The Intertwined Dance of Financial and Inventory Market Cycles: A Chart-Pushed Evaluation

Associated Articles: The Intertwined Dance of Financial and Inventory Market Cycles: A Chart-Pushed Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Intertwined Dance of Financial and Inventory Market Cycles: A Chart-Pushed Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

The Intertwined Dance of Financial and Inventory Market Cycles: A Chart-Pushed Evaluation

The inventory market and the broader economic system are inextricably linked, engaged in a posh dance that influences investor conduct, enterprise choices, and total societal well-being. Whereas not completely synchronized, their cyclical patterns usually mirror one another, albeit with various levels of lead and lag. Understanding this relationship, visualized by means of charts and financial indicators, is essential for navigating the turbulent waters of investing and financial forecasting.

This text delves into the intricate relationship between financial and inventory market cycles, utilizing illustrative charts and examples to focus on key phases and their implications. We’ll discover the main, coincident, and lagging indicators that assist economists and buyers gauge the present stage of the cycle and anticipate future traits.

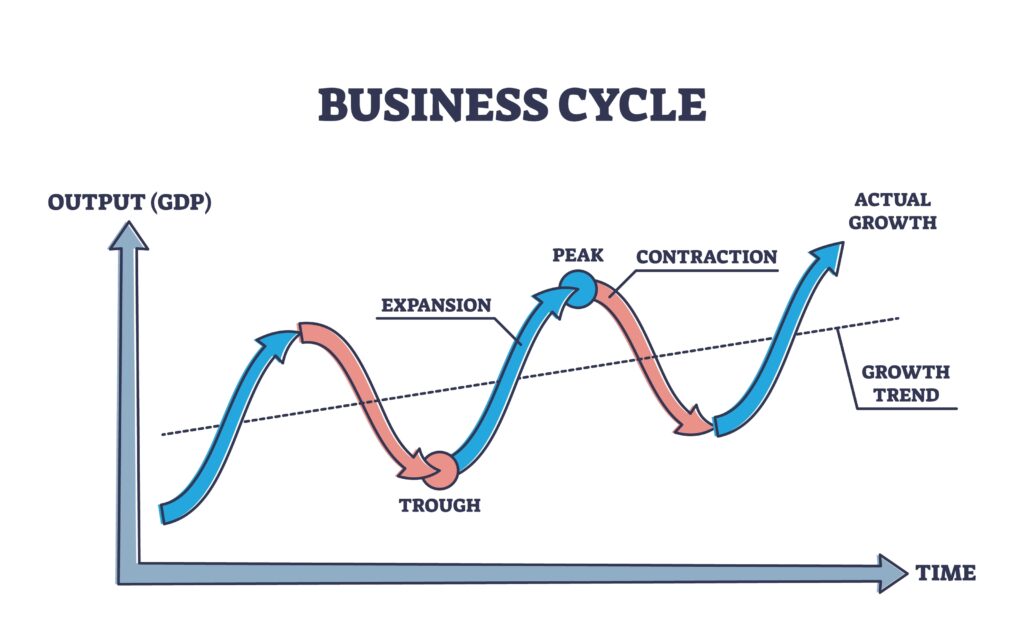

Understanding Financial Cycles:

Financial cycles are characterised by recurring intervals of enlargement and contraction in financial exercise. These fluctuations are usually measured utilizing numerous macroeconomic indicators, together with:

- Gross Home Product (GDP): The overall worth of products and providers produced inside a rustic’s borders. A sustained enhance in GDP signifies financial enlargement, whereas a lower indicators a recession.

- Employment Charge: The proportion of the working-age inhabitants that’s employed. Rising employment usually accompanies financial enlargement, whereas job losses are a trademark of contractions.

- Inflation Charge: The speed at which the overall stage of costs for items and providers is rising. Average inflation is mostly thought of wholesome, however excessive inflation might be detrimental to financial stability.

- Curiosity Charges: The price of borrowing cash. Central banks usually manipulate rates of interest to affect financial exercise. Decrease charges stimulate borrowing and funding, whereas larger charges curb inflation.

- Client Confidence: A measure of client optimism concerning the economic system. Excessive client confidence usually fuels spending and financial development.

(Insert Chart 1: A stylized illustration of a typical financial cycle displaying GDP development, unemployment charge, and inflation charge over time. Clearly label expansionary and contractionary phases, peaks, and troughs.)

Chart 1: This chart would visually reveal the standard cyclical sample, displaying GDP development peaking earlier than unemployment falls, and inflation usually lagging behind GDP development. The labels would clearly illustrate the expansionary and contractionary phases, peaks (financial highs), and troughs (financial lows).

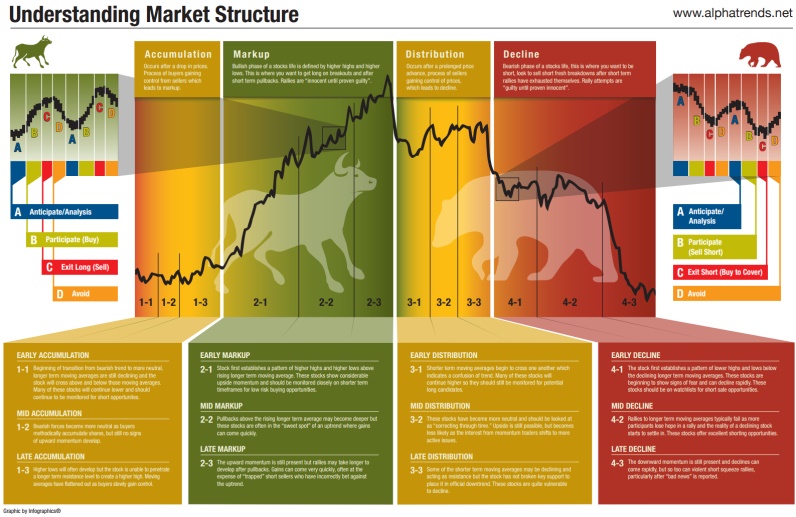

Understanding Inventory Market Cycles:

Inventory market cycles, whereas influenced by the broader economic system, additionally exhibit distinctive traits pushed by investor sentiment, market psychology, and particular firm efficiency. Key indicators for assessing inventory market cycles embrace:

- Inventory Market Indices: Broad market indices just like the S&P 500 or the Dow Jones Industrial Common mirror the general efficiency of a lot of publicly traded firms. Sustained will increase point out a bull market, whereas sustained decreases sign a bear market.

- Volatility: Measures the diploma of worth fluctuations out there. Excessive volatility usually accompanies intervals of uncertainty and worry.

- Investor Sentiment: Gauged by means of surveys and different measures, investor sentiment displays the general optimism or pessimism of buyers. Excessive optimism can result in market bubbles, whereas excessive pessimism can gasoline sharp declines.

- Earnings Progress: The expansion in income reported by publicly traded firms. Sturdy earnings development usually helps larger inventory costs.

(Insert Chart 2: A stylized illustration of a typical inventory market cycle displaying a significant inventory market index, volatility, and investor sentiment. Clearly label bull and bear markets, peaks, and troughs.)

Chart 2: This chart would visually present the standard bull and bear market phases, with the inventory market index peaking earlier than volatility will increase considerably, and investor sentiment usually main market actions. Clear labeling of bull and bear markets, peaks, and troughs is crucial.

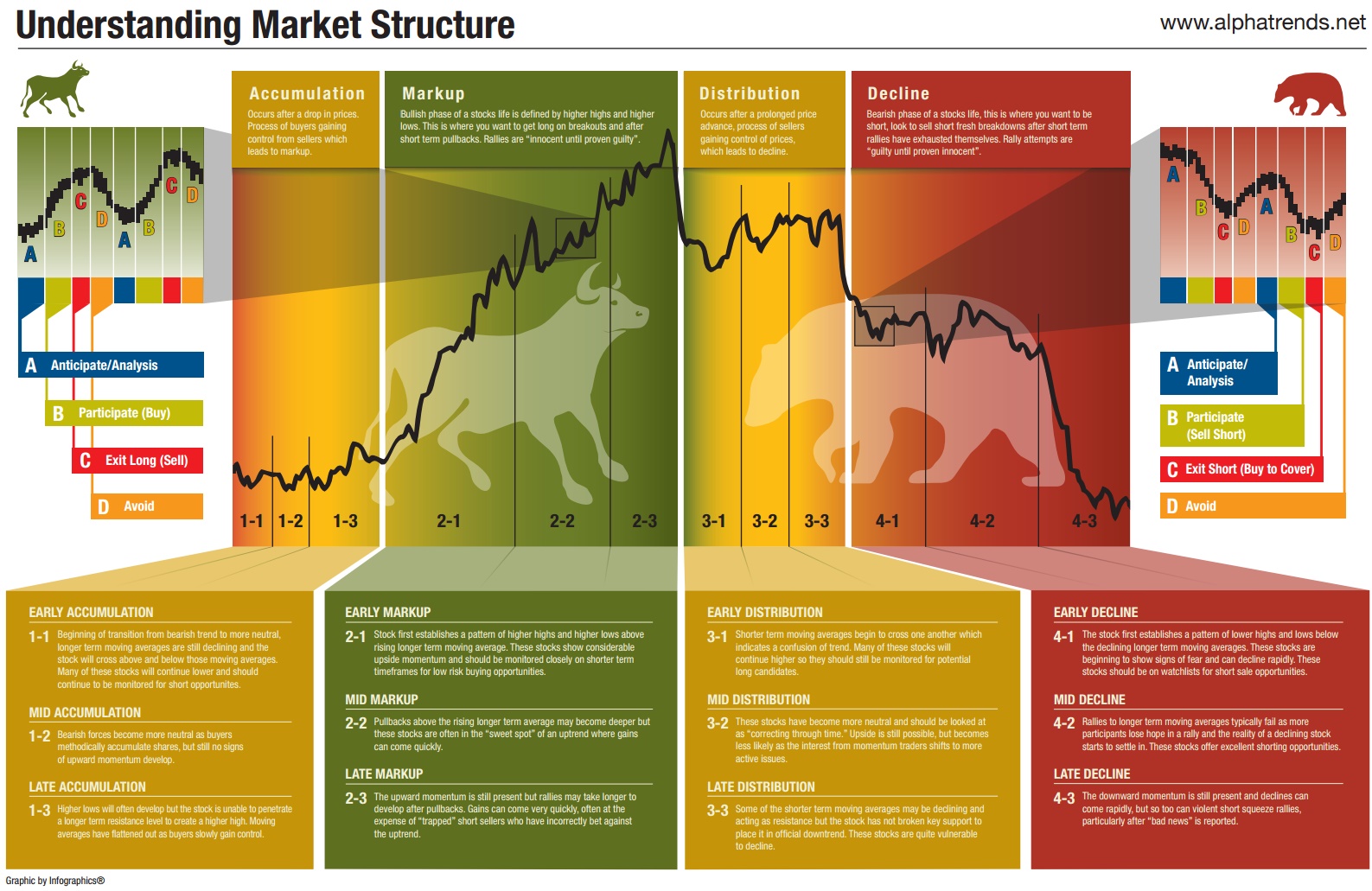

The Interaction Between Financial and Inventory Market Cycles:

The connection between financial and inventory market cycles is complicated and never all the time completely correlated. Nevertheless, some basic observations might be made:

- Main Indicators: Some financial indicators, corresponding to client confidence and manufacturing orders, usually precede modifications within the broader economic system and the inventory market. These are beneficial instruments for anticipating future traits.

- Coincident Indicators: Indicators like GDP and employment charges have a tendency to maneuver in tandem with the general financial cycle. They supply a snapshot of the present financial scenario.

- Lagging Indicators: Indicators corresponding to unemployment charge (usually lagging behind financial downturn) and inflation (usually lagging behind financial enlargement) usually verify the course of the financial cycle after it has already begun to shift.

Usually, inventory markets are inclined to anticipate financial modifications. A bull market would possibly start earlier than the economic system reveals clear indicators of enlargement, reflecting investor optimism about future development. Conversely, a bear market would possibly begin earlier than a recession is formally declared, reflecting investor fears about potential financial slowdown. This lead-lag relationship shouldn’t be all the time constant, nevertheless, and the magnitude of the lead or lag can differ significantly relying on numerous components.

(Insert Chart 3: A mixed chart displaying GDP development and a significant inventory market index over a big interval (e.g., the final 20 years). Spotlight intervals of divergence and convergence between the 2.)

Chart 3: This chart would visually reveal the interaction between financial development (GDP) and inventory market efficiency over an prolonged interval. It might spotlight situations the place the inventory market leads or lags the economic system, emphasizing intervals of convergence (the place each transfer in the identical course) and divergence (the place they transfer in reverse instructions).

Elements Influencing the Relationship:

A number of components can affect the power and timing of the connection between financial and inventory market cycles:

- Financial Coverage: Central financial institution actions, corresponding to rate of interest changes, can considerably affect each the economic system and the inventory market.

- Fiscal Coverage: Authorities spending and taxation insurance policies may also affect financial exercise and investor sentiment.

- Geopolitical Occasions: International occasions, corresponding to wars or political instability, can create uncertainty and disrupt each financial and market cycles.

- Technological Innovation: Main technological developments can drive financial development and create new funding alternatives, influencing each cycles positively.

- Investor Sentiment and Hypothesis: Market psychology performs an important function, usually amplifying or dampening the affect of financial fundamentals.

Conclusion:

The connection between financial and inventory market cycles is a dynamic and multifaceted one. Whereas not completely correlated, understanding the interaction between these cycles, aided by the evaluation of main, coincident, and lagging indicators, is essential for knowledgeable decision-making in each investing and financial coverage. By fastidiously analyzing financial information and market traits, buyers and policymakers can higher navigate the inherent uncertainties and capitalize on alternatives offered by these cyclical fluctuations. Nevertheless, it is essential to do not forget that predicting the long run with absolute certainty is inconceivable. A nuanced understanding of the historic relationship, mixed with a cautious strategy, is one of the best technique for navigating the complicated dance between the economic system and the inventory market.

Closure

Thus, we hope this text has supplied beneficial insights into The Intertwined Dance of Financial and Inventory Market Cycles: A Chart-Pushed Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!