Unpacking the American Pie: A Deep Dive into the US Federal Price range By the Lens of a Pie Chart

Associated Articles: Unpacking the American Pie: A Deep Dive into the US Federal Price range By the Lens of a Pie Chart

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Unpacking the American Pie: A Deep Dive into the US Federal Price range By the Lens of a Pie Chart. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Unpacking the American Pie: A Deep Dive into the US Federal Price range By the Lens of a Pie Chart

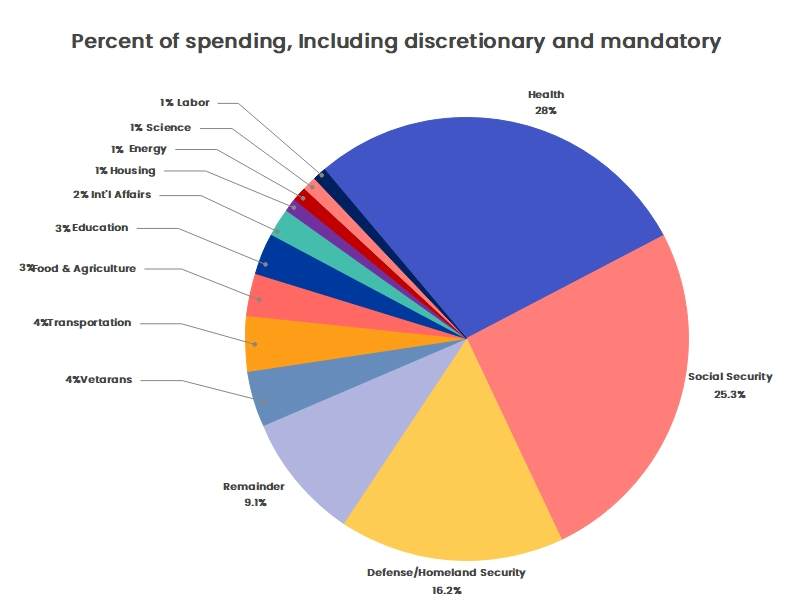

America federal funds, a colossal sum representing trillions of {dollars} yearly, is a posh tapestry woven from quite a few threads of spending and income. Understanding this intricate system is essential for knowledgeable civic engagement and accountable governance. Whereas the sheer scale of the funds might be daunting, visualizing it by a pie chart presents a strong instrument for greedy the relative proportions of various spending classes and income sources. This text will dissect a hypothetical pie chart representing the US federal funds, exploring the important thing sectors, their implications, and the inherent complexities concerned in such a simplified illustration.

Establishing the Hypothetical Pie Chart:

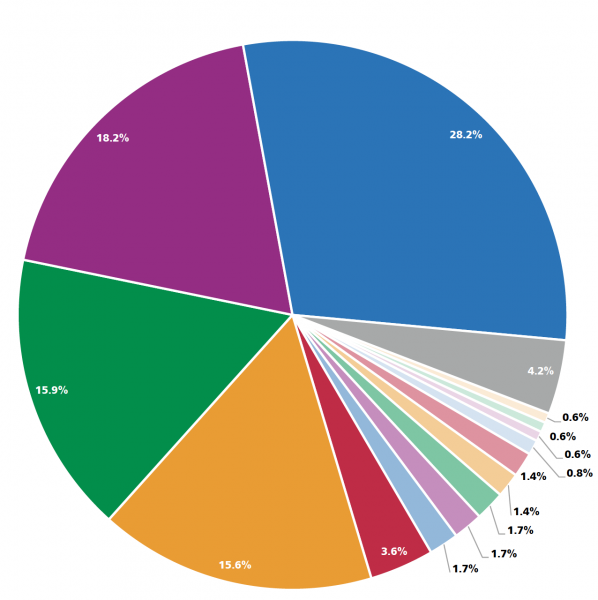

To create a significant evaluation, we’d like a baseline. Let’s assume a simplified pie chart representing the fiscal yr 2024 US federal funds, acknowledging that exact figures fluctuate and official information lag. The chart will spotlight main spending classes and income streams, sacrificing granular element for readability. A practical pie chart would possibly look one thing like this (percentages are illustrative and approximate):

- Obligatory Spending (35%): This encompasses applications with pre-determined spending ranges, largely pushed by current legal guidelines. Key parts embody Social Safety, Medicare, and Medicaid.

- Discretionary Spending (20%): This sector represents areas the place Congress yearly appropriates funds. Examples embody protection, training, transportation, and nationwide parks.

- Internet Curiosity (10%): The price of servicing the nationwide debt – the curiosity funds on accrued federal borrowing.

- Different Obligatory Spending (5%): This residual class consists of smaller obligatory applications not explicitly talked about above.

- Income (30%): This part represents the full income collected by the federal authorities, primarily by particular person revenue taxes, company revenue taxes, payroll taxes, and excise taxes.

Analyzing the Slices:

1. Obligatory Spending (35%): The Entitlement Problem:

The biggest slice of the pie, obligatory spending, represents the dedication the federal government has made by established entitlement applications. Social Safety, designed to offer retirement, incapacity, and survivor advantages, is a cornerstone of this section. Medicare, offering healthcare for the aged and disabled, and Medicaid, providing healthcare for low-income people and households, represent important parts. These applications are important for the well-being of hundreds of thousands of People, however their progress is essentially pushed by demographic shifts (getting older inhabitants) and healthcare value inflation. This creates a persistent pressure between sustaining these essential providers and controlling funds deficits. Coverage discussions usually middle on reforming these applications to make sure their long-term solvency with out compromising the advantages they supply.

2. Discretionary Spending (20%): The Enviornment of Coverage Selections:

Discretionary spending, whereas smaller than obligatory spending, is an important space for shaping nationwide priorities. Protection spending, a good portion of this class, displays nationwide safety considerations and commitments. Different crucial areas embody training, infrastructure, analysis and improvement, and environmental safety. These applications are topic to annual appropriations, making them weak to political battles and budgetary constraints. The relative measurement of every discretionary program displays ongoing debates concerning the authorities’s function in addressing numerous societal challenges. For instance, elevated funding in infrastructure might enhance financial progress, however it would possibly require diverting funds from different applications, triggering tough trade-offs.

3. Internet Curiosity (10%): The Rising Burden of Debt:

The rising nationwide debt is more and more mirrored within the rising slice devoted to web curiosity. This represents the price of borrowing cash to finance previous funds deficits. Greater rates of interest exacerbate this value, putting additional pressure on the funds and probably crowding out spending on different important applications. Managing the nationwide debt is a long-term problem that requires a complete method involving fiscal self-discipline, financial progress, and probably tough coverage decisions relating to spending and taxation.

4. Different Obligatory Spending (5%): The Hidden Prices:

This class encompasses a variety of smaller obligatory applications, usually missed however collectively important. Examples embody numerous federal worker retirement advantages, veterans’ advantages, and different entitlement applications with smaller budgets. Whereas individually much less distinguished than Social Safety or Medicare, their cumulative influence contributes to the general budgetary image.

5. Income (30%): The Funding Mechanisms:

The income slice represents the full revenue collected by the federal authorities. Particular person revenue taxes are sometimes the most important contributor, adopted by payroll taxes (funding Social Safety and Medicare), company revenue taxes, and excise taxes (on particular items and providers). The relative contribution of every income supply can fluctuate primarily based on financial circumstances and tax insurance policies. Debates surrounding tax reform usually revolve round problems with equity, effectivity, and the general influence on financial progress and revenue inequality. Discovering a sustainable income stream to fund the federal government’s obligations is a crucial ingredient of accountable fiscal administration.

Limitations of the Pie Chart:

Whereas a pie chart supplies a useful visible illustration of the funds’s composition, it has limitations. The simplification inherent in such a visualization inevitably obscures essential particulars. It fails to seize the dynamic nature of the funds, the interdependencies between applications, and the nuanced coverage decisions concerned in allocating sources. Furthermore, the pie chart would not illustrate the off-budget objects or the complexities of presidency accounting. It is important to keep in mind that a pie chart presents a snapshot, not a complete evaluation.

Conclusion:

The US federal funds, represented visually by a pie chart, reveals a posh interaction of spending priorities and income sources. Understanding the relative proportions of obligatory spending, discretionary spending, web curiosity, and income is essential for knowledgeable civic participation. Whereas the pie chart simplifies a posh system, it supplies a useful start line for participating with the crucial points going through the nation’s fiscal future. Additional exploration past the simplified visible is important for a whole understanding of the intricacies and challenges inherent in managing the US federal funds. By delving deeper into the person parts and their underlying coverage implications, we will foster a extra knowledgeable and engaged citizenry able to contributing to accountable and sustainable fiscal governance.

Closure

Thus, we hope this text has supplied useful insights into Unpacking the American Pie: A Deep Dive into the US Federal Price range By the Lens of a Pie Chart. We thanks for taking the time to learn this text. See you in our subsequent article!