart of accounts is an funding within the long-term well being and success of any group.

Closure

Thus, we hope this text has offered worthwhile insights into The Chart of Accounts: A Basis for Monetary Readability and Management. We thanks for taking the time to learn this text. See you in our subsequent article!