Topping Chart Patterns: Recognizing, Decoding, and Buying and selling the Peaks

Associated Articles: Topping Chart Patterns: Recognizing, Decoding, and Buying and selling the Peaks

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Topping Chart Patterns: Recognizing, Decoding, and Buying and selling the Peaks. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Topping Chart Patterns: Recognizing, Decoding, and Buying and selling the Peaks

Topping chart patterns symbolize an important facet of technical evaluation, signifying a possible shift from an uptrend to a downtrend. These patterns, shaped by worth motion and quantity, supply merchants precious insights into market sentiment and potential reversal factors. Understanding how you can determine, interpret, and commerce these patterns is crucial for navigating market volatility and maximizing buying and selling alternatives. This text delves deep into the world of topping chart patterns, exploring their traits, variations, and sensible functions.

Understanding the Essence of Topping Patterns:

Topping patterns, of their easiest kind, are chart formations that point out a fruits of upward momentum. They usually seem on the finish of an uptrend, reflecting a shift in market sentiment from bullish to bearish. This shift is commonly characterised by waning shopping for strain and growing promoting strain, leading to a worth reversal. The patterns themselves aren’t infallible predictors of worth actions; somewhat, they supply a probabilistic indication of a possible worth decline. Affirmation by means of different technical indicators and elementary evaluation is all the time really helpful earlier than making any buying and selling choices.

Key Traits of Topping Patterns:

A number of key traits assist distinguish topping patterns from mere worth fluctuations:

-

Value Motion: Topping patterns exhibit a definite worth construction, usually involving a collection of upper highs and decrease highs (or greater lows and decrease lows in some instances), culminating in a peak. The precise form varies relying on the precise sample.

-

Quantity: Quantity evaluation performs an important function in confirming topping patterns. Usually, quantity needs to be excessive in the course of the preliminary phases of the sample formation, indicating sturdy shopping for strain. Because the sample develops, quantity tends to lower, reflecting waning shopping for curiosity and probably growing promoting strain. This divergence between worth and quantity is a powerful sign of a possible reversal.

-

Time Body: The time it takes to kind a topping sample can range considerably, starting from a couple of days to a number of months and even years, relying on the underlying asset and market situations. Longer-term patterns usually carry extra weight and point out a extra vital potential reversal.

-

Breakdowns: The affirmation of a topping sample normally happens when the value breaks beneath a big help degree throughout the sample. This breakdown is commonly accompanied by elevated quantity, reinforcing the bearish sign.

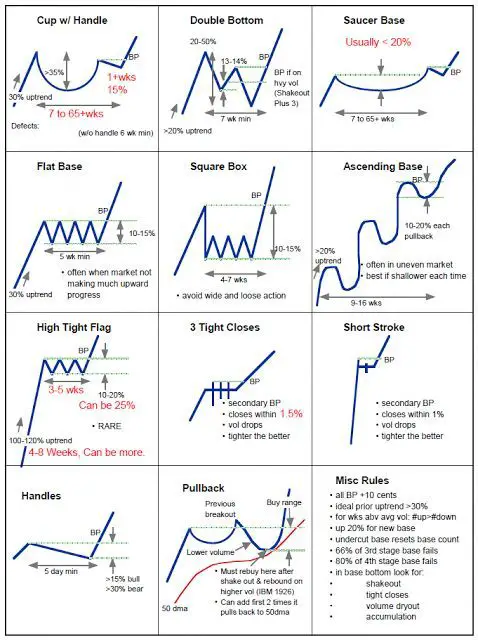

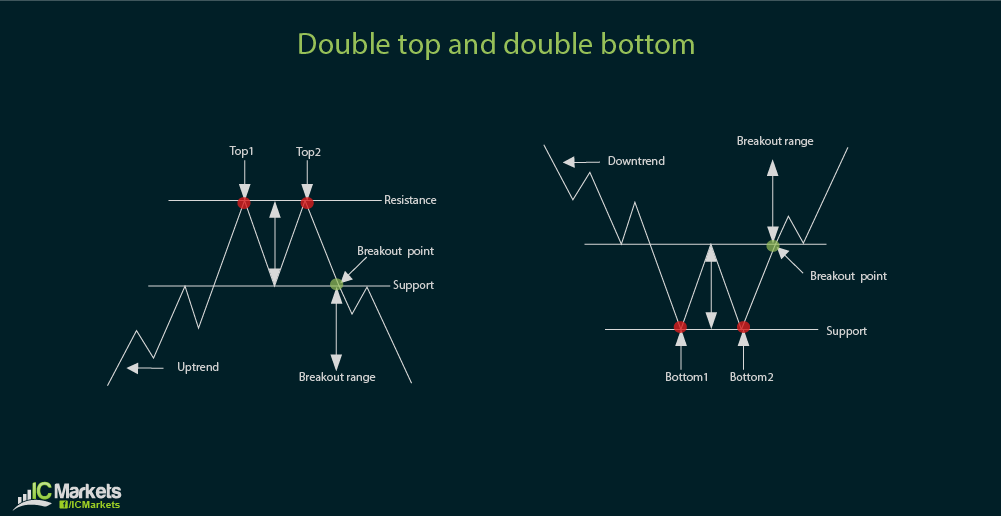

Widespread Topping Chart Patterns:

A number of distinct topping patterns are continuously noticed within the monetary markets. Understanding their distinctive traits is important for efficient buying and selling:

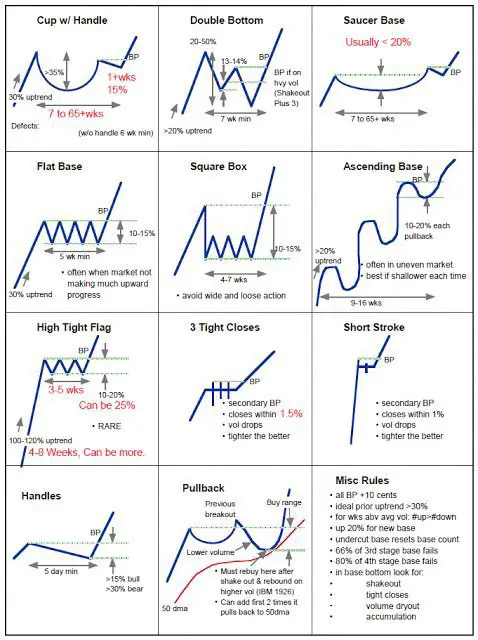

1. Head and Shoulders (H&S): That is maybe essentially the most widely known topping sample. It consists of three distinct peaks: a left shoulder, a head (the best peak), and a proper shoulder. The neckline connects the troughs between the left shoulder, head, and proper shoulder. A breakdown beneath the neckline confirms the sample and alerts a possible worth decline.

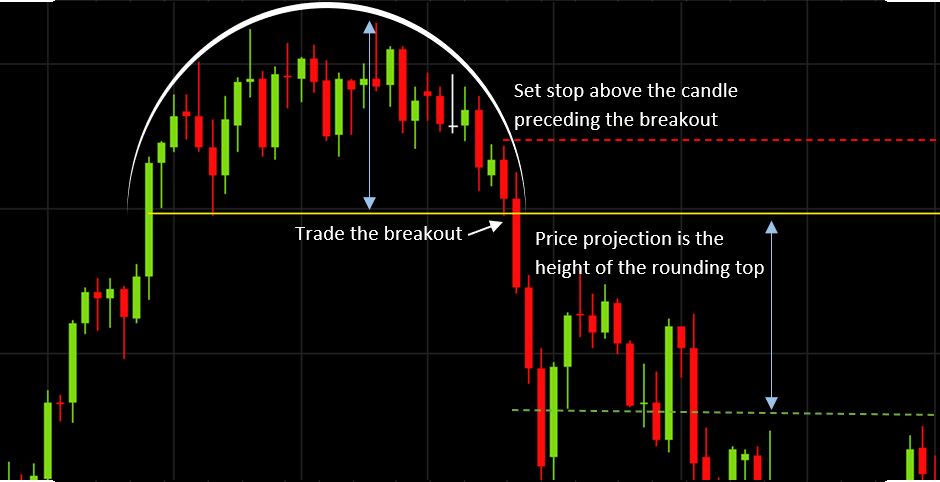

2. Double Prime: This sample kinds when the value reaches two roughly equal highs, adopted by a decline. The neckline, on this case, is the help degree between the 2 peaks. A break beneath this neckline confirms the sample.

3. Triple Prime: Much like a double prime, however with three roughly equal highs. This sample typically suggests a stronger bearish sign than a double prime, implying a extra vital potential worth decline.

4. Broadening Prime: This sample is characterised by progressively widening worth swings, with every successive excessive and low being additional aside than the earlier one. It signifies growing volatility and indecision, culminating in a possible breakdown.

5. Inverse Head and Shoulders: Whereas not strictly a topping sample, it is vital to say the inverse H&S, which is a bottoming sample. Understanding this sample helps merchants differentiate between potential reversals and continuations.

Decoding Topping Patterns:

Decoding topping patterns requires a holistic method, combining worth motion evaluation with quantity research and different technical indicators:

-

Affirmation: A easy worth breakdown beneath the neckline (or help degree) will not be ample affirmation by itself. Elevated quantity accompanying the breakdown strengthens the bearish sign.

-

Assist and Resistance: Analyzing help and resistance ranges helps decide the potential worth targets after the breakdown. The space between the neckline and the top in an H&S sample can usually function a worth goal.

-

Different Indicators: Combining topping patterns with different technical indicators like RSI, MACD, or transferring averages can present extra affirmation and improve buying and selling accuracy. Divergence between worth and these indicators could be a notably sturdy sign.

-

Elementary Evaluation: Whereas technical evaluation is essential, incorporating elementary evaluation can present a extra complete perspective. Destructive information or occasions associated to the underlying asset can reinforce the bearish sign recommended by the topping sample.

Buying and selling Methods with Topping Patterns:

As soon as a topping sample is recognized and confirmed, varied buying and selling methods could be employed:

-

Brief Promoting: The most typical technique is brief promoting the asset after the breakdown. This entails borrowing the asset and promoting it, hoping to purchase it again at a cheaper price later and revenue from the distinction.

-

Protecting Places: Shopping for put choices can act as insurance coverage towards potential losses if the commerce goes towards expectations. Put choices give the holder the precise, however not the duty, to promote the asset at a predetermined worth.

-

Trailing Cease-Loss Orders: Implementing a trailing stop-loss order helps defend income and restrict potential losses. This order mechanically sells the asset if the value drops beneath a predetermined degree, which adjusts as the value rises.

-

Threat Administration: Correct threat administration is paramount. By no means threat extra capital than you possibly can afford to lose. Decide acceptable stop-loss ranges and place sizing primarily based in your threat tolerance and buying and selling plan.

Limitations of Topping Patterns:

It is essential to acknowledge the restrictions of topping patterns:

-

False Breakouts: Generally, costs could break beneath the neckline or help degree however then shortly get better, leading to a false sign. This highlights the significance of affirmation by means of quantity and different indicators.

-

Subjectivity: Figuring out topping patterns could be subjective, with totally different merchants probably decoding the identical chart formation in another way. Clear pointers and constant methodology are important.

-

Market Noise: Market noise can obscure the formation of topping patterns, making identification difficult. Filtering out noise by means of acceptable time frames and indicators is essential.

Conclusion:

Topping chart patterns are precious instruments for technical analysts and merchants, offering insights into potential worth reversals. Nonetheless, they aren’t foolproof predictors. Profitable buying and selling with topping patterns requires a complete understanding of their traits, cautious interpretation, affirmation by means of different indicators, and rigorous threat administration. By combining technical evaluation with elementary evaluation and a disciplined buying and selling plan, merchants can leverage topping patterns to reinforce their buying and selling efficiency and navigate market volatility successfully. Keep in mind that steady studying and adapting to market situations are essential for long-term success in buying and selling. All the time follow accountable buying and selling and seek the advice of with monetary professionals earlier than making vital funding choices.

Closure

Thus, we hope this text has offered precious insights into Topping Chart Patterns: Recognizing, Decoding, and Buying and selling the Peaks. We respect your consideration to our article. See you in our subsequent article!