The Trial Stability: A Basis of Monetary Accuracy and the Chart of Accounts

Associated Articles: The Trial Stability: A Basis of Monetary Accuracy and the Chart of Accounts

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to The Trial Stability: A Basis of Monetary Accuracy and the Chart of Accounts. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

The Trial Stability: A Basis of Monetary Accuracy and the Chart of Accounts

The trial stability, a seemingly easy report, serves as a cornerstone of correct monetary record-keeping. It is a essential step within the accounting cycle, offering a snapshot of the balances in all normal ledger accounts at a particular cut-off date. Understanding its development and significance requires a stable grasp of the chart of accounts, the organizational framework that underpins the complete course of. This text delves into the intricacies of the trial stability, its relationship with the chart of accounts, widespread errors, and greatest practices for its efficient use.

The Chart of Accounts: The Blueprint of Monetary Data

Earlier than understanding the trial stability, we should first grasp the chart of accounts. This can be a complete listing of all of the accounts utilized by a enterprise to document its monetary transactions. It’s primarily a hierarchical construction that categorizes accounts based mostly on their operate, offering a scientific approach to set up monetary information. A well-designed chart of accounts is essential for correct monetary reporting and environment friendly monetary administration.

The construction sometimes follows a standardized format, usually using a numbering system to point the account’s classification. Widespread classifications embody:

-

Property: These signify what an organization owns, together with money, accounts receivable (cash owed to the corporate), stock, property, plant, and tools (PP&E), and intangible property (patents, copyrights).

-

Liabilities: These signify what an organization owes to others, together with accounts payable (cash owed to suppliers), salaries payable, loans payable, and deferred income.

-

Fairness: This represents the house owners’ stake within the firm, together with widespread inventory, retained earnings, and different contributed capital.

-

Revenues: These signify the earnings generated from the corporate’s major operations, akin to gross sales income, service income, and curiosity income.

-

Bills: These signify the prices incurred in producing income, akin to value of products bought (COGS), salaries expense, lease expense, utilities expense, and promoting expense.

The chart of accounts is tailor-made to the particular wants of every enterprise. A small retail retailer may need a less complicated chart of accounts in comparison with a big multinational company with various operations. The extent of element and the particular account names will fluctuate, however the basic classifications stay constant. A well-structured chart of accounts ensures consistency and facilitates environment friendly information retrieval and evaluation. For instance, an in depth chart of accounts may separate gross sales income into totally different classes based mostly on product strains or buyer segments, offering extra granular insights into enterprise efficiency.

The Trial Stability: A Reconciliation of Account Balances

As soon as transactions are recorded within the normal ledger utilizing the chart of accounts, the trial stability is ready. It is a report that lists all of the accounts from the chart of accounts and their corresponding debit and credit score balances. The elemental accounting equation – Property = Liabilities + Fairness – should all the time stability. Which means that the full debits should equal the full credit. The trial stability verifies this equality, serving as an important examine on the accuracy of the bookkeeping course of.

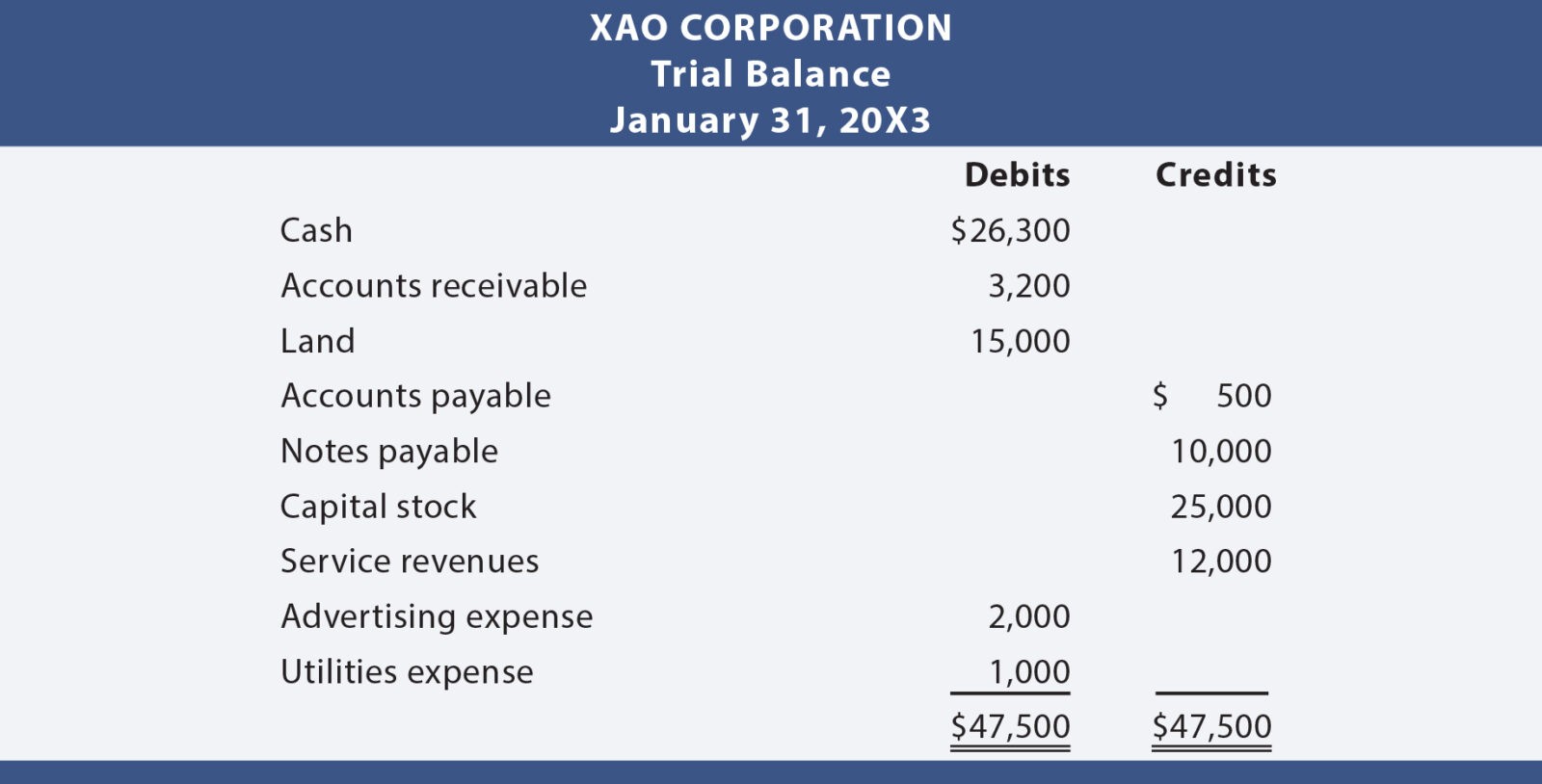

A easy trial stability may appear to be this:

| Account Title | Debit | Credit score |

|---|---|---|

| Money | $10,000 | |

| Accounts Receivable | $5,000 | |

| Stock | $2,000 | |

| Accounts Payable | $3,000 | |

| Salaries Payable | $1,000 | |

| Proprietor’s Fairness | $13,000 | |

| Gross sales Income | $15,000 | |

| Value of Items Bought | $8,000 | |

| Hire Expense | $1,000 | |

| Whole | $26,000 | $26,000 |

This instance demonstrates that the full debits ($26,000) equal the full credit ($26,000), indicating that the accounting equation is balanced. If the totals do not match, it signifies an error someplace within the recording course of. This necessitates an intensive evaluation of the final ledger to establish and proper the discrepancy.

Varieties of Trial Balances:

A number of varieties of trial balances exist, every serving a particular goal:

-

Unadjusted Trial Stability: That is ready earlier than adjusting entries are made on the finish of an accounting interval. It displays the balances within the accounts earlier than contemplating accruals, deferrals, or different changes.

-

Adjusted Trial Stability: That is ready after adjusting entries are made. It displays the balances within the accounts after contemplating all essential changes. That is the premise for making ready the monetary statements.

-

Submit-Closing Trial Stability: That is ready after closing entries are made on the finish of an accounting interval. It solely reveals the everlasting accounts (property, liabilities, and fairness) with their balances carried ahead to the following accounting interval. This trial stability verifies that the everlasting accounts are balanced after closing momentary accounts (revenues and bills).

Widespread Errors in Trial Balances and Their Detection:

Even with cautious record-keeping, errors can happen. Widespread errors embody:

- Transposition errors: Incorrectly coming into digits (e.g., coming into 123 as 132).

- Slide errors: Incorrectly putting the decimal level.

- Mathematical errors: Easy addition or subtraction errors.

- Omission errors: Failing to document a transaction totally.

- Incorrect account classification: Posting a transaction to the incorrect account.

Detecting these errors requires cautious scrutiny of the trial stability and the final ledger. Methods like evaluating debit and credit score totals, analyzing particular person account balances for uncommon quantities, and re-calculating totals might help establish discrepancies. Software program packages usually embody error-checking options to help on this course of.

Greatest Practices for Trial Stability Preparation and Use:

-

Often put together trial balances: Making ready trial balances often, akin to month-to-month, helps establish errors early and prevents them from accumulating.

-

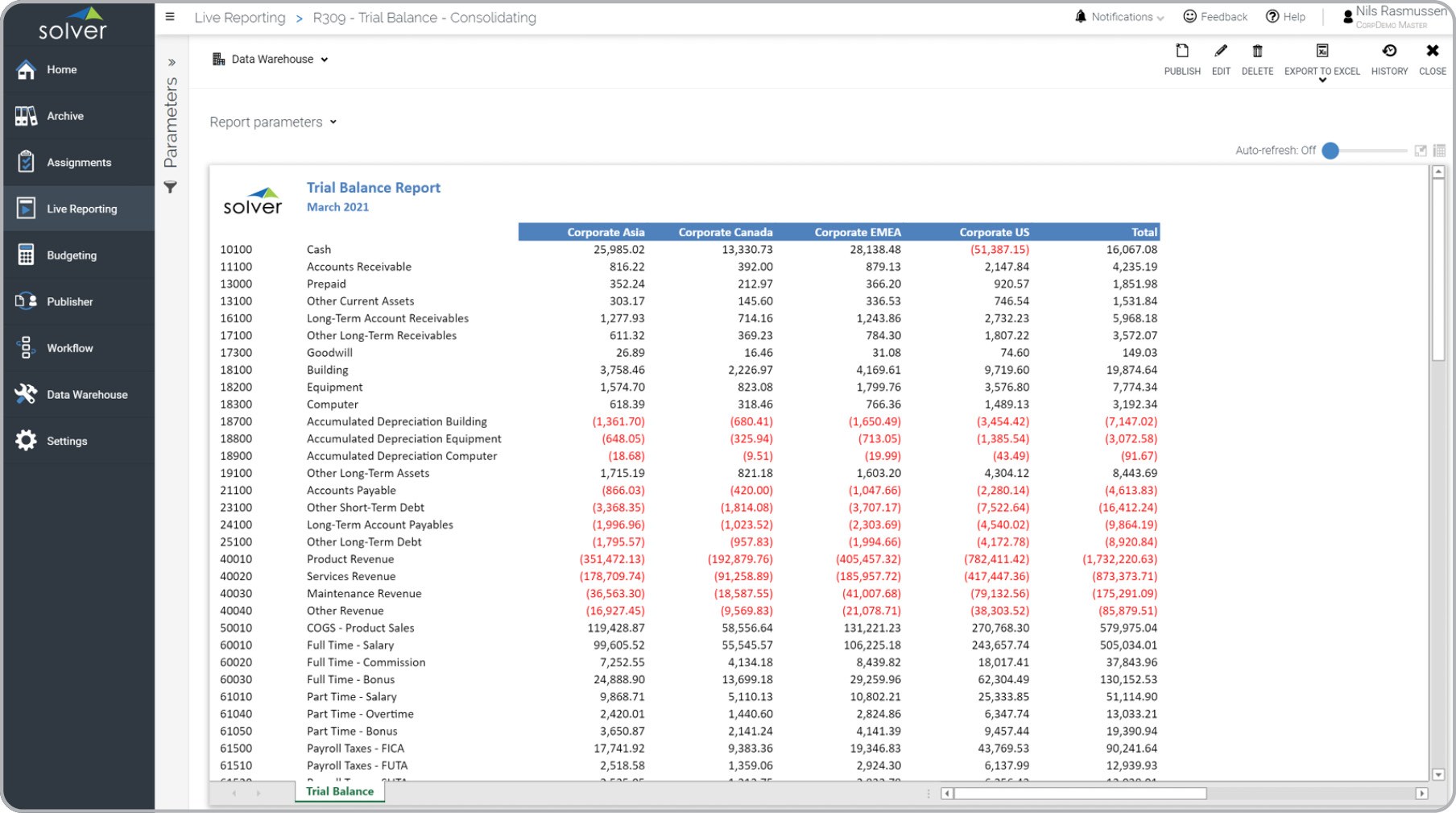

Use accounting software program: Accounting software program automates many facets of the trial stability preparation course of, lowering the danger of handbook errors.

-

Reconcile financial institution statements: Often reconciling financial institution statements with the money account within the normal ledger helps establish discrepancies and make sure the accuracy of the money stability.

-

Implement inside controls: Robust inside controls, akin to segregation of duties and common evaluations of transactions, assist forestall errors and fraud.

-

Doc all changes: Clearly doc all adjusting and shutting entries to make sure transparency and traceability.

Conclusion:

The trial stability, whereas seemingly easy, is a crucial element of the accounting cycle. Its accuracy hinges on a well-structured chart of accounts and meticulous record-keeping. Understanding the connection between these two parts is important for producing dependable monetary statements and making knowledgeable enterprise selections. By implementing greatest practices and utilizing acceptable instruments, companies can leverage the trial stability to keep up the integrity of their monetary data and make sure the accuracy of their monetary reporting. Common evaluation and a spotlight to element are paramount to forestall errors and keep the essential stability that underpins the complete accounting system.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)

Closure

Thus, we hope this text has supplied helpful insights into The Trial Stability: A Basis of Monetary Accuracy and the Chart of Accounts. We hope you discover this text informative and useful. See you in our subsequent article!